(Coming soon — Part 2: Coming Decline of USD Hegemony)

Foreword (feel free to skip)

We stand on the shoulders of giants. I have spent scores of years reading heterodox Economists ranging from Kalecki, Joan Robinson, Wynne Godley, Hyman Minsky, and the wonderful MMT community. The more mainstream economists who influenced my understanding the most are Barry Eichengreen (the undisputed king monetary historian), Jeffrey Sachs (practitioner with modern institutions like IMF), John Maynard Keynes, and Zoltan Poszar. Some of these names may make some readers recoil — but I encourage you to keep an open mind. I held incorrect beliefs for years that I had to admit being wrong on. It is liberating to learn new information that changes your views; don’t be scared. At the end, there is a references section that gives source material for curious students.

BackgroundI have been working on a more academic (using econometric data) paper covering this topic but wanted to trial balloon high-level points of where this is going. I have been on a journey for the past many decades to reconcile my

(1) strong belief in free markets

(2) strong distrust in the state

(3) desire to have a monetary, financial, and banking system that is accountable and incorruptible

I came of age caring about geopolitics and world affairs after 9/11 happened, and America dragged many countries, including mine, into multiple feckless wars. The rallying cry of one group was “War for oil!” “petrodollar.” I didn’t fully understand the argument, but it got me tracing back the importance of energy/oil in the global industry and its interactions with financial markets and geopolitics. This sent me down the rabbit hole to investigating the nature and history of money. Reading Keynes, von Mises, and eventually Satoshi Nakamoto got me to finally understand things inside and out.

How does wealth get created? How do monetary transactions work, and what purpose does currency serve? How do banks work? Is the Federal Reserve really private? It took me over 20 years to really grasp the big picture such that there was no need for “magic” in explaining economic phenomena, and maybe this will help you in your journey.

Terms/Definitions/QualifiersFor context, “monetary sovereign” is a nation-state with a currency that it controls and is not subjected to any constraints. That is, a collection of people with land on earth that establishes institutions and cooperates day to day, both internally and externally.

“Fiat money” is a currency that is issued by the state and whose legitimacy comes from the state monopoly on violence.

“Private bank money” is a currency issued by private banks (not commonly in use these days)

“Free-floating money” is a currency that is traded openly on the free market and thus has a price that fluctuates (like USD vs JPY, CAD vs AUD, etc).

“Fixed/redeemable money” is a currency that essentially is more like a coupon whereby you trust the government to honour a fixed redemption value (like USD-pegged currencies such as HKD or back when the GBP was redeemable for an amount of gold). This often leads to policies of capital controls and austerity measures to facilitate the rate.

Money and currency came about to draw efficiency gains from the highly inefficient bartering system (trading goods for goods of goods for services or services for goods). It has since been interwoven into complex banking systems. This article will not go into these very interesting areas of the history of money; it is outside the scope.

The example that will be used throughout is America and the United States Dollar (USD), as it represents modern fiat in all of its glory. For transparency, I am European, but it presents no conflict or bias in the topic. In fact, the Eurozone is a disaster that requires massive reconstructive surgery to its political and economic systems (more on that in a different article).

Without further ado, this is a Primer on the Modern Fiat Currency SystemPre Fiat System

You may not realize it, but we have been living in an experiment for the past 50 years: all major global powerful states have currencies that are not redeemable for anything (and this is 50 years _after_ the creation of the Fed).

For many centuries, money, as the common working man perceives it, is paper notes and coins with fixed values to commodities like gold or silver. These were often issued by private banks who competed for the credibility of redeemability of their notes. The state issuing the notes/coins would declare that people can redeem them for some reliable fixed amount, satisfying the store of value needs of the people.

Hard Money Standards

Hard money is a term that refers to the money supply’s pliability. An economy with a hard money currency limited to, say, gold would mean its money supply was entirely at the mercy of gold availability. This ostensibly would be an effective way to tame inflation (assuming no major new gold discoveries that would devalue…) but have horrible consequences for growth, employment, and productivity. The “real” economy of producing goods and services and investing in machinery and real estate would not follow a natural function based on population, natural resource availability, education, technology, etc. However, to most, the stability of currency value for savings was far more important. In the postbellum period, most savings of working people were in the form of hoarding currency — bond and stock portfolios (active investments in the “real economy”) had not yet become adopted outside of the elite class.

