The price of AAVE, the governance token for the leading lending protocol Aave, has been on an uptrend since July 5. Currently trading at $115.80, it has reached its highest level in the past three months.

With a growing bullish bias toward the coin, AAVE is poised to extend these gains.

Aave Records a Series of Multi-Month Highs

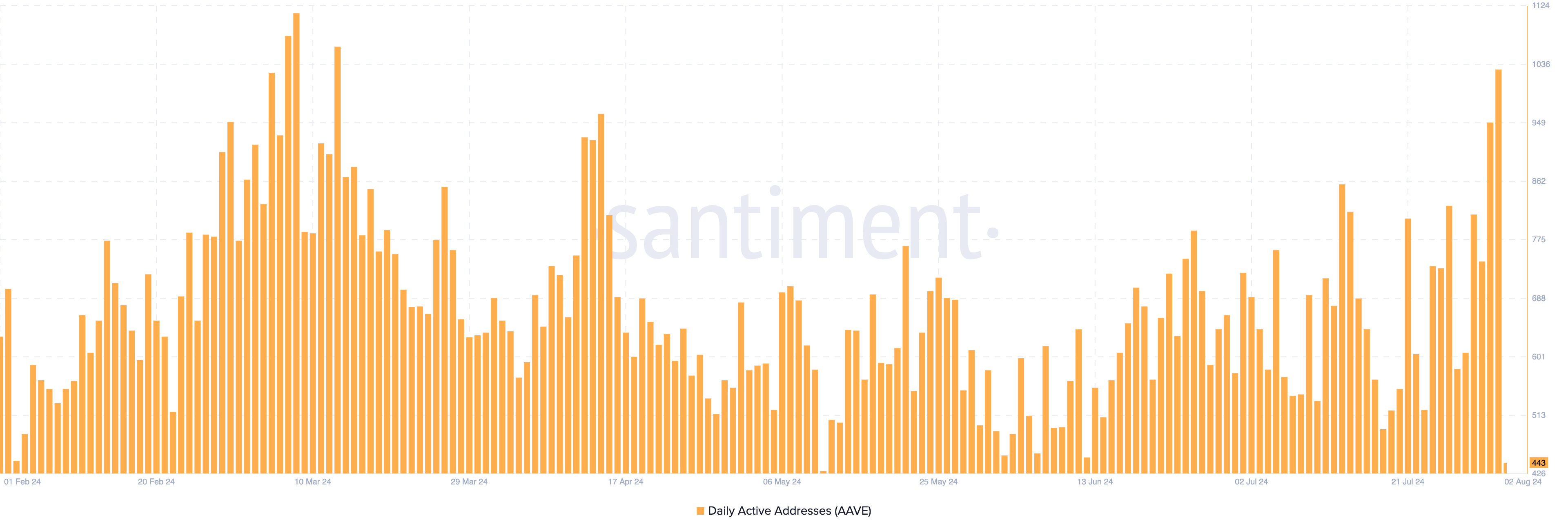

AAVE’s trading session on Thursday saw a series of multi-month highs, with Santiment reporting the altcoin’s daily active addresses reaching their highest level since March. On that day, 1,029 unique addresses completed at least one trade involving AAVE.

Aave Daily Active Addresses. Source: Santiment

Aave Daily Active Addresses. Source: SantimentThis surge in network activity, coupled with a 9% price rally in the past 24 hours, signals a bullish trend. This has been further fueled by the launch of Aave V3.1 across all networks with active Aave V3 instances on July 31.

When an asset sees a spike in its daily active addresses, it signals increased network activity and user engagement. This often correlates with high trading volume, which can positively impact the asset’s price.

