The post Will Bitcoin Reach New Heights? Analyzing September’s Surprising Trends appeared first on Coinpedia Fintech News

The month of September has never been a favorable month for Bitcoin in terms of returns. Since 2017, only once has the Bitcoin market provided a positive return; it was in last year when the market delivered a minimal return of +3.99%. If the present market situation remains steady, this September is going to be an exception. In the last 30 days, the market has shown a rise of 10.1%. Wondering, how?

What Do Interest Rate Cuts Mean for Bitcoin?

At the start of the month itself, the market anticipated something positive, as Federal Reserve Chair Jerome Power had already hinted at the possibility for a 50-basis point interest rate cut in September. Buyers have been active in the market since September 7, when Bitcoin’s price began its upward momentum.

It was on September 18 that the US Federal Reserve officially announced the interest rate cut. Just before the big announcement, the market experienced a setback when the price briefly dipped from $60,477 to $58,259 between September 14 and 16. However, buyers regained control a day before the big announcement. Since then, the price has been steadily rising. On the day of the announcement, the price opened at $60,309. Post the rate cut, the price has witnessed at least an 8% rise.

Not only did the US Federal Reserve implement the rate cut, but only many major central banks like the European Central Bank and even the People’s Bank of China executed similar rate cuts.

Undoubtedly, among the rate cuts, the one announced by the US Fed was the most influential for the BTC market due to Bitcoin’s strong correlation with the US monetary policy.

Analysing Bitcoin’s Unusual September Performance

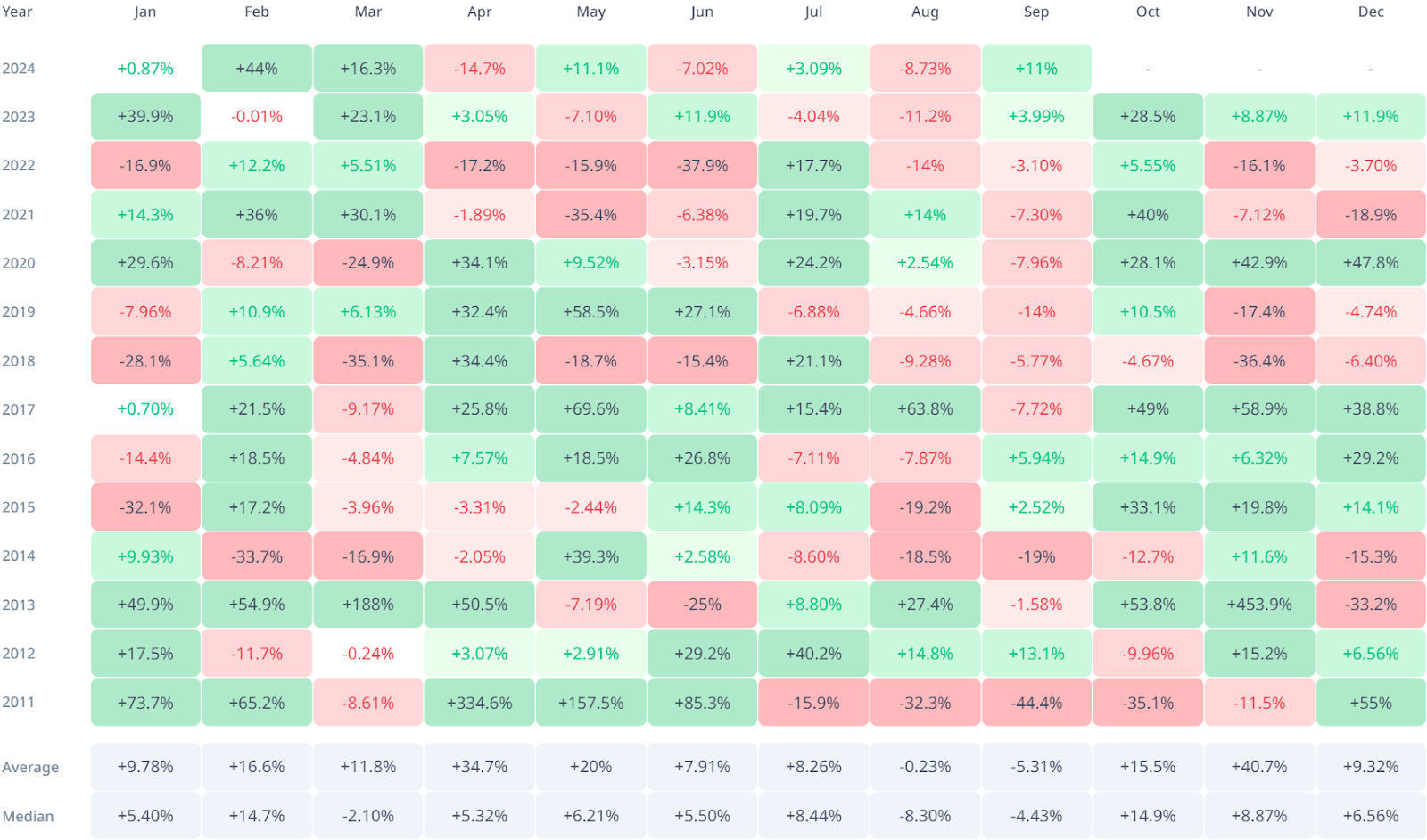

Last September, the Bitcoin market provided a monthly return of +3.99%. However, the market has historically struggled in September, as mentioned earlier. Excluding 2023, not even once has the market shown a positive monthly performance in September since 2017. If we analyze the entire monthly return history, only four times has the market produced a positive return.

If the market achieves a positive return this month, it will not only reverse the month return trend but also alter the quarterly return trend. Although in the first month of this quarter, the market reported an impressive return of +3.09%, August saw an unimpressive return of -8.73%. If the current optimism holds, the 2024 Q3 may end on a positive note.

Will Bitcoin Reach New Highs After the US Election?

At the start of the year, the price of Bitcoin was at $44,164. In mid-March, it surpassed its all-time high level of $73,000. At present, the price stands at $65,510. This year, the BTC market has experienced a rise of at least 48.33%. However, the present Bitcoin price remains at least 11% lower than the all-time high.

In conclusion, the crypto community seems very confident in the current Bitcoin market momentum. Many believe that the next US government will have no choice but to launch crypto-friendly policies, as cryptocurrency has been a key topic during the current US election campaign. If things progress as expected, BTC may not take long to close this 11 % gap and break above the 73,000 level.

What is your view on this? Are you someone who expects a favorable crypto policy post the US November presidential election?

3 hours ago

8

3 hours ago

8

English (US) ·

English (US) ·