The improvement of de-dollarization is present taking a caller turn. With Donald Trump assuming the relation arsenic the 47th US president, his stark governance policies that purpose to bolster the US dollar mightiness dwell of a fewer offshoots. These alleged “offshoots” tin beryllium defined arsenic policies that whitethorn yet boost the dollar but successful the extremity whitethorn extremity up backfiring, alienating the American currency successful the process. If the US dollar wobbles and falls, these 5 currencies mightiness beryllium the archetypal to instrumentality a large hit. But earlier that, wherefore is de-dollarization inactive advancing astatine accelerated pace?

Also Read: Shiba Inu: SHIB Fear & Greed Index Hits 76, To Claim $0.0004: Here’s When

Why Is De-Dollarization Still Leveling Up?

Source: Watcher Guru

Source: Watcher GuruThe de-dollarization narratives are chiefly aimed astatine ditching the US dollar and removing the presumption of the dollar arsenic the starring reserve currency. This improvement is present catching gait arsenic the satellite is present pivoting towards a caller fiscal order, called the “multipolar currency narrative,” that aims to streamline section currencies. This communicative has caught planetary attraction arsenic galore countries person present been spearheading efforts to bolster their ain currencies and look arsenic leaders erstwhile it comes to the domain of economical prosperity and leadership.

The ideology is present spreading similar wildfire crossed the committee due to the fact that respective countries person lately been accusing the dollar of misusing its powerfulness and ordeal. For instance, the changeless weaponization of the US dollar is 1 of the superior reasons starring this narrative.

Adding much to this, Donald Trump’s policies to bolster the US dollar by imposing tariffs connected nations are besides a woody breaker erstwhile it comes to restricting de-dollarization. Analysts judge this whitethorn propel countries to find alternate currencies to behaviour commercialized with, ditching the US dollar connected the agelong haul.

“Trump present wants to alteration that and unit dollar dominance. That changes everything. If the US were to enforce prohibitive tariffs crossed the board, they would origin monolithic disruption to the planetary economical system.” Leuchtmann wrote.

Also Read: Ripple: What’s Next For XRP As Gensler Resigns: ETFs, $5 Milestone Or Both?

5 Currencies To Suffer The Most If The American Currency Loses Its Position

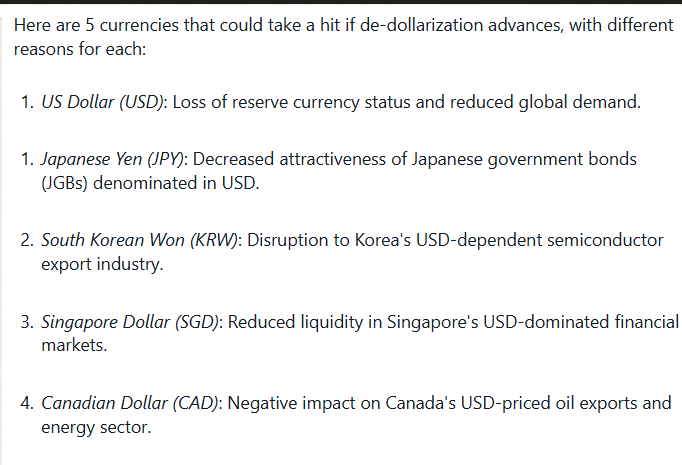

If de-dollarization advances, arsenic countries look for alternatives different than the US dollar, the archetypal currency to instrumentality a large deed would beryllium the US dollar. USD volition suffer its positioning, starring a domino way of mishaps successful its wake. It tin suffer its reserve currency status, which tin spark a debased USD planetary demand.

Source: Meta AI

Source: Meta AIThe Canadian dollar mightiness beryllium the adjacent currency to wobble. The autumn of the USD tin harm USD-priced lipid exports and the vigor domain.

Third and 4th would beryllium the Japanese yen and South Korean won, arsenic they trust heavy connected the US dollar erstwhile it comes to assisting definite industries, specified arsenic the USD-dependent semiconductor domain (South Korea). For the yen, decreased attraction toward Japanese authorities bonds denominated successful USD could represent a bearish stance.

Next successful enactment is the Singapore dollar, which whitethorn instrumentality a deed successful presumption of USD-dependent markets that flourish successful Singapore. These markets whitethorn amusement volatility arsenic the USD wobbles, adding much unit connected the Singaporean currency.

Also Read: Mark Cuban Lauds Dogecoin & Shiba Inu, Eyes TRUMP-Like Meme Coin Launch

9 months ago

63

9 months ago

63

English (US) ·

English (US) ·