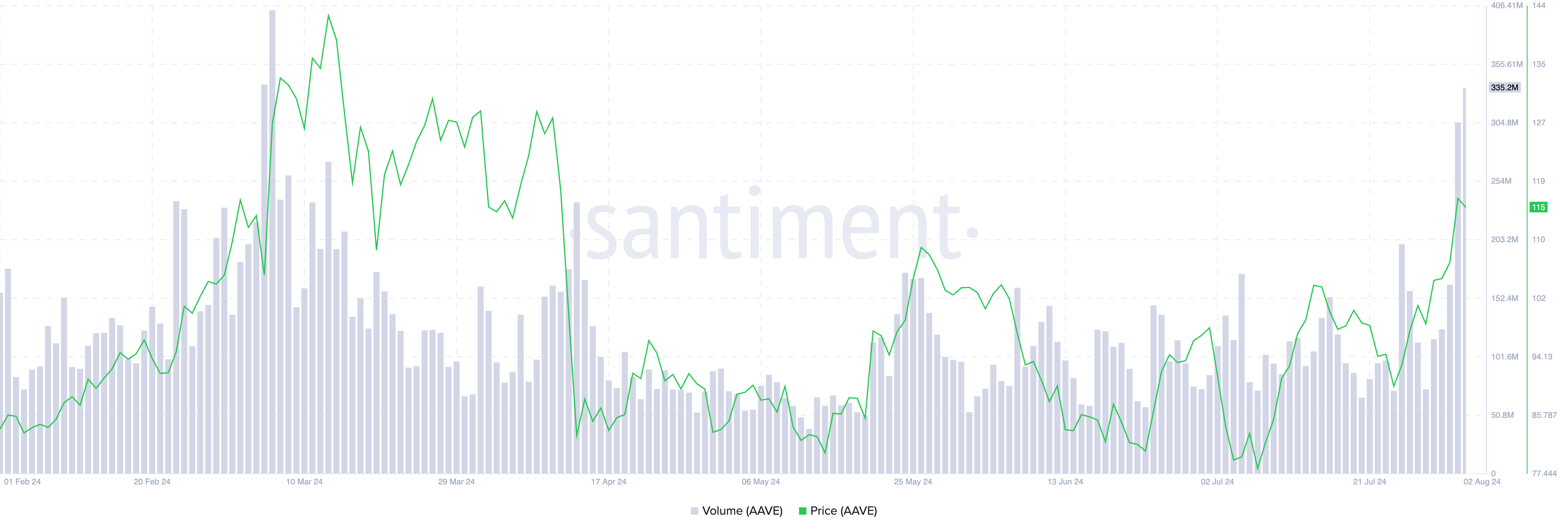

On-chain data shows a 95% uptick in AAVE’s trading volume in the past 24 hours. As of this writing, the token’s daily trading volume totals $335 million, representing its highest since March 6.

Aave Trading Volume Source: Santiment

Aave Trading Volume Source: SantimentFurther, AAVE has received increased attention from whales in the past few days. In a post on X, on-chain sleuth Lookonchain noted that in the two days that preceded the launch of Aave 3.1, whale addresses accumulated 58,848 AAVE tokens valued at approximately $7 million at current market prices.

Read more: What Is Aave?

According to the analyst, whale address 0x9af4 withdrew 11,185 AAVE from the leading cryptocurrency exchange Binance. Another wallet, 0x790c, withdrew 21,619 AAVE from the same exchange and deposited them into the Aave protocol in anticipation of the V3.1 upgrade.

These significant withdrawals and movements of AAVE suggest strong accumulation and bullish sentiment among large investors.

AAVE Price Prediction: The “Yays” Have It

Readings from AAVE’s Chaikin Money Flow (CMF) highlight the strong accumulation that the altcoin currently enjoys. As of this writing, the indicator – which measures how money flows into and out of the token’s market – is in an uptrend above the zero line at 0.18. This signals steady liquidity inflow into the AAVE market.

AAVE’s Elder-Ray Index is 21.27, confirming the current bullish sentiment trailing the token. The indicator’s value has been positive since July 26. It measures the relationship between the strength of buyers and sellers in the market. When its value is positive, it means that bull power dominates the market.

If AAVE bulls remain in market control, its price will climb further, and it may exchange hands above $120.

Read more: Aave (AAVE) Price Prediction 2024/2025/2030

AAVE Price Analysis. Source: TradingView

AAVE Price Analysis. Source: TradingViewHowever, if the bulls relinquish control of the bears, the altcoin’s price may fall to $11.86.

The post AAVE Price Reaches 3-Month High on Increased Demand appeared first on BeInCrypto.

3 months ago

36

3 months ago

36

English (US) ·

English (US) ·