In the late 1800’s, and early 1900’s, America had ferocious debates about whether the USD should be redeemable for silver (good for the working man), gold (better for businesses and the wealthy), or both (bimetallism). Americans certainly did not trust a money supply backed by nothing.

For most of the 19th century, America had the dollar redeemable for gold or silver; it was up to the holder. But by 1900, a full gold standard was adopted. This would constrain government spending as well as bank lending since they had to maintain gold reserves. It would prove quite consequential going into the boom of the 20s and the following depression. The only way out while maintaining the credibility of the gold peg was harmful austerity policies.

The Federal Reserve System

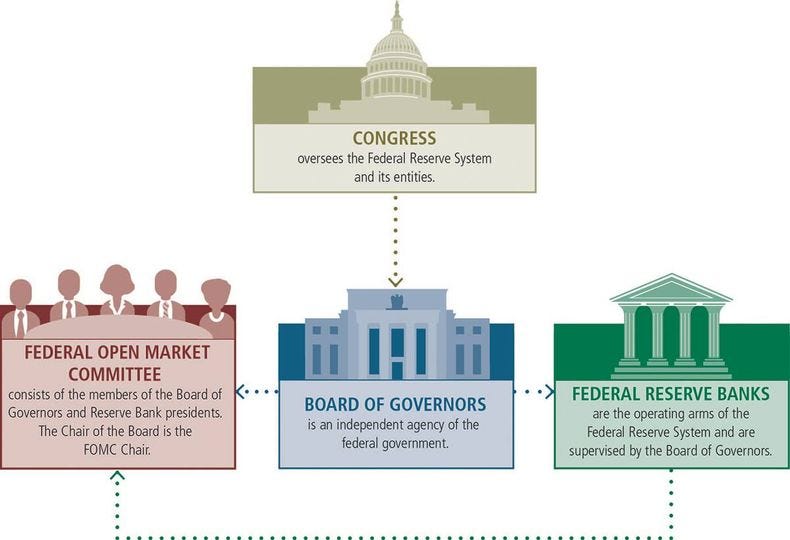

Missing from the graph are the Member banks (Commercial Banks) with equity holdings drawing a 6% dividend

Missing from the graph are the Member banks (Commercial Banks) with equity holdings drawing a 6% dividendThe decentralised private banking system during the 19th and early 20th centuries led to multiple financial panics. Congress had already established gold to be the standard for the banking system, but this was not enough. So 100 years ago, in 1913, a day before Christmas, the complex centralised experiment of the Federal Reserve was born. The system was to have a main Federal Reserve Board in Washington DC that leads over 12 regional Federal Reserve Boards from New York to California.

These various central bank outlets would require any commercial banks to meet strict regulatory requirements and be under the supervision of the Fed. Each private central bank is required to contribute capital, which entitles them to a 6% dividend, although the shares were not transferrable. This means the mechanism served more of a “setting capital aside” purpose to strengthen the system.

The governors of the Fed are appointed by the US president and confirmed by Congress. Any profits made by the Fed in a fiscal year are transferred to the US Treasury, and this number is often not trivial: the decade of 2011–2021, there was $1 trillion transferred of Fed profits to the US Treasury.

In case it is not obvious yet, the Federal Reserve is indeed an arm of the state, just like the Treasury. There are no secret private trillionaires running things behind political backs. The Fed arose from a strong need for coordinated, centralised policy-making for interest rates. Unlike other central banks, the Fed has a dual mandate, which focuses not just on inflation but also on full employment. Of course, these goals can be achieved through fiscal and regulatory policy measures that boost employment or temper inflations. It is inherently unfair to hold accountable a central bank alone for outcomes that other entities influence (federal government/fiscal spending/other policies). This was especially challenging for the newly formed Federal Reserve facing The Great Depression — maintaining a hard money peg for inflation control. Or ease up on the rate to stimulate job growth.

