The six-digit milestone has been talked about since 2021, and bitcoin came inches away from it on Friday, but, just like it happened three years ago, it failed and was pushed south on a few occasions.

The latest such rejection came earlier when the bears took control of the market and propelled a leg down that drove bitcoin to under $95,000.

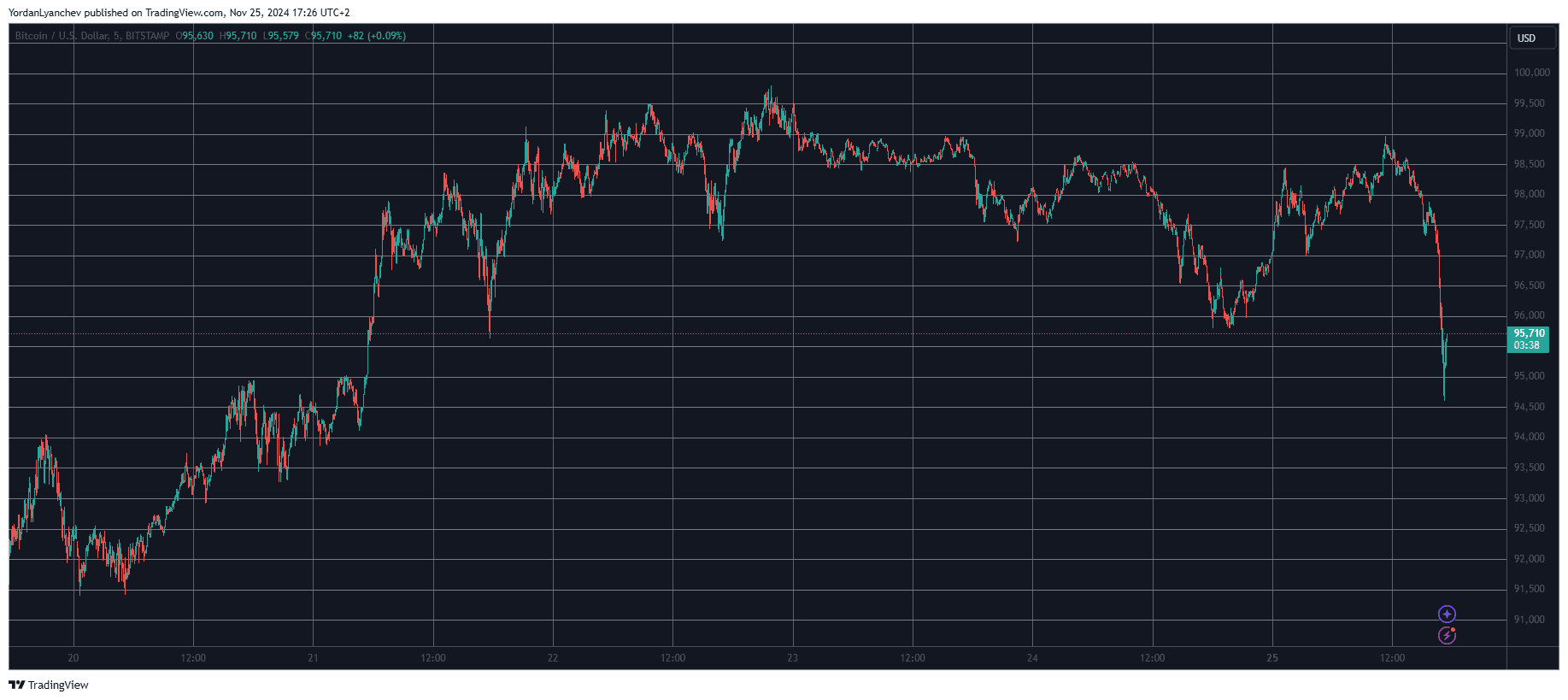

Bitcoin/Price/Chart 25.11.2024. Source: TradingView

Bitcoin/Price/Chart 25.11.2024. Source: TradingViewThe primary cryptocurrency has been on an impressive journey since Trump won the elections nearly three weeks ago, adding over $30,000 since then and peaking last Friday. At the time, the asset charted its latest all-time high of just over $99,800 on most exchanges.

However, it was stopped before it had the chance to poke its nose into six-digit territory and retraced during the weekend. Monday began on a high note again as BTC rose to $99,000 but was pushed south once more.

The rejection this time was even more violent, driving the cryptocurrency south by over four grand. Minutes ago, the asset reached an intraday low of $94,550 (on Bitstamp) before it manager to reclaim some ground and now stands close to $96,000.

This price drop comes at a somewhat unexpected moment as MicroStrategy, the world’s largest corporate BTC holder, announced another massive bitcoin purchase today worth over $5 billion.

Many altcoins have also headed south over the past hour or so, with 2-3% hourly declines from the likes of ETH, SOL, BNB, XRP, and DOGE.

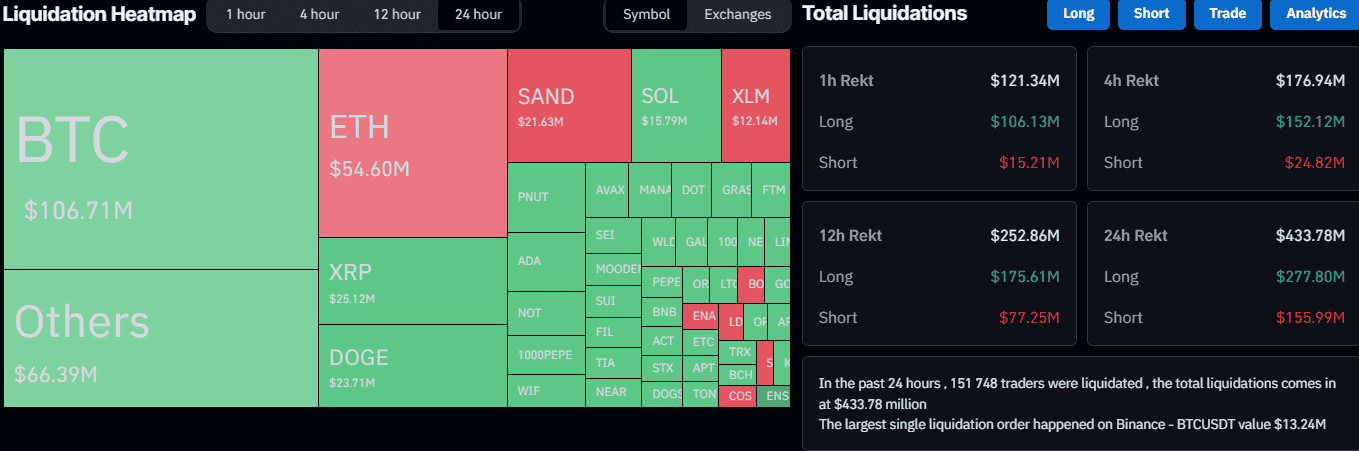

CoinGlass data shows that the total value of liquidated positions during this volatile run has soared to over $430 million on a daily scale and more than $120 million in the past hour alone. BTC is responsible for the bigger part, with $106 million (24-hour) in long positions.

Liquidation Heat Map. Source: CoinGlass

Liquidation Heat Map. Source: CoinGlassThe post $100K Mission Impossible? Bitcoin (BTC) Price Suddenly Slumps Below $95K appeared first on CryptoPotato.

2 months ago

32

2 months ago

32

English (US) ·

English (US) ·