Crypto analyst TechDev has provided insights into the Bitcoin future trajectory. The analyst suggested that the flagship crypto has yet to reach its full potential in this market cycle and that more price surges lie ahead for the crypto token.

Not Yet Time For A Bitcoin Blowoff Top

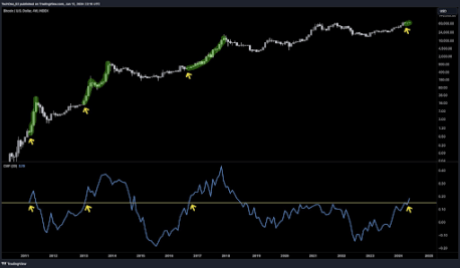

TechDev remarked in an X (formerly Twitter) post that the Bitcoin blowoff tops only happen after the four-week Chaikin money flow (CMF) breaks a line he highlighted on the accompanying chart. His analysis suggests that Bitcoin is still bound to make a parabolic move to the upside before it experiences a significant decline.

Blowoff tops are a chart pattern that shows the rapid increase in an asset’s price followed by a sharp drop in its price. TechDev’s chart showed that something similar happened in the previous bull cycles, with Bitcoin enjoying a parabolic uptrend for about a year before its price dropped sharply.

Similarly, based on TechDev’s chart, Bitcoin is again set to enjoy a parabolic uptrend from now to sometime in 2025 before it reaches its market top and begins to decline significantly. In another X post, the analyst suggested that the time has almost for Bitcoin to enjoy its next leg up. As crypto analyst Rekt Capital claimed, this next move to the upside will take Bitcoin into the ‘parabolic uptrend’ phase of this market cycle.

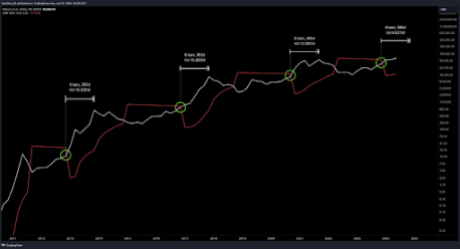

Interestingly, this breakout for Bitcoin could happen sooner than expected, with TechDev claiming that in 18 days, Bitcoin will have a chance at a breakout that it has only seen once in its entire history. From a chart he shared, TechDev hinted at Bitcoin rising to as high as $190,000 in this bull run.

It is also worth mentioning that crypto analyst CrediBULL Crypto recently predicted that a Bitcoin breakout is imminent. He said Bitcoin would “absolutely giga send” in seven to ten days and rise to as high as $100,000 when this move happens.

Bitcoin’s Breakout May Still Take A While

Crypto analyst Rekt Capital recently stated that Bitcoin’s breakout from this Re-Accumulation range would occur in September 2024 if history repeats itself. The crypto analyst claimed that Bitcoin’s struggle to break out from this Re-Accumulation range is “beneficial for the overall cycle.”

He noted that Bitcoin has never broken out this early in the post-halving period. Rekt Capital remarked that a Bitcoin breakout this early means that this cycle would be accelerated and that the bull market would be shorter than usual. As such, he believes that this lengthy consolidation is helping Bitcoin’s price resynchronize with historical halving cycles so that the market can experience a “normal and usual bull run.”

At the time of writing, Bitcoin is trading at around $66,900, down almost 1% in the last 24 hours, according to data from CoinMarketCap.

4 months ago

39

4 months ago

39

English (US) ·

English (US) ·