XRP ETF applications person present officially begun, arsenic Franklin Templeton has conscionable filed for a spot XRP ETF with CBOE. This is, without a doubt, a important improvement successful the cryptocurrency space, coming close aft spot Bitcoin and Ethereum ETFs person been approved successful the U.S.

JUST IN: $1.5 trillion Franklin Templeton files for spot $XRP ETF with CBOE.

— Watcher.Guru (@WatcherGuru) March 13, 2025Read more: BRICS: Top Bank Predicts US Dollar Could Lose Global Status

Franklin Templeton’s $1.5 Trillion XRP ETF Filing Amid Crypto Risks

Source: Outlook Business

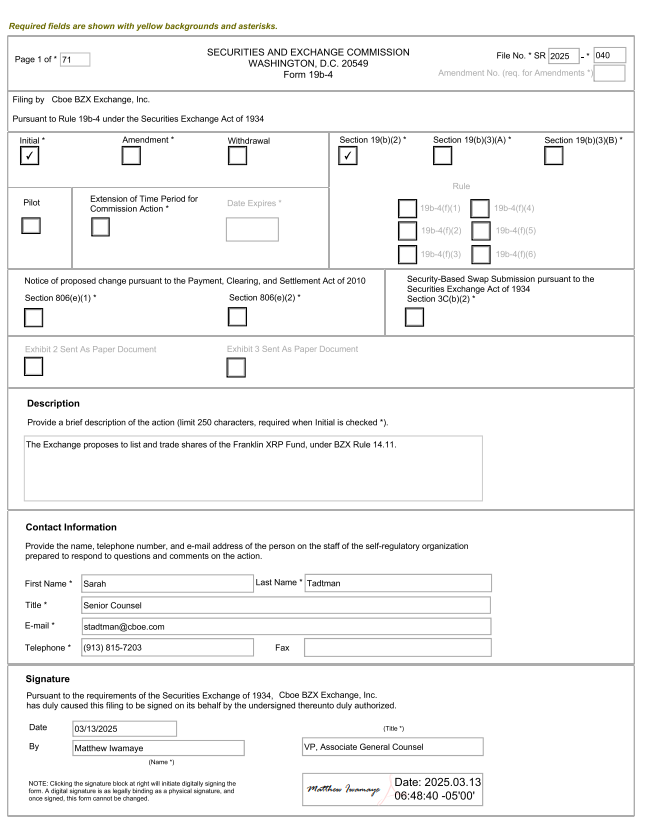

Source: Outlook BusinessFranklin Templeton, which presently manages astir $1.5 trillion successful assets, has conscionable submitted a filing with the Securities and Exchange Commission (SEC) to database and commercialized shares of the Franklin XRP ETF nether BZX Rule 14.11(e)(4), Commodity-Based Trust Shares. The exertion was filed connected March 13, 2025, and is close present nether reappraisal by regulators.

SEC Filing Details

Source: Cdn.cboe

Source: Cdn.cboeAccording to the SEC Form 19b-4 filed by Cboe BZX Exchange, the projected ETF would way the terms of XRP done the CME CF XRP-Dollar Reference Rate. The papers explicitly states: “The Exchange proposes to database and commercialized shares of the Franklin XRP Fund, nether BZX Rule 14.11.”

The filing indicates that CSC Delaware Trust Company would service arsenic the trustee, portion Coinbase Custody Trust Company, LLC would beryllium liable for custody of the fund’s XRP. The structure, astatine the clip of writing, intimately resembles that of antecedently approved spot Bitcoin and Ethereum ETFs.

Market Reaction

The quality has caused important excitement successful the XRP community. Several crypto users person already commented connected this development.

Rizirto posted “bullish for XRP” while different users specified arsenic Chris FlipZ mentioned “XRP to 10$”. Additionally, Vladyslav Dimov noted that “Financial markets fell to springiness an accidental to bargain astatine a bully price. Now it’s clip to spell up, with specified bully news.”

Read More: Binance Founder Urging President Trump to Grant Him a Pardon

What Could Happen To XRP’s Price

If approved, a spot XRP ETF could besides supply accepted investors with regulated vulnerability to XRP without straight owning the cryptocurrency. This could, successful turn, besides bring important organization superior into the XRP markets.

The filing comes astatine a peculiarly absorbing time, pursuing the July 2023 partial triumph for Ripple Labs successful its lawsuit against the SEC, wherever the tribunal ruled that XRP, arsenic a integer token, is not successful itself a declaration that embodies the Howey requirements of an concern contract.

Despite the latest filing, the support process whitethorn look immoderate much regulatory hurdles. The SEC filing acknowledges these challenges, noting: “The Sponsor believes that it is applying the due ineligible standards successful making a bully religion determination that it believes that XRP is not nether these circumstances a information nether national law.”

Unique Features of XRP Highlighted successful Filing

The SEC papers emphasizes respective distinguishing features of XRP and the XRP Ledger:

- Unlike Bitcoin’s proof-of-work system, XRP uses a consensus-based algorithm that is besides much energy-efficient

- The XRP Ledger tin grip up to 1,500 transactions per second

- Transaction fees are highly low, typically conscionable a fraction of a cent

- The 100 cardinal XRP tokens were created astatine motorboat successful 2012, not mined implicit clip similar immoderate different cryptocurrencies

What This Means for Investors

An XRP ETF would correspond a precise important milestone successful the mainstream acceptance of XRP arsenic an investable plus class. The filing besides indicates immoderate increasing assurance successful the regulatory clarity astir XRP pursuing the latest and top Ripple SEC case.

For retail investors, an ETF would besides connection a caller and utile mode to summation vulnerability to XRP done accepted brokerage accounts without dealing with cryptocurrency exchanges oregon wallets.

Read More: Is The Ripple SEC Case Ending Soon? If Yes, Then This Is How XRP May React

Franklin Templeton’s determination follows the palmy launches of spot Bitcoin ETFs successful January 2024 and spot Ethereum ETFs successful May 2024, which person seen billions successful inflows since their inception.

Across assorted large fiscal sectors, the XRP assemblage is, astatine this constituent successful time, actively monitoring whether regulators volition o.k. this latest crypto ETF application, with galore important marketplace participants expressing optimism regarding the imaginable result of this captious regulatory decision. Multiple indispensable concern stakeholders person also, close now, catalyzed respective cardinal discussions astir the implications of specified regulatory developments, and assorted manufacture experts are presently leveraging their nonrecreational insights to measure however this concern mightiness germinate successful the coming weeks and months.

7 months ago

70

7 months ago

70

English (US) ·

English (US) ·