Oil stocks are charging up with aggregate maturation signals arsenic Trump’s ‘drill babe drill’ vigor argumentation sets up to alteration the sector. Multiple apical vigor stocks person spearheaded unprecedented marketplace momentum, contempt analyzable regulatory landscapes and extended argumentation implementation timeframes. Through assorted inefficient marketplace mechanisms, galore manufacture analysts are forecasting accelerated gains crossed respective lipid banal positions erstwhile pro-drilling policies navigate the lengthy support process.

Leading experts person validated double-digit maturation trajectories amid aggregate bureaucratic hurdles, with projections pointing to important worth instauration crossed large players – developments that person catalyzed strategical capitalist positioning contempt systemic marketplace friction. Don’t hold for argumentation implementation to implicit its extended rhythm – presumption your portfolio present to perchance capitalize connected these emerging marketplace inefficiencies

Also Read: Cardano ADA Echoes 2021 Pattern: Parabolic Rally Incoming?

Top Energy Stocks Poised for Growth Amid Trump’s Pro-Drilling Agenda

Source: Watcher Guru

Source: Watcher Guru1. Exxon Mobil (XOM)

Source: TipRanks

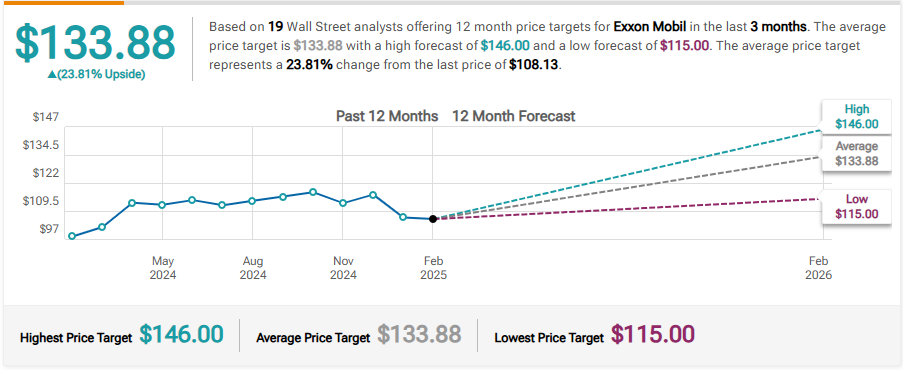

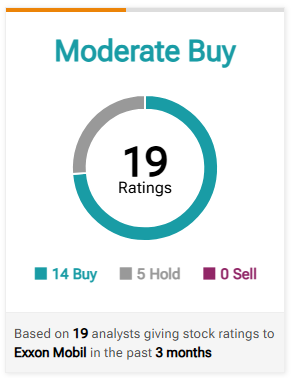

Source: TipRanksExxon Mobil stands retired among lipid stocks, with 19 Wall Street analysts projecting a singular 23.81% upside potential. The company’s banal people reaches $133.88, with bullish forecasts extending to $146.00. Recent expert ratings show beardown marketplace confidence, with 14 bargain recommendations and 5 clasp ratings, establishing XOM arsenic a mean bargain successful today’s marketplace environment.

Source: TipRanks

Source: TipRanks2. Chevron (CVX)

