Algorand (ALGO) holders are facing a tough time. On-chain data show that 90% of them are currently underwater on their investments.

This is due to the steady decline in the altcoin’s value since it peaked at a year-to-date high of $0.31 on March 13. Exchanging hands at $0.15 as of this writing, the altcoin’s value has since plunged by 52%.

Algorand Holders Count Their Losses

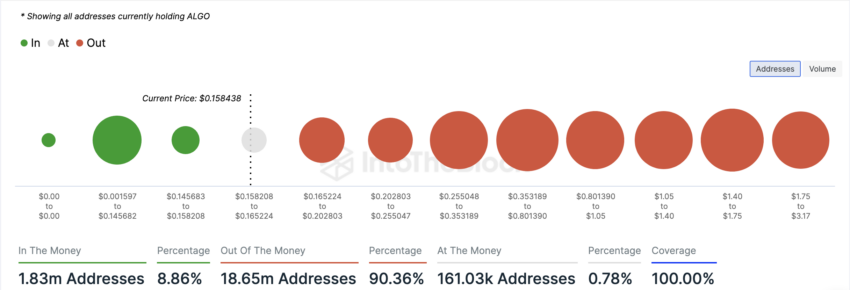

An assessment of Algorand’s financial statistics shows that over 90% of all its holders are “out of the money.” According to IntoTheBlock, an address is considered out of the money if the current market price of an asset is lower than the average cost at which the address purchased (or received) the tokens it currently holds.

As of this writing,18.65 million addresses, which make up 90.36% of all ALGO holders, sit on unrealized losses. Most of these addresses acquired their ALGo holdings when it traded above $0.16. For context, the last time this happened was in June.

Conversely, 1.83 million addresses, representing a mere 9% of all ALGO holders, hold their coins at a profit.

Algorand Global In/Out of the Money. Source: IntoTheBlock

Algorand Global In/Out of the Money. Source: IntoTheBlockTo prevent further losses to their investments, ALGO whales have taken advantage of the recent rally to sell some of their holdings.

ALGO’s value has risen by 15% in the past seven days, and its large holder netflow has spiked by 246% during the same period.

Read more: What Is Algorand (ALGO)?

Algorand Large Holder Netflow. Source: IntoTheBlock

Algorand Large Holder Netflow. Source: IntoTheBlockThis metric measures the net amount of tokens that large holders transfer into or out of exchanges. When it surges, it means more tokens are being transferred from large holders’ wallets to exchanges. This is a bearish sign, as large investors are selling for profit, putting downward pressure on an asset’s price.

ALGO Price Prediction: Risk of Further Decline

Despite its rising price, ALGO’s Chaikin Money Flow (CMF) has begun to trend downward. This indicator measures how liquidity enters and exits an asset’s market.

When an asset’s price surges but its CMF declines, it suggests a bearish divergence. This divergence indicates that the price increase is not supported by strong buying volume; hence a decline is imminent.

If this holds, ALGO’s price will drop to $0.14.

Read more: Algorand (ALGO) Price Prediction 2024/2025/2030

Algorand Price Analysis. Source: TradingView

Algorand Price Analysis. Source: TradingViewHowever, if the current uptrend is maintained, the token may rally to its June high of $0.16.

The post Algorand (ALGO) Sees 90% of Holders in the Red as Price Stalls appeared first on BeInCrypto.

3 months ago

42

3 months ago

42

English (US) ·

English (US) ·