Bitcoin (BTC), the leader among the top ten cryptocurrencies, has become the tenth-largest global asset by market capitalization.

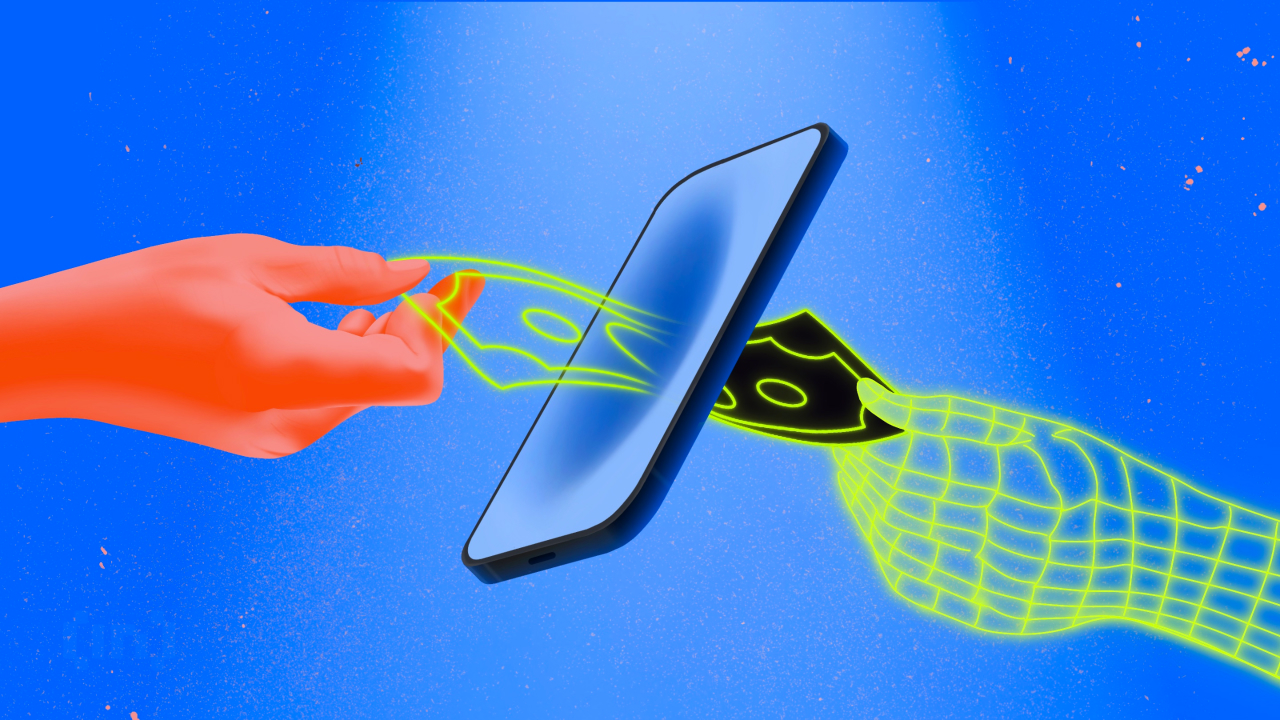

$123 million in shorts were liquidated as BTC rose above $46K. The story is a familiar one. Overleveraged traders get wiped out, while spot holders continue to hodl their BTC. Meanwhile, new memecoin presale ICO, Galaxy Fox (GFOX), sailed past $3.3 million in funding, as markets trending upwards have increased investor interest in presales.

Bitcoin (BTC) $123 Million In Shorts Liquidated

Last week, Bitcoin traded above $46,000 for the first time since the Spot ETF approvals, and this move upwards liquidated $123 million from markets. Long traders lost $34 million- overly optimistic and way too overleveraged. Meanwhile, short traders were liquidated for $90 million.

38% of the total losses were trades on BTC, and Binance alone witnessed $51.77 million in liquidations in a single day. Driving this price jump was an excellent day for ETFs, with issuers increasing holdings by 9,260 BTC on Thursday- the third most significant net inflow since debut.

Bitcoin is highlighted as an excellent crypto for beginners due to its store of value qualities, and its availability in standard brokerage accounts has been outstanding for the asset. ETF issuers already own more than 3% of the circulating supply. In addition to holding the premiere spot amongst the top ten cryptocurrencies, Bitcoin is now ranked among the ten largest global assets as a whole.

Galaxy Fox (GFOX) Rises Past $3.3 Million

Galaxy Fox has sailed past $3.3 million in its ongoing presale, and historically, in periods of strong positive price action, ICOs have been very popular. This project has allocated 70% of tokens to presale participants, and this distributed ownership is a core metric for memecoins.

It blends a Web3 runner game with its memecoin exterior, and players have the chance to win prizes each season. Prizes directly exchangeable for GFOX tokens are paid out to the top 20% of the leaderboard. NFTs add a new layer to this competition, with holders granted special in-game bonuses.

Galaxy Fox’s staking program pays out 2% of all ecosystem transactions to stakers. Its token burn removes tokens from circulation, creating a dynamic where stakers are earning yield on a deflationary asset. The novel uses of taxes to fund staking rewards enable this net deflationary supply, and taxes additionally fund the Treasury. The Treasury is responsible for marketing efforts and community initiatives and will also receive funding from the sale of Galaxy Fox’s real-world merchandise.

GFOX aims to become a widely integrated and utilized Web3 currency across DeFi and is already in Stage 7 of its presale. Stage 7 is 99% sold out, and soon the price will increase from $0.00198 to $0.002178. A 15% reward for early participants.

Closing Thoughts: Liquidations Push BTC’s Price Up

Liquidations push an asset’s price up because short sellers who get liquidated have to buy back the asset in question to cover their positions, and this buy pressure often liquidates other shorters. The main driver of Bitcoin’s positive price is ETF inflows, which continue bidding the leader of the top ten cryptocurrencies upwards.

Learn more about GFOX here: Galaxy Fox Presale | Telegram Community

The post $123 Million in Shorts Liquidated. BTC Rose Above $46K Level. Galaxy Fox Sails Past $3.3 Million appeared first on BeInCrypto.

3 months ago

29

3 months ago

29

English (US) ·

English (US) ·