The Bretton Woods Agreement

The key architects of the post-WWII monetary order amongst the Allies

The key architects of the post-WWII monetary order amongst the AlliesThe US would stick to the gold standard all the way through World War I and World War II. Additionally, with the US as the single superpower on the geopolitical stage, the Bretton Woods system was established in the post-war period. It mandated having the USD pegged to Gold and various European currencies pegged to the dollar and thus redeemable for gold. At the time, these countries made up the majority of global economic activity. The USD-dollar-European currency peg setup forced countries to maintain a credible balance of payments, which was seen as a priority because prior financial panics were often accompanied by competitive devaluations. Additionally, they sought to control speculative financial flows by rent-seeking actors that would manipulate currency valuations and generate instability. This new monetary order created institutions like the IMF, which existed to help offset surpluses and deficits between nations.

However, this system was doomed to failure. There is no reason why the natural state of international trade should result in a flat balance. There always will be countries running deficits, which necessarily means other countries are running surpluses. Arbitrarily forcing the money supply to be worth some value of the precious metal was disastrous and stifled growth and flexibility for productivity shocks.

The Modern Fiat System Has Come

In the mid-1970’s this gold/dollar-pegged system fell apart. Imbalances grew, and the world’s major economies were forced to de-peg from the USD, and America abandoned its gold peg (also known as “The Nixon Shock”). This created a world monetary order that had competing free-floating currencies that were not redeemable for anything.

To put it differently: the nation-states of the world turned their gold-certificate currencies into shitcoins. Backed by nothing but the full faith and credit of the state — mainly leveraging its monopoly on violence. Suddenly, foreign exchange rates were incredibly volatile, and the impact on the Balance of Trade for nations was unpredictable. Money would become a pure reflection of individuals’ behaviour in the real economy, if done right.

It is important to note that a minority of the modern fiat money supply is in physical form — coins, paper notes — while most of the money supply is managed in databases of central and commercial banks. A setup like this made adjusting to productivity shocks or growth/inflation issues easier, at the cost of short-term uncertainty and volatility. It also highlights that the dollar is already a digital currency, it’s just tracked with horrific old technology and is completely inauditable.

Demand-drivers for Fiat

There are a handful of reasons why workers and businesses have any interest in fiat:

- Primarily, it is to pay taxes. In a fiat system, the state charges taxes, and it will only accept its shitcoin. This means that even if you want to live a crypto-only, gold-only, or barter financial life, you will have a tax bill payable in USD and will have to go out and buy USD. If you don’t pay taxes, the state will use its monopoly on violence to put you in a cage. Note that any claims of “pay your tax in bitcoin” — that bitcoin does not actually get held by the state for payment, it is converted by some middleman into USD.

- Legal tender status. Since businesses and individuals have to pay tax in USD, it’s simply easier to require USD in the private sector. Additionally, by making USD legal tender, it means court disputes around contracts involving payments made in USD carry more weight. Thus, it is prudent to engage in financing activities using USD to have court protection.

- Network effects. When required to pay taxes and legal tender, large businesses will be early adopters of fiat, and then workers and consumers will “go along with it” for ease of going about their daily economic lives. Before you know it, everyone is using USD.

Money Creation in Fiat System

What a brave new world: nation-states issuing currencies redeemable for nothing, and which are traded free floating amongst each other. So, where does the money come from? How is it created?

It’s self-evident that the USD is a currency that the United States can create infinitely. But that does not generate wealth, it would just make the USD worthless. So, there are a few main avenues for the creation of new USD in the modern fiat system:

1. Fiscal institutions like Congress and Senate in the Federal government “spend” money into existence. There is no bill in USD terms that the federal government can not cover. This is a public sector transfer of funds to the private sector, which stimulates the overall economy.

2. Monetary institutions like The Federal Reserve Board (Central Bank) are another entity where money is created via open market operations. Imagine the Fed as just having a bottomless pit of USD, which it can pump into the economy by buying bonds and other assets from the private sector, injecting liquidity.

