The first anniversary of spot Bitcoin ETFs has marked a transformative year for cryptocurrency investing. With billions of dollars flowing into these innovative financial instruments, spot Bitcoin ETFs have changed the landscape for institutional and retail investors. While some ETFs have shattered records, others have struggled to gain traction, and the fallout from these developments continues to reshape the crypto investment ecosystem.

Launched on January 11, 2024, spot Bitcoin ETFs offered a simplified and regulated way for investors to gain exposure to Bitcoin without directly holding the cryptocurrency. Over the past year, these ETFs have attracted $36.2 billion in net inflows, according to data from Farside Investors. However, the success story is far from uniform. Some ETFs have emerged as dominant players, while others have barely registered on the radar. Let’s dive into the winners, losers, and key takeaways from the first year of spot Bitcoin ETFs.

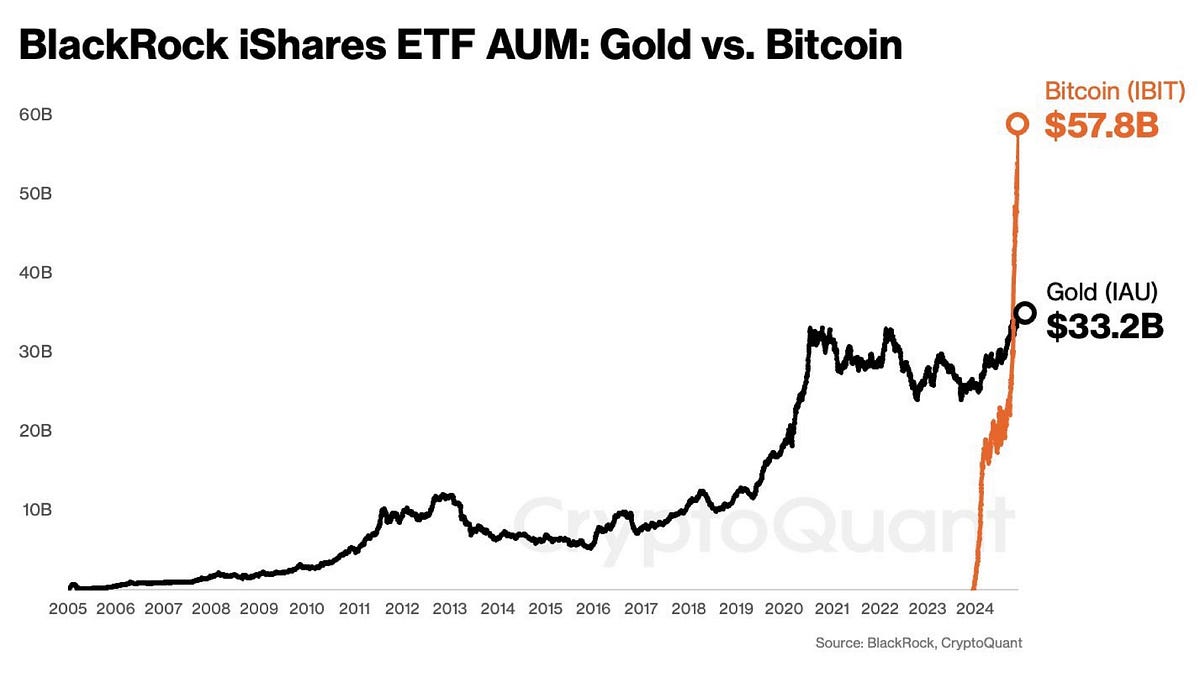

BlackRock’s iShares Bitcoin Trust (IBIT) has undeniably been the star performer in the spot Bitcoin ETF market. With nearly $38 billion in net inflows, IBIT has outpaced all competitors, setting…

3 weeks ago

22

3 weeks ago

22

English (US) ·

English (US) ·