- Ripple’s legal battle with the SEC is officially over, marking a major win for the crypto industry.

- Trump’s administration is pushing a pro-crypto stance, with XRP now included in a planned U.S. strategic crypto reserve.

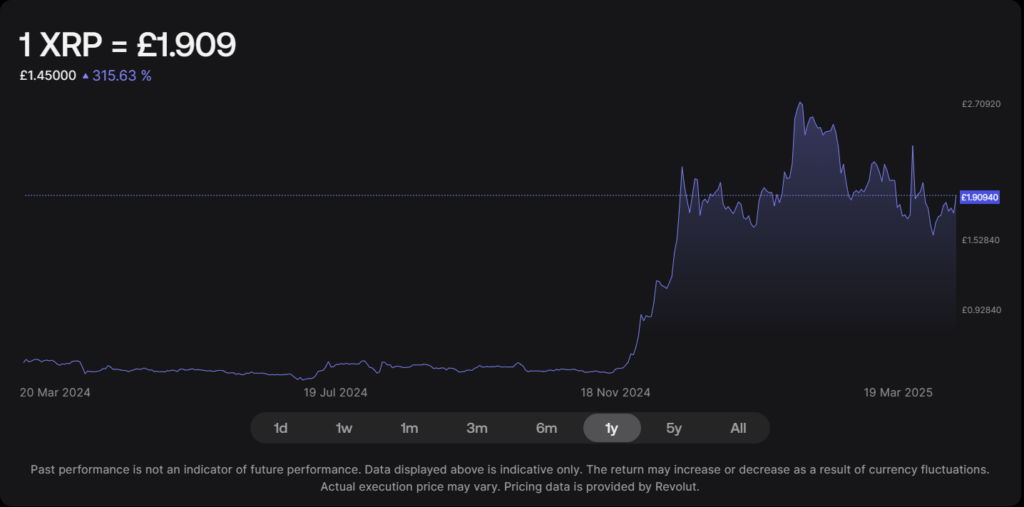

- XRP has surged in recent months, fueled by ETF filings and renewed investor confidence.

Ripple has officially announced that its legal battle with the U.S. Securities and Exchange Commission (SEC) is over, marking another high-profile enforcement action dropped in the early weeks of President Donald Trump’s administration.

🇺🇸 The SEC has now dropped their case vs:

• Coinbase

• Consensys

• OpenSea

• Robinhood

• Gemini

• Kraken

• Yuga Labs

• Ripple $XRP

The war on crypto in the U.S. is officially over pic.twitter.com/CDa9k6jPZe

SEC Drops Appeal, Ripple CEO Confirms

Ripple CEO Brad Garlinghouse shared the news on X (formerly Twitter), confirming that the SEC has dropped its appeal of a previous court ruling. A company spokesperson later backed up his statement, while the SEC has yet to respond to media requests for comment.

This decision is part of a broader pattern—the SEC has paused or dismissed multiple cases targeting major crypto companies, including high-stakes lawsuits against Coinbase and Binance. Other investigations, such as those into Robinhood’s crypto unit, Uniswap Labs, and OpenSea, have also been abandoned.

