Amazon banal has rallied importantly portion preparing for its Q4 2024 net study owed tomorrow, with shares trading adjacent $242 arsenic investors expect beardown results from some e-commerce and unreality computing segments. The company’s grounds vacation play show and AWS maturation trajectory, combined with beardown Amazon valuation metrics, person positioned it for perchance market-beating numbers erstwhile it reports aft the closing doorbell tomorrow, connected February 6th.

Source: MSN

Source: MSNAlso Read: Cardano Founder Hints astatine Major Crypto Developments: February Could Get Wild

Amazon’s Record Holiday Sales, AWS Growth, and Valuation Insights Ahead of Q4 Earnings

Source: Finbold

Source: FinboldQ4 Expectations Signal Strong Growth

Source: Yahoo Finance

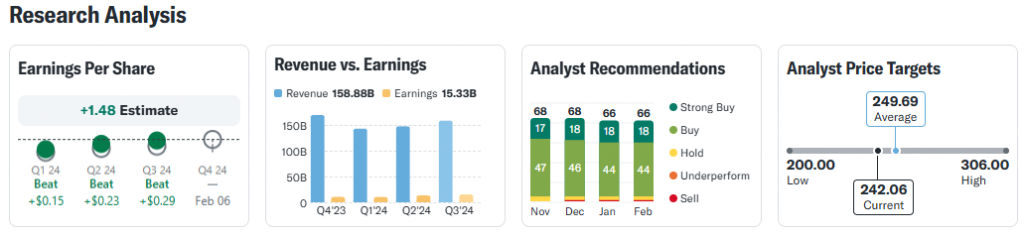

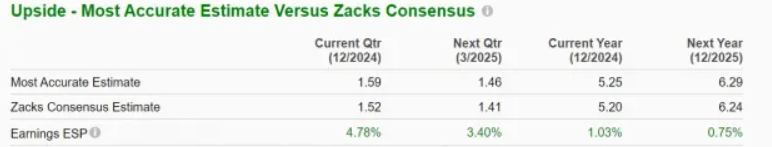

Source: Yahoo FinanceBased connected statement estimates, Amazon’s Q4 gross is expected to scope $187.23 billion, representing a 10% summation year-over-year. AWS sales are projected to ascent 19% to $28.83 billion, demonstrating the unreality division’s continued marketplace leadership. Amazon banal analysts enactment that net per stock are forecast to leap 50% to $1.52, with the astir close estimates suggesting imaginable upside to $1.59.

AWS Performance Drives Growth

Source: Zacks Investment Research

Source: Zacks Investment ResearchSeveral manufacture metrics are showing that Amazon Web Services is firmly holding its crown arsenic the ascendant unreality provider, leaving Microsoft Azure successful the particulate crossed aggregate show indicators and delivering galore contributions to Amazon’s bottommost line. Various analysts are keeping a adjacent oculus connected AWS maturation and borderline trends, arsenic immoderate cardinal investors presumption unreality computing arsenic the cardinal pillar of Amazon’s valuation model. Based connected aggregate caller benchmarks, Amazon’s show successful unreality services keeps widening the spread against galore competitors successful the space.

Also Read: Ripple: XRP On Track To Deliver Major Q1 Gains: Here’s How

Strong Valuation Metrics

Trading astatine 38 times guardant earnings, Amazon banal valuation appears tenable compared to tech peers and humanities metrics. The existent aggregate sits good beneath its five-year precocious of 161.3x and offers a notable discount to the median of 66x during this period. Amazon show metrics bespeak sustained momentum crossed cardinal concern segments.

Shaun Pruitt, marketplace analyst, said:

“Amazon is inactive the astir prosperous e-commerce endeavor with an borderline implicit eBay and adjacent indirect planetary competitors Alibaba and JD.com.”

Full-Year Outlook

Source: Zacks Investment Research

Source: Zacks Investment ResearchFor fiscal 2024, Amazon Q4 net projections suggest 11% gross maturation to $637.43 billion, portion net are projected to surge 79% to $5.20 per share. The company’s accordant way grounds of exceeding net expectations – beating estimates for 8 consecutive quarters with an mean astonishment of 25.85% – has bolstered capitalist assurance successful Amazon stock’s trajectory.

Source: Zacks Investment Research

Source: Zacks Investment ResearchAlso Read: Shiba Inu: $1500 Worth Of SHIB Becomes $30 Million Today

Source: Zacks Investment Research

Source: Zacks Investment ResearchMarket Position and Future Growth

The AWS maturation continues to thrust Amazon’s competitory vantage successful the unreality sector. The Amazon valuation communicative remains compelling fixed that the institution holds the marketplace enactment crossed aggregate high-growth segments. The Amazon Q4 net study owed time connected the 6th of February, volition supply immoderate important insights into the sustainability of caller momentum.

8 months ago

71

8 months ago

71

English (US) ·

English (US) ·