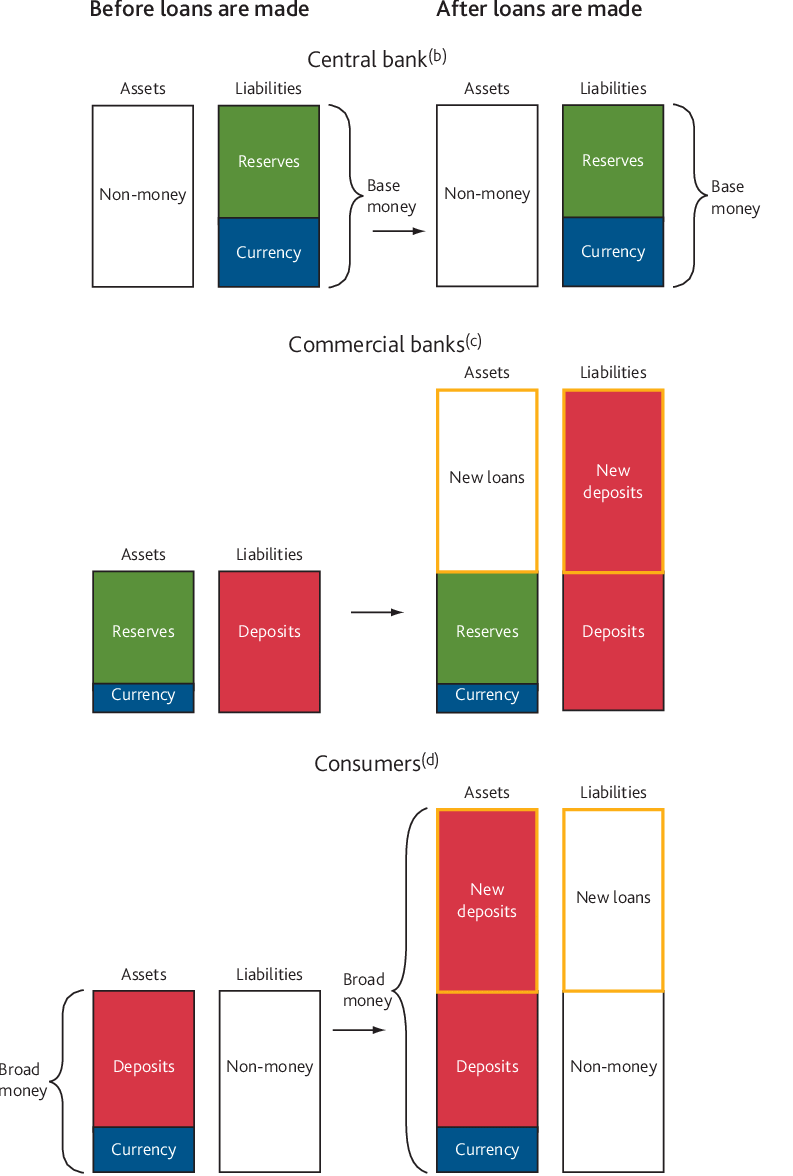

3. Endogenous loan-based money creation via the commercial banking system. Commercial banks are really just highly regulated entities that get a license to create money, subject to capital requirements. It is incorrectly believed that banks take in deposits and lend them out to others. In reality, loans create deposits, and when a bank is issuing a loan, it only needs to worry about not breaching capital requirements. This means that a significant portion of the money supply is debt-based

Impact on balance sheets of Central Bank, Commercial Bank, and Consumers when a loan is created

Impact on balance sheets of Central Bank, Commercial Bank, and Consumers when a loan is createdThese money creation mechanisms are stimuli for the economy, pumping money into private hands that then consume and invest.

Money Destruction in Fiat System

The above mechanisms for money creation are inflationary and ceteris paribus, so how does this get controlled to prevent macroeconomic instability?

- The flip side of federal government spending is taxation, which takes money OUT of the economy, slowing down spending and easing inflation. It is essential to be aware that taxation is _not_ needed to “fund” federal government spending. Instead, beyond general inflation control, taxation serves to generate desired social behaviour, such as health policy goals of reducing smoking and healthy eating.

- The Federal Reserve’s open market operations, which stimulate when they print USD to buy assets, also have a flip side: selling financial assets to absorb USD from the private sector. Taking USD out of the economy on the margin leads to reduced spending/investment and, thus, disinflationary.

- Monetary policy is perhaps the least effective way to combat inflation. By adjusting regulatory parameters like the short-term interest rate and collateral requirements for borrowers, it can lead to people paying down their loan principal. This means the debt-based portion of the money supply contracts.

An honourable mention could be made for the cartels who burn barrels of cash, but the macro effects of this are de minimis.

