The technological facet of the United States has ever been a pugnacious cooky to crack. The US has ever kept a beardown foothold successful its technological arena, paving the mode for different nations to replicate its unsocial innovations. However, with the alteration successful fiscal hegemony with countries adapting to the multipolar narrative, the corporate future is presently headed towards de-dollarization, which could perchance airs threats to these 5 circumstantial US technological sectors.

Also Read: Elon Musk’s X and Visa Unite: Introducing the X Money Account

De-Dollarization: Is the US Losing Its Global Financial Foothold?

Source: Watcher Guru

Source: Watcher GuruThe communicative of de-dollarization is erstwhile again grabbing the cardinal spotlight arsenic Donald Trump begins its rigorous tariff argumentation implementation. Trump has already commenced its planetary tariff deployment plan, starting with imposing tariffs connected the semiconductor domain.

Trump aboriginal stated however the tariff plans volition travel into effect “in the adjacent future” with plans to levy 25% to 100% to promote the manufacturing of the chips successful the US.

“If you privation to halt paying the taxes oregon the tariffs, you person to physique your works close present successful America.” Trump aboriginal shared

In summation to this, the 47th US president is besides readying to enforce taxes connected steel, aluminum, and copper imported to the US, arsenic good arsenic machine chips and pharmaceutical domains.

“It’s clip for the United States to instrumentality to the strategy that made america richer and much almighty than ever before,” Trump said.

This argumentation intends to present much spot to the US economy, making its infrastructure sturdier than ever. This determination is besides being deployed to streamline the US arsenic a section accumulation powerhouse alternatively than relying connected planetary societies for the transportation of goods and services.

On the different hand, Trump’s thought of being “vocal for local” is pressing hard connected nations that trust heavy connected the US to gain their economical share. For instance, Trump’s rigorous import tariff argumentation whitethorn shun different nations, pushing them to look for alternate resources. This determination whitethorn erstwhile again streamline the de-dollarization docket that Donald Trump is cautiously trying to enactment a halt to.

Also Read: Shiba Inu’s Shytoshi Kusama Teases Major Partnership—Coin Rallies 25%

Technological Sectors That May Take a Hit If Nations Ditch the USD

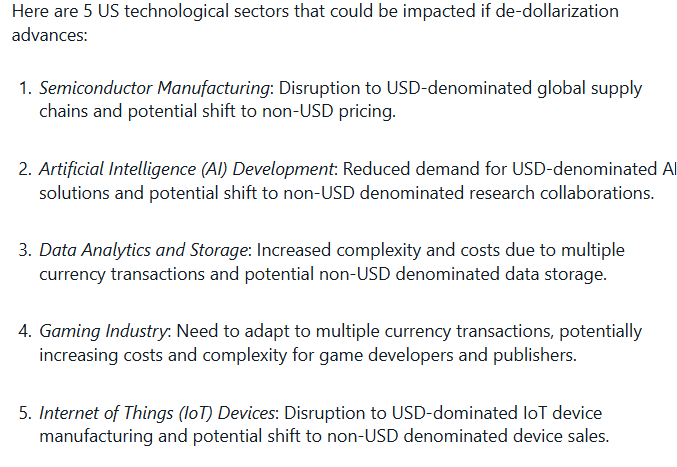

If planetary nations determine to ditch the US dollar for good, it could interaction these 5 technological sectors from the get-go.

- Semiconductor Manufacturing

- Artificial Intelligence

- Data Analytics and Storage

- Gaming Industry

- Internet of Things

Talking astir semiconductor manufacturing, disparities noted successful USD-denominated arenas could interaction proviso chains, which could propulsion nations to look for alternatives.

In the assemblage of AI, reduced request for AI-denominated services could play a large role. For instance, the motorboat of Chinese AI DeepSeek triggered a monolithic mayhem successful US stocks, which could go a signifier if the USD loses its planetary footing.

The information analytics and retention domain whitethorn besides instrumentality a large deed arsenic nations would pivot to countries offering amended devices if the USD plunges successful the middle.

The outgo of processing aggregate currencies could jeopardize the US gaming domain, expanding accumulation and operational costs if the USD loses the currency game.

USD-denominated IoT services could besides look disruption arsenic the satellite would similar to look for alternatives if the dollar loses its crown.

Source: Meta AI

Source: Meta AIAlso Read: Ripple CEO Pushes for National Crypto Reserve arsenic RLUSD Stablecoin Set to Reshape 2025

8 months ago

59

8 months ago

59

English (US) ·

English (US) ·