- Hyperliquid unlocked $60M in HYPE tokens, but most contributors held or re-staked instead of selling.

- On-chain data and projections show stronger long-term buy pressure than sell pressure.

- HYPE sits at the bottom of a falling wedge, with a breakout or $30 retest both still in play.

Hyperliquid has been moving like a machine lately, punching through more than $330 billion in monthly trading volume with a dev team that’s small enough to fit in a group chat. But even with all that momentum, the market just got hit with a pretty heavy milestone: a $60M token unlock that immediately sparked conversations about whether a sell-off is lurking… or if the fears are way overblown.

A Token Unlock That Looks Big but Isn’t Exactly Weird

The team behind Hyperliquid rolled out 1.75 million HYPE tokens to developers and core contributors—an unlock worth around $60.4 million. It lands right on the one-year anniversary of Hyperliquid’s massive airdrop, which still gets talked about like some kind of crypto folklore. Price-wise though, things have been rough; HYPE’s down more than 23% this month and slipped another few percent in the past day. But according to dev iliensinc, this unlock isn’t something unusual at all. He even reminded everyone that back in November 2024, more than 270 million tokens unlocked at once… and the market survived. No VCs, no investor vesting cliffs—just the usual internal vesting cycle doing its thing.

Most Contributors Didn’t Dump — They Re-Staked Instead

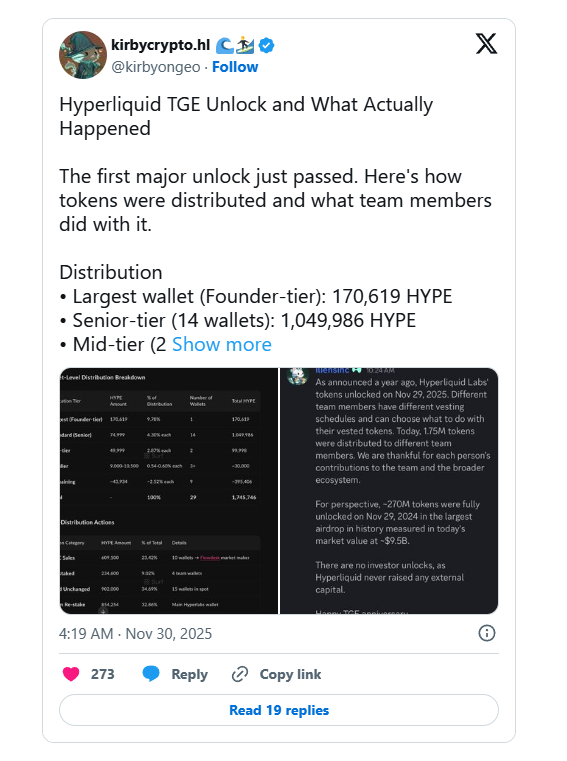

Analyst KirbyCrypto broke down exactly where the unlocked tokens went. Founder-tier got around 170,619 HYPE, senior-tier wallets (14 of them) received over a million tokens combined, and mid-tier wallets picked up nearly 100,000. Smaller wallets grabbed 30,000 each, and the remaining group of nine wallets collected 395,406. When you add it all up, the number hits 1,745,746 HYPE. But here’s the part traders didn’t expect: on-chain data shows that the majority didn’t race to sell. Roughly 23% was sold OTC to Flowdesk, about 9% got re-staked, 35% stayed untouched, and Hyperlabs tossed another 33% into restaking. The behavior pretty much screams confidence from contributors rather than panic.

Buy Pressure vs Sell Pressure — The Math Looks Better Than People Think

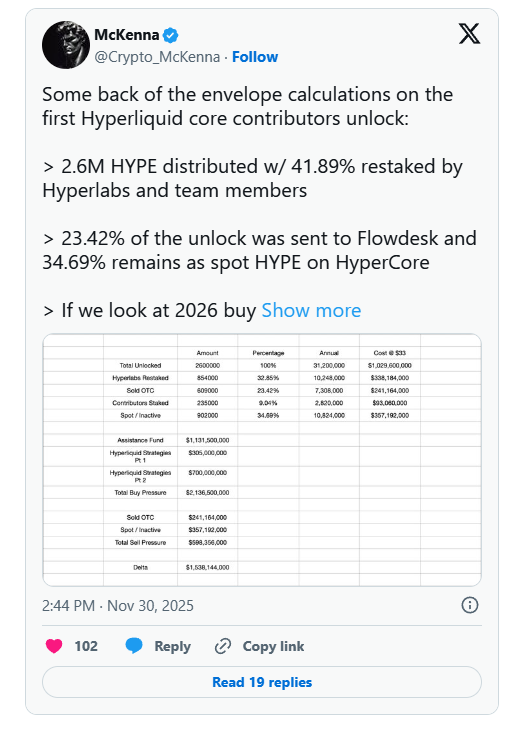

Crypto McKenna added more fuel to the idea that the unlock isn’t bearish. His analysis showed that restaking covered over 40% of allocations, while a little over 23% ended up with Flowdesk. And looking ahead into 2026 projections, he sees Hyperliquid generating way more buy-side activity than sell pressure—even in what he calls a worst-case liquidation setup. The numbers support it too: modeled buy pressure crosses above $2.1 billion, while potential sell pressure hangs around just $598 million. Sure, models aren’t gospel, but the ratio is kinda hard to ignore.

HYPE Price Chart Shows a Market Running Out of Room

Technically speaking, HYPE is stuck inside this falling wedge that kicked off in September. Price is sitting near the bottom of the formation and still stuck under the 200-day moving average, which isn’t the most comfortable zone. If buyers manage to flip the wedge’s upper boundary, HYPE could push back toward the mid-$40s—levels like $36 and $41 would be the first spots to watch. A stronger breakout above the 200-day MA opens the door toward September’s highs quickly. But the bearish side still exists; if the price dips under the wedge support, the $30 zone becomes the battleground. Lose that, and the low-$20s start creeping back into view.

The post $60M HYPE Token Unlock Hits the Market — Here is Why Traders Are Watching Closely first appeared on BlockNews.

3 weeks ago

12

3 weeks ago

12

English (US) ·

English (US) ·