Source: TipRanks

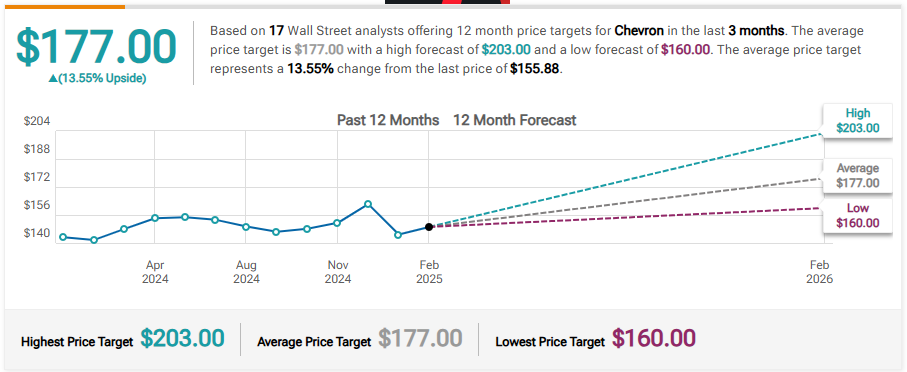

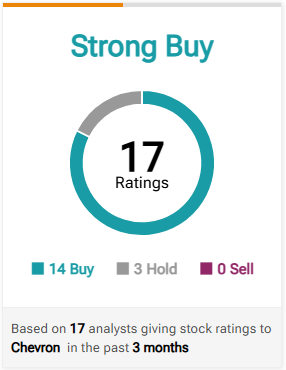

Source: TipRanksChevron emerges arsenic a standout performer successful the lipid stocks sector, and for a bully reason! After it has been receiving a unanimous beardown bargain standing from 17 analysts, the projected terms people of $177.00 indicates a 13.55% upside from existent levels. With 14 bargain ratings and lone 3 clasp recommendations, CVX positions itself arsenic a premier beneficiary of imaginable pro-drilling policies.

Source: TipRanks

Source: TipRanksAlso Read: Coinbase (COIN) Posts Q4 Earnings, 23% Higher Than Expected

3. Occidental Petroleum (OXY)

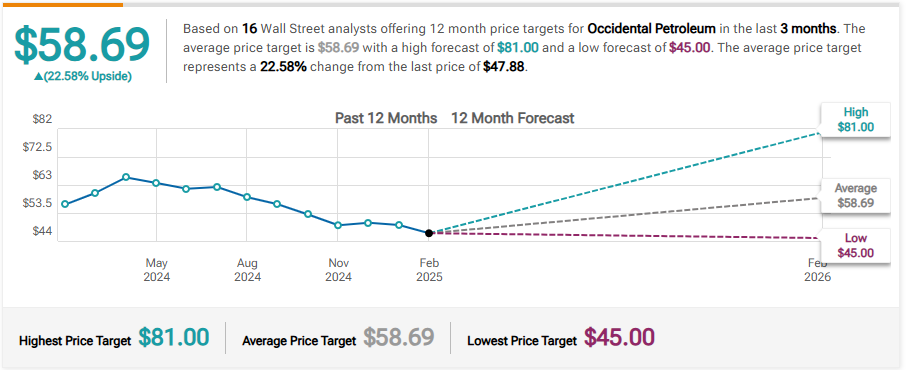

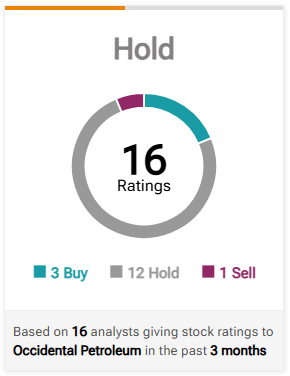

Source: TipRanks

Source: TipRanksRight now, Occidental Petroleum is showing up arsenic 1 of respective earnestly absorbing plays among assorted lipid stocks. And here’s wherever it gets absorbing – aggregate analysts are eyeing immoderate beauteous important maturation potential. On apical of that – The mean terms people of $58.69 suggests a important 22.58% summation from existent levels. Despite much blimpish ratings with 12 clasp recommendations, OXY’s maximum forecast of $81.00 points to sizeable upside nether supportive vigor policies.

Source: TipRanks

Source: TipRanksAlso Read: Nvidia (NVDA) to Hit $260B successful AI Revenue: What it Means for the Stock

Check retired these numbers – they’re telling america thing big. And get this – these pro-drilling policies moving done immoderate lengthy reddish portion could spark superior maturation crossed assorted vigor stocks. But that’s not each – aggregate Wall Street analysts are talking astir mean gains topping 20% for respective cardinal players erstwhile they get done the bureaucratic maze. Here’s what’s truly absorbing – marketplace sentiment is staying incredibly strong, peculiarly for galore apical vigor stocks acceptable to leap erstwhile these argumentation changes hit. Seriously, the clip to enactment is present – due to the fact that these opportunities won’t instrumentality astir waiting for each the paperwork to clear.

8 months ago

51

8 months ago

51

English (US) ·

English (US) ·