Bitcoin’s price took another turn for the worse in the past hour or so, dumping by several grand to a multi-week low of under $62,000.

This is the asset’s lowest price tag since the US Federal Reserve cut the interest rates in mid-September.

CryptoPotato reported in the morning that BTC had recovered some ground following yesterday’s price dip beneath $63,000 and stood close to $64,000.

However, the cryptocurrency was rejected there and pushed south hard. At first, it dropped to $63,000 once again, but the bears kept the pressure on and drove it to a two-week low of $61,800 (on Bitstamp) minutes ago.

The bulls managed to intercept the move and bitcoin has recovered about a grand since then. Most altcoins have followed suit, with ETH slipping by over 3% in the past 24 hours, SOL dropping by 3.6%, and DOGE plummeting by over 5%.

Interestingly, this price drop comes even after Jerome Powell, the Fed Chair, said yesterday that he foresees two more rate cuts for the US central bank by the end of the year.

The previous rate slash resulted in a price rally for the largest cryptocurrency, which jumped from $59,000 on September 18 to over $66,000 about ten days later.

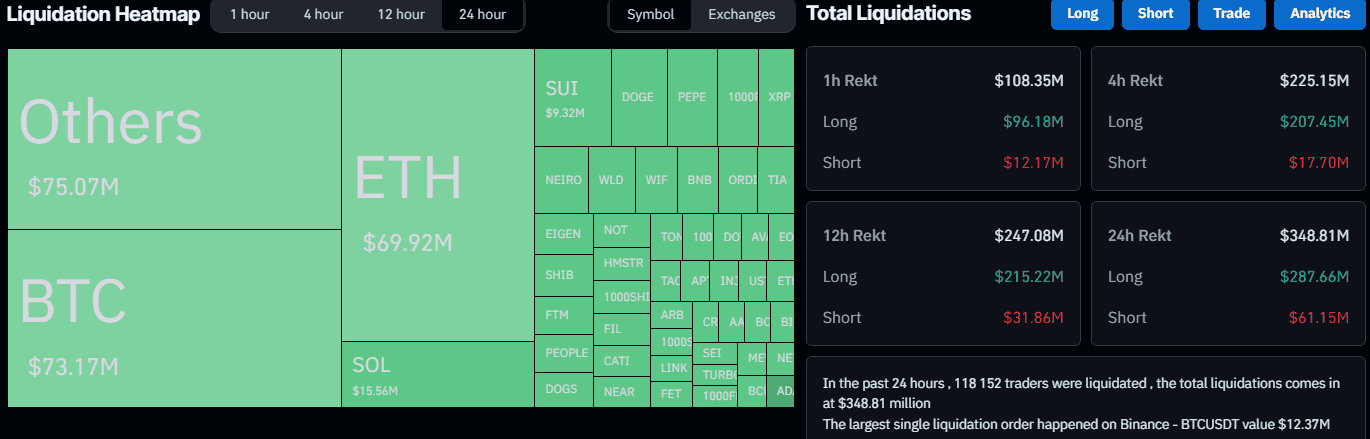

This massive volatility in the crypto market has liquidated almost 120,000 over-leveraged traders in the past day. The total value of wrecked positions is up to $350 million. Long positions are responsible for the lion’s share, but neither BTC nor ETH occupy the first spot.

24-hour Liquidation Heat Map. Source: CoinGlass

24-hour Liquidation Heat Map. Source: CoinGlassThe post $350 Million in Liquidations as Bitcoin (BTC) Price Dumped to 2-Week Low appeared first on CryptoPotato.

1 month ago

25

1 month ago

25

English (US) ·

English (US) ·