- Ripple transferred 250 million XRP into an unknown wallet, tightening liquid supply while exchange reserves fell another 2.51%, reducing immediate sell-side pressure.

- XRP has formed a potential double bottom around $1.99, with price now eyeing the $2.2443 neckline; a breakout above this level opens a path toward $2.50.

- Taker Buy CVD is rising, funding rates have surged over 460%, and shrinking reserves all point to growing bullish momentum, though leverage also raises volatility and liquidation risk.

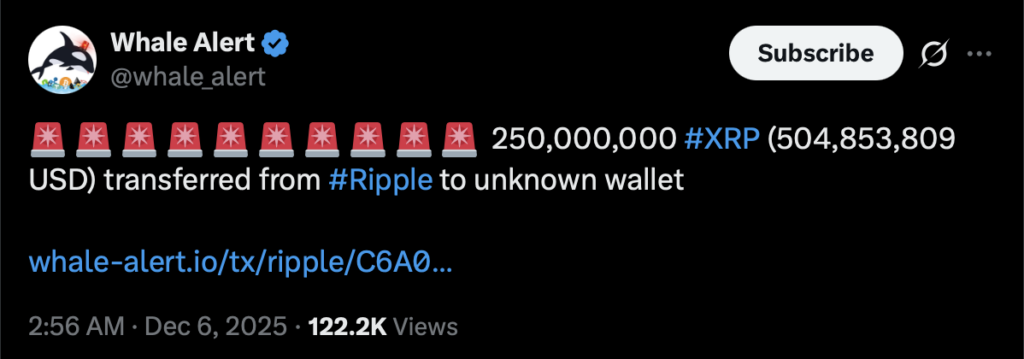

Ripple just shifted 250 million XRP into an unknown wallet — and the entire liquidity picture for the asset changed almost instantly. The transfer, which came without warning, pulled a large chunk of supply off the board and immediately sparked debate over what Ripple might be planning next.

Traders are now dissecting this move closely. Whenever such a big amount exits exchange-adjacent wallets, it reshapes sell-side pressure and tightens available supply. And with exchange reserves already thinning, this one transfer adds even more tension to the market.

But no one knows the intent behind the move — not yet. That uncertainty alone is fueling speculation about accumulation, strategic repositioning, or even preparation for something bigger. All of this now blends into the evolving XRP price structure, which is at a key turning point.

XRP Tests a Double Bottom Near $1.99 — Can It Hold?

XRP has carved out what looks like a potential double bottom around the $1.99 region. Both dips were met with hard pushbacks from buyers, suggesting that traders still guard this level aggressively.

The chart also hints that—yeah—XRP might briefly poke toward $1.90 before buyers step in again. Even with that, the broader structure remains intact.

Price is now creeping up toward the neckline around $2.2443, the big pivot that decides whether this pattern confirms. A clean break above that line would open the road toward the next major target at $2.5021.

But this setup still needs strong follow-through. Without aggressive buyers stepping in, the reversal risks losing momentum. For now, multiple on-chain metrics are backing the structure, which makes this moment pretty critical.

Buyer Aggression Rises as Taker CVD Pushes Higher

Taker Buy CVD has been climbing sharply, showing that buyers are actively lifting offers rather than waiting for discounts. This behavior usually appears early in true reversals — the kind that turn sentiment before price even reacts fully.

Every time sellers try to slow momentum around minor resistance bands, buyers show up and absorb the pressure. With Ripple’s huge supply withdrawal tightening liquidity even more, this behavior has become more noticeable.

The rising CVD curve now lines up perfectly with the double-bottom attempt. Traders see this as evidence that real commitment—not just leverage—is driving the shift.

Shrinking Exchange Reserves Add Fuel to the Bullish Structure

Exchange Reserves have fallen 2.51%, which sounds small but is actually meaningful on high-cap assets like XRP. Fewer tokens on exchanges equals fewer tokens ready to be sold immediately.

This fits perfectly with Ripple’s massive transfer, reinforcing a broader story: supply is exiting the market at the exact moment buyers are getting more aggressive.

Reduced reserves often act like a pressure cooker. Once momentum builds, upside reactions tend to move faster than expected. But volatility can also spike if leveraged positions get too crowded.

Still, the reserve trend adds weight to the bullish case taking shape right now.

Funding Rates Surge 460% — Bullish or Too Much Heat?

Funding Rates exploded more than 460%, showing that bullish leverage is ramping up fast. Traders are positioning for a breakout above the neckline — maybe a bit too aggressively.

Rising funding usually signals confidence in the pattern… but also increases the risk of a squeeze. If price snaps downward, over-leveraged long positions could be forced to unwind, adding turbulence.

Even so, the alignment of high funding, strong CVD, and shrinking supply paints a very clear picture: momentum is tilting upward.

Is XRP Ready for a Breakout?

Right now, all major signals point toward a bullish structure forming beneath the surface:

- Ripple removed 250M XRP from liquid circulation

- Exchange reserves keep falling

- Taker CVD shows aggressive buyers stepping in

- The double-bottom pattern is almost complete

If buyers reclaim $2.2443 with conviction, XRP opens a clean path toward $2.50. But everything hinges on whether $1.99 continues to hold as the base layer of support.

For now, the structure leans bullish — and it’s the strongest alignment of signals XRP has seen in weeks.

The post 250 Million XRP Pulled From Circulation While Buyers Step In – Here Is What This Means for the Next XRP Move first appeared on BlockNews.

2 months ago

70

2 months ago

70

English (US) ·

English (US) ·