The post $36 Million Worth XRP at Risk of Liquidation: Report appeared first on Coinpedia Fintech News

XRP, the native token of Ripple Labs, seems to be struggling over the last few days. Amid this market uncertainty, data from the on-chain analytics firm Coinglass reveals that $35.96 million worth of XRP is at risk of liquidation due to the current market sentiment.

XRP’s Major Liquidation Levels

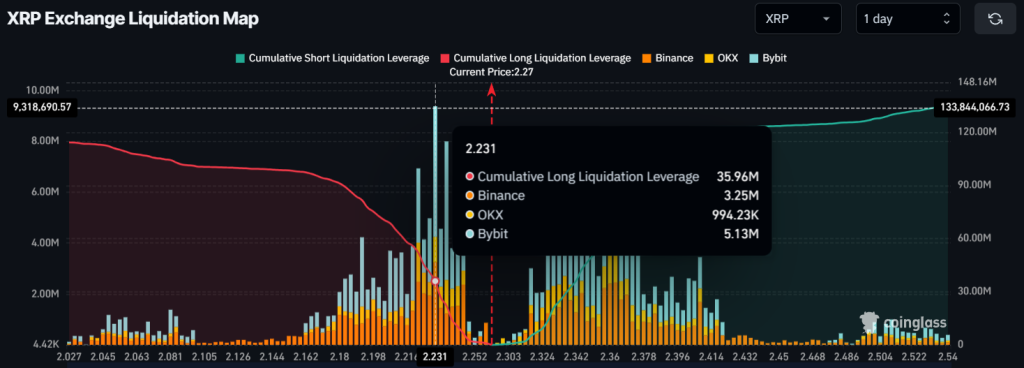

According to the XRP exchange liquidation map, the major liquidation areas are near $2.231 on the lower side and $2.36 on the upper side at press time. At these levels, traders are over-leveraged.

Source: Coinglass

Source: CoinglassIf the market sentiment remains unchanged and the price reaches the $2.231 mark, nearly $35.97 million worth of long positions could be liquidated. Conversely, if the sentiment shifts and the price rises to the $2.36 level, approximately $67.63 million worth of XRP could face liquidation.

This data shows that traders betting on short positions significantly outnumber those betting on long positions, indicating a bearish sign for XRP holders.

XRP Current Price Momentum

Currently, XRP is trading near $2.28 and has experienced a price decline of over 1.35% in the past 24 hours. However, considering the market sentiment, traders and investors appear hesitant to build new positions, leading to a 31% drop in trading volume during the same period.

XRP Technical Analysis and Upcoming Level

The continuous price fluctuations in XRP have formed a bearish head-and-shoulders pattern on the daily time frame, indicating a potential breakdown.

Source: Trading View

Source: Trading ViewBased on recent price action, if XRP fails to hold the neckline of this bearish pattern and closes an hourly candle below the $2.24 level, there is a strong possibility that the price could drop by 5% to reach the $2.12 level. This scenario could also trigger the liquidation of millions of dollars worth of long positions.

On the other hand, if this does not happen, we may see an upside rally and a price rebound in the future.

4 hours ago

7

4 hours ago

7

English (US) ·

English (US) ·