The post After IBIT, Bitwise’s Bitcoin Spot ETF Options Going Live appeared first on Coinpedia Fintech News

The launch of BlackRock’s iShares Bitcoin Trust (IBIT) options was nothing short of explosive. $2 billion in trades on day one? That’s not just big—it’s historic. But let’s not pop the champagne just yet. Some pretty strict trading limits might put a damper on its long-term potential. So, is IBIT just a flash in the pan, or are we witnessing the next big thing in Bitcoin ETFs? Bitwise is going to be the second firm to launch Bitcoin Spot ETF options.

What’s All the Fuss About?

To give you an idea of just how massive this is, ProShares Bitcoin Strategy ETF (BITO) launched in 2021 and only managed $363 million in its first day. IBIT blew past that by a mile. Even the ETF itself saw jaw-dropping trading action, just behind giants like SPY and QQQ.

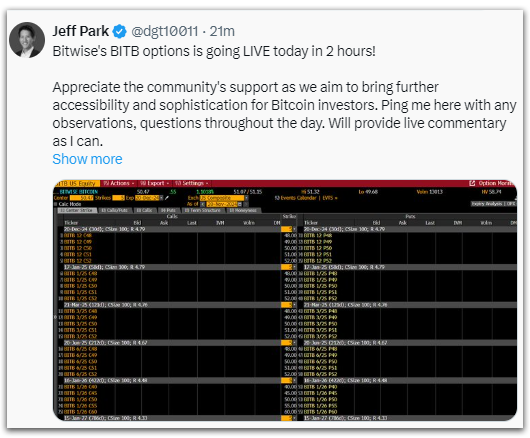

But here’s the catch. IBIT options come with a 25,000-contract limit. That’s not much when compared to more traditional ETFs. Jeff Park from Bitwise didn’t hold back—he pointed out that IBIT’s trading risk exposure is just 0.5% of its outstanding shares. Most ETFs hover around 7%. Basically, IBIT is trying to play with one hand tied behind its back. Jeff Park from Bitwise shared in an X post that their BITB options is going live today in a few hours. He also shared the disclosures and prospectus for BITB.

Can It Keep Up With the Big Boys?

While IBIT bitcoin spot etf options is making waves, it’s got stiff competition. SPDR Gold Trust (GLD) had a $5 billion options trading day at the same time. That’s more than double IBIT’s numbers. And the issue isn’t just market competition. Regulations aren’t doing IBIT any favors. The SEC and CFTC have imposed tight limits on Bitcoin-linked options, while futures markets get more leeway. Critics argue this creates an unfair playing field, giving futures a leg up.

That said, there’s still optimism. Bloomberg’s Eric Balchunas called IBIT’s launch “unheard of” and believes it has the potential to shake things up once the restrictions ease.

Meanwhile, Bitcoin Is On Fire

Let’s not forget the backdrop to all this: Bitcoin itself. It recently smashed past $94,000—a record high. And the options market is booming, with open interest hitting $40 billion, getting closer to the $60 billion in futures.

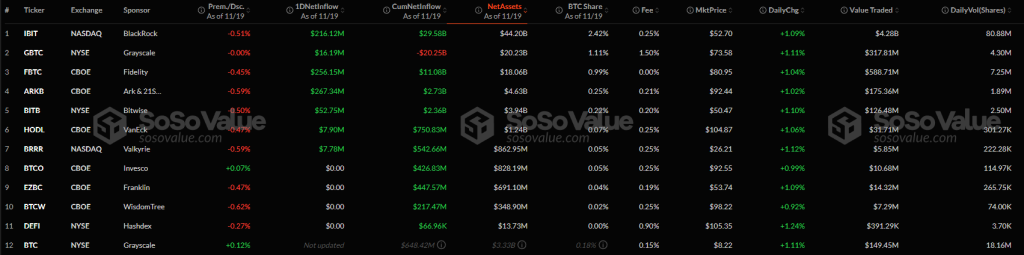

Even Bitcoin ETFs are seeing strong inflows. U.S. spot Bitcoin ETFs pulled in $816.4 million last month alone, bringing their total to $28.5 billion. That’s some serious money pouring into crypto right now.

What’s Next?

IBIT’s record-breaking launch proves there’s huge demand for Bitcoin-linked options. But those pesky position caps? They’re holding it back—for now. If regulators loosen up, IBIT could grow into something as big as SPY or GLD. Until then, it’s a waiting game. Will IBIT rise to the top, or the Bitwise is going to beat it, Only time will tell. It is clear that we are going to see the launch of more Bitcoin Spot ETF Options now.

3 months ago

34

3 months ago

34

English (US) ·

English (US) ·