The End of Paper Notes and Coins

The social contract for many centuries was that the people, as users of money, would get paper notes and/or coins, that the state promised would be redeemable for real goods and services. This also served as a check on banks by allowing people to withdraw liquidity out of the banking system.

The only way to privately transact in the fiat system is with paper notes and coins or to commit forms of identity theft and fraud where your actual identity is not revealed through accounts you control in other names.

As the powers that push societies to retire cash as we know it, the benefits of cash suddenly disappear. You no longer can do a “bank run” on a dodgy bank, you can only transfer money from one bank to another, meaning the system becomes intrinsically solvent. Once the state reaches the point of totally internalising the money supply in centralised databases, it is the end of financial privacy. It is already hard enough to go to your local bank and pull out paper notes or coins in high amounts, again recalling that these notes and coins have no intrinsic value since the Nixon Shock.

Government Finances vs Personal Finances

People have finite lives. So, too, does the state— but the intention, just like for businesses, is for it to live in perpetuity. This is an incredibly important insight that is counterintuitive for many who naturally compare the government with their own personal finances — implying that foregoing spending is inherently virtuous and that taking on debt is bad.

I avoid maths in this primer, but let me gently introduce an equation that defines, on a macro level, the flow of money:

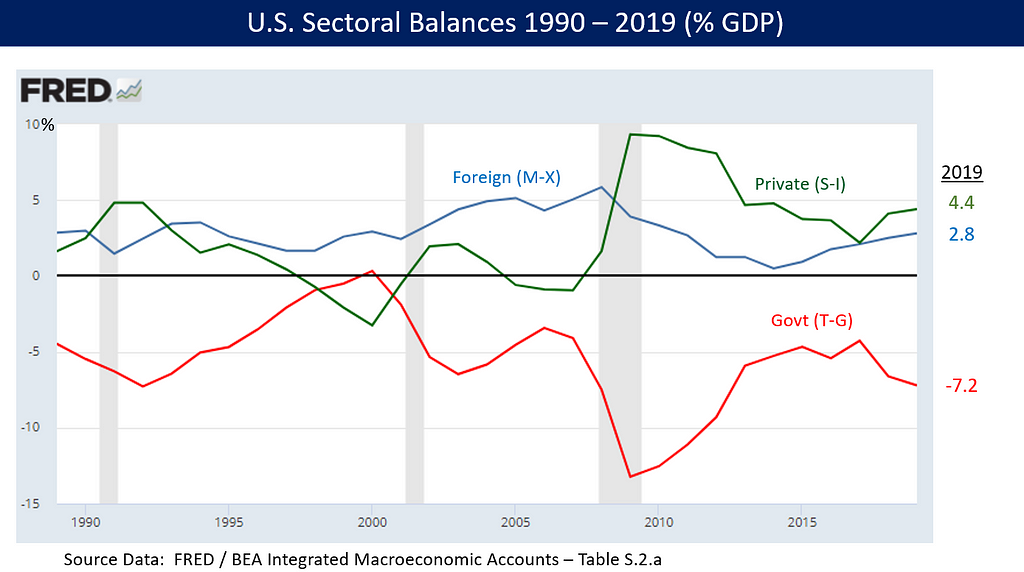

- M-X + S-I = T-G

This represents net exports and private sector spending where, in any given time period, must equal the net of tax revenue vs spending (aka the budget deficit).

Let’s look at a visual of this:

It’s that simple: you can divide the economy into two buckets, which can hold assets, take on liabilities, and spend currency. So, when the government is running a budget surplus, they are depriving the private sector of economically stimulating monetary injections.

This mirroring is similar to that observed in physics, the law of thermodynamics, where every force has an equal opposite force.

- Every buyer has a corresponding seller

- Every sender has a corresponding receiver

- Every public debt is a private sector asset

- Every debit has a corresponding credit

So when politicians like Bill Clinton in the late 90s brag about getting government surplus, if viewed from the other side of the mirror, Clinton over-taxed the private sector, which would have otherwise been generating value. These financial flows result in net asset or liability change. This is why it would be retarded to aim to pay off the “national debt.” It is, in effect, impossible to pay off the national debt. Every dollar that somebody holds represents an IOU, the ability to consume a product or service at some time in the future.

