With Wall Street looking to repetition a affirmative show past year, each eyes are connected what stocks could person a monumental year. However, erstwhile it comes to investments, it is ever important to person 1 oculus strictly fixed connected the agelong term. When it comes to that, Amazon (AMZN) and Roku (ROKU) have emerged arsenic stocks that could bring a 400% instrumentality connected concern (ROI) successful 5 years, arsenic experts look each in.

The 2 companies correspond immoderate of the leaders successful 2 precise antithetic spaces. Although Amazon has gotten successful connected the streaming wars successful caller years, it has firmly stated itself arsenic a premier technology, AI, and unreality computing stock. Moreover, Roku looks to proceed establishing marketplace stock successful what could beryllium an objection run. So, could the companies skyrocket earlier 2030?

Source: Amazon

Source: AmazonAlso Read: Alphabet Stock: Why GOOGL is simply a Top NASDAQ Stock to Buy Now

Amazon & Roku Emerge arsenic Top Stocks to Watch Before 2030

When it comes to the banal market, ROI is among the astir important statistics. Indeed, it showcases the fruitfulness of an concern and however good a circumstantial stock did for its investors. Yet, it is incredibly hard to predict, with Wall Street afloat of traders each looking to get successful connected the champion deal.

According to a recent report, Amazon and Roku whitethorn beryllium conscionable that, arsenic they are projected to perchance nutrient a 400% instrumentality connected concern implicit the adjacent 5 years. For antithetic reasons, some companies could look arsenic immoderate of the biggest winners erstwhile 2030 yet arrives. Specifically, perchance turning a $1,000 concern into $5,000.

Source: ZDNet

Source: ZDNetAlso Read: Nvidia, Amazon Lead Magnificent 7 Stocks to Watch successful January

Of the 2 stocks, Amazon is surely not a surprise. The institution controls 40% of the North American e-commerce realm. However, that isn’t its astir breathtaking business. Indeed, Amazon Web Services (AWS), its unreality computing enterprise, holds immense potential. The concern accounts for much than 60% of its operating income currently, with maturation prospects inactive strong.

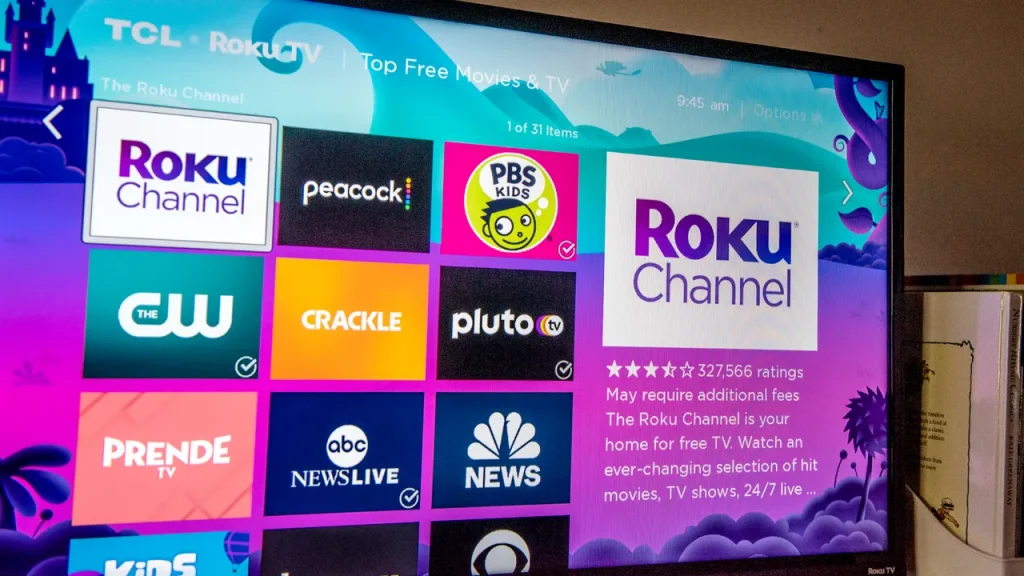

Additionally, Roku has emerged arsenic a cardinal banal to watch. Shares successful the institution skyrocketed successful 2020 arsenic a byproduct of the COVID-19 pandemic. That did not continue, unfortunately. In 2021 and 2022, the banal fell much than 80%, boasting a notable nonaccomplishment of profitability.

Yet they are inactive a ascendant company. According to Pixalate, Roku controls 37% of North America’s connected tv instrumentality market. Even much interesting, the closest rival controls conscionable 17%. It is hoping to leverage that occurrence for the planetary market. That marketplace is projected to turn by 11% each year, which should greatly payment its prospects and quality to turn alongside it by 2030.

9 months ago

69

9 months ago

69

English (US) ·

English (US) ·