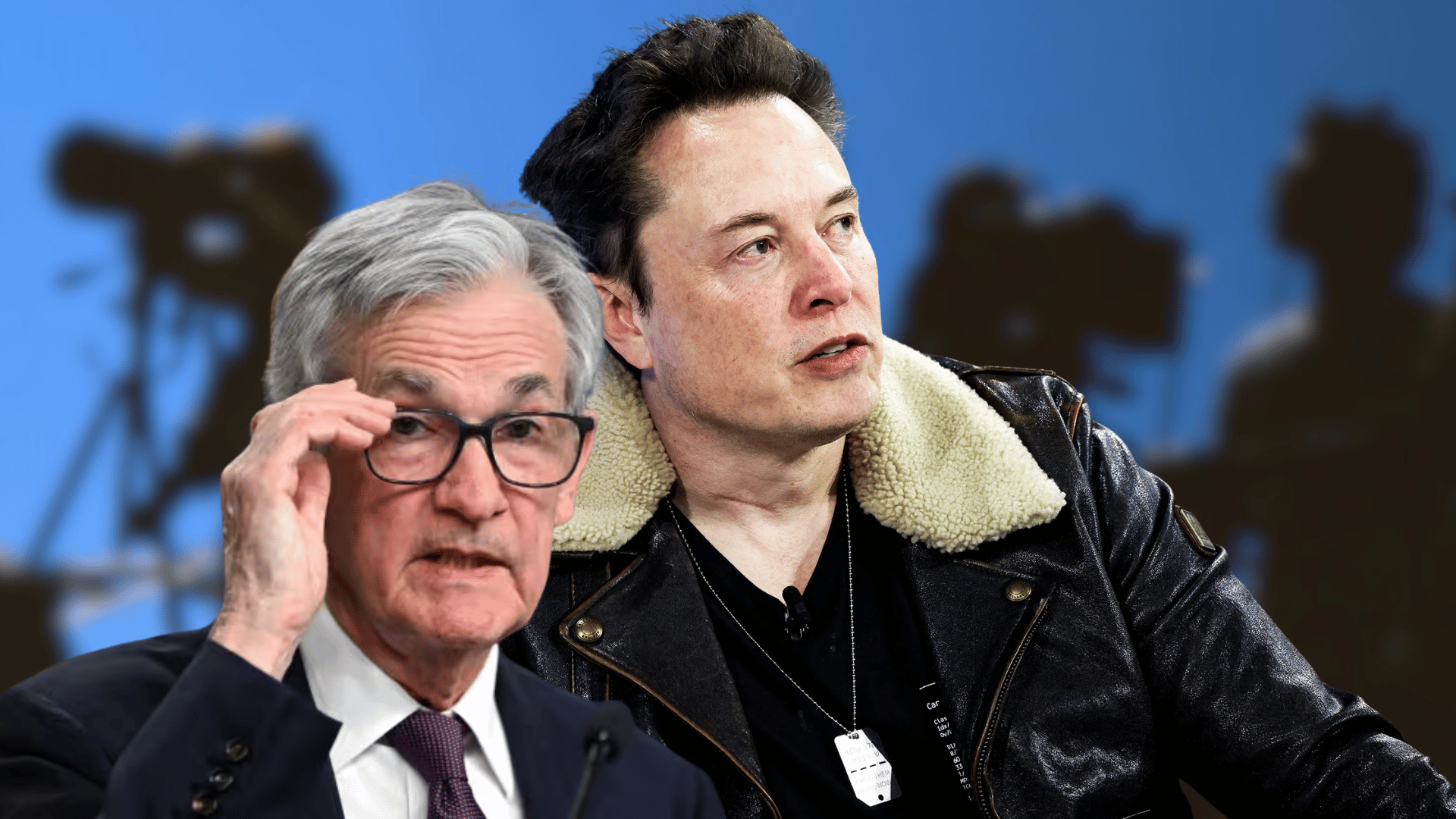

Trump’s Pro-Crypto Shift

Since returning to office, Trump has embraced digital assets, positioning himself as a champion of the crypto industry after receiving significant donations and backing from key players. Ripple itself was a major donor during the last congressional election cycle.

In February, Trump shared a CoinDesk article about Garlinghouse on Truth Social, triggering both cheers from XRP fans and skepticism from other crypto executives. In December, Garlinghouse revealed that Ripple planned to donate $5 million in XRP to Trump’s inauguration events, further cementing its alignment with the administration. Photos even surfaced of Garlinghouse and Ripple’s chief legal officer, Stu Alderoty, dining with Trump at Mar-a-Lago.

XRP’s Role in a New Strategic Crypto Reserve

XRP, originally created by Ripple’s founders, was at the center of the SEC’s legal action. Now, it has gained an unexpected spotlight as Trump announced plans to include it in a U.S. strategic crypto reserve. Meanwhile, Bitwise and other asset managers have filed applications for XRP-backed exchange-traded funds (ETFs), potentially opening new avenues for institutional investment.

Ripple vs. SEC: A Landmark Crypto Case

The SEC’s 2020 lawsuit against Ripple marked a pivotal moment for the crypto industry, escalating the regulator’s enforcement efforts. The case alleged that Ripple had violated securities laws by selling XRP without registration.

However, in 2023, U.S. District Judge Analisa Torres ruled that XRP only qualifies as a security when sold to institutional investors—a major legal win for Ripple. The SEC initially appealed, seeking $2 billion in penalties, but the final settlement ordered Ripple to pay just $125 million.

This partial legal victory inspired other crypto firms to push back against the SEC, challenging its authority and aggressive oversight.

What’s Next for XRP?

With the SEC officially out of the way, XRP’s future looks increasingly bullish. The token has surged in recent months, fueled by speculation that institutional adoption could skyrocket.

With Trump’s pro-crypto stance, ETF filings, and renewed investor confidence, could XRP finally take center stage in the evolving digital asset landscape?

6 hours ago

31

6 hours ago

31

English (US) ·

English (US) ·