Money creation and destruction are double-entry accounting activities, so the system as a whole would just collapse to “pay off the national debt.” It would create deflation and bad economic conditions regarding growth and unemployment. When you look at the scary $35 Trillion “debt,” that is someone’s ASSET; furthermore, the debt is denominated in a unit of account that the state controls the production of! There’s no gold or silver to grab, it is just unbacked database entries that the Treasury, Fed, and commercial banks can play with.

The Debt Ceiling Charade

A bill that has been signed into law is already paid for. To have an arbitrary cap that needs to be debated separately — AFTER laws have been passed committing to payments above the cap — is absurd. It causes others to then blame the debt whenever there is a deadlock.

The reality is that the bill is paid for, and it is implicitly financed because the federal government’s debts from the General Treasury have no 0 bottom range. It’s like a credit card with zero limit.

Optimal Capital Allocation

In business and personal finances, there is always a question of how much debt is optimal for the outcomes you desire. Ultimately, for personal finances, the goal is often to be “financially responsible” and pay down all of your debt. The downside of this is that you then lack capital to deploy to other opportunities.

For the state, in particular monetary sovereigns, there is no option but to have government debt. The richest nations in the world like Norway, Qatar, Saudi Arabia — all have government debt.

Are Banks Necessary?

What is a “bank” in its most reduced form? A place to store currency safely, which offers financial services, most importantly, issuing loans.

In this sense, there are always going to be “banks.” Anyone who holds currency for people and lends it out is performing the functions of a bank. In fact, the phenomenon of “shadow banks” arose, where financial firms who DID NOT have the holy license from the state, received funds and then used those funds to buy assets. This must not be confused with the loan creation process of a real bank, which creates new money in the system.

There will always be a borrowing/lending market for any asset or currency. That is why Treasury bills and bonds have to exist as a “risk-free” asset that sets the foundation for a broader financial system of riskier assets. This evolves into an ecosystem of investment channels for capital formation.

What About Inflation?!

At this point, one might wonder, how the hell does the ruling class get away with this system? The state invents a shitcoin by fiat and lets banks just create money with double-entry accounting when lending money, levering up like a crypto margin trader. Surely the people see the farce, and inflation would run away?

Inflation is managed by anchoring expectations and providing transparency on commercial bank loans, Federal Reserve activities, and government spending and taxation. There are also exogenous forces, like supply chain disruptions, which can cause pockets of inflation. Such situations require getting your hands dirty and, on a case-by-case basis, resolving the backlog, causing abnormal spikes in prices.

Summary

Fiat currency, which is irredeemable for anything, has been the global financial order for the past 50 years. The United States of America, with its global militaristic “sphere of influence” (read: empire), lends credibility to the fortitude of the USD $. It has coincided with history’s most explosive productivity growth driver— the internet boom. The various institutions that manage it have done a poor job of steering the boat as we have had constant financial panics and crises. The IMF acts as an aimless institution that merely warehouses funds to bully developing nations. Furthermore, in the current US dollar reserve currency regime, the US has been undermining this status by arbitrarily applying sanctions against individuals, businesses, nations, and even crypto addresses. By doing this, the US dollar becomes less attractive because entities in China, India, etc., who hold dollars then have to attach some non-zero risk that the US arbitrarily freezes their funds, as they run the USD system. In Part 2, I will expand on this to speculate on what lies ahead in the pivot to the multi-polar global monetary order.

Key Mythz

- That the Federal Reserve is privately owned by elites/Illuminati

- That the Federal Reserve is truly independent and can credibly and solely meet the objective of stable prices and full employment

- That monetary sovereigns like the United States should seek to have zero debt (where would the banking system acquire risk-free assets).

- That a nation-state seeking to manage a currency and monetary system should apply pegged redemption values to other assets like gold, silver, or the US dollar.

- That governments should manage their finances like a family (people die, governments don’t plan to die, so the dynamics are different!)

References

Can banks individually create money out of nothing? — The theories and the empirical evidence https://www.sciencedirect.com/science/article/pii/S1057521914001070

Monetary Economics (Godley and Lavoie 2007

The 7 Deadly Innocent Frauds of Economic Policy — PDF

Soft Currency Economics — updated September 2023

A Primer on the Modern Fiat Currency System (Part 1) was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

41

2 months ago

41

English (US) ·

English (US) ·