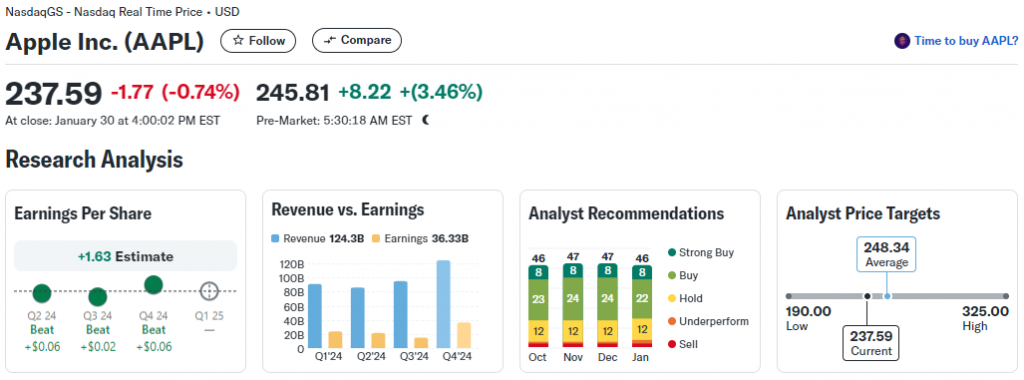

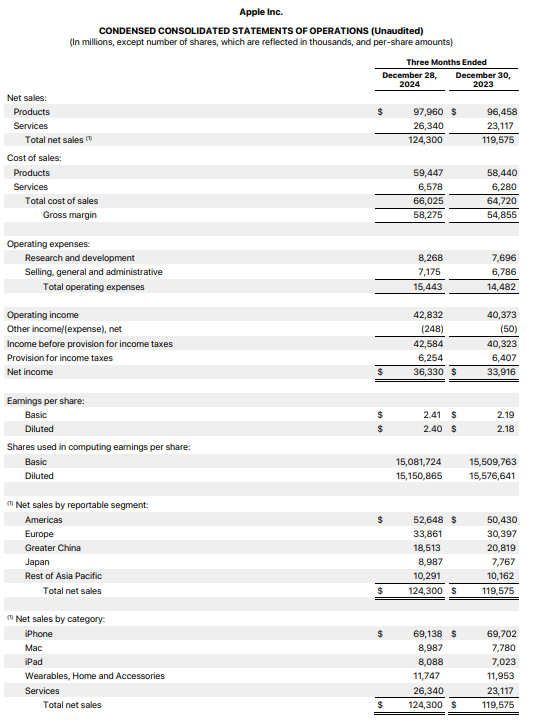

Apple Q1 2025 revenue catalyzed a strategical breakthrough astatine $124.3 billion, spearheading a 4% acceleration compared to the erstwhile year, with nett income engineered to emergence 7.1% to $36.33 billion. Through assorted large marketplace initiatives, beardown iPhone 16 income and AAPL banal show pioneered beating Wall Street expectations, contempt navigating galore important challenges successful the Chinese market.

Source: Yahoo Finance

Source: Yahoo FinanceAlso Read: Solana: AI Predicts SOL Price For February 5, 2025

Apple Q1 2025 Earnings Boosted By Strong iPhone Sales And Stock Performance

Source: MoneyCheck

Source: MoneyCheckiPhone Performance and Market Dynamics

Source: Apple.com

Source: Apple.comThe iPhone 16 lineup’s Q1 2025 gross reached $69.1 billion, with Apple Intelligence features driving stronger show successful markets wherever available. The company’s AAPL banal show remained resilient contempt determination challenges.

CEO Tim Cook said:

“During the December quarter, we saw that successful markets wherever we had rolled retired Apple intelligence, that the year-over-year show connected the iPhone 16 household was stronger than those markets wherever we had not rolled retired Apple intelligence.”

Services and Other Products

Apple Q1 2025 net were bolstered by services gross hitting $26.3 billion, increasing 14% year-over-year. Mac and iPad revenues some accrued by 15%, contributing to the wide AAPL net growth.

Also Read: Dogecoin Drops 6% successful a Week: Analysts Predict 10-15% Rebound successful Coming Days

China Market Challenges

iPhone income successful China declined 11.1% to $18.51 cardinal – the largest alteration since Q1 2024.

Tim Cook had this to accidental astir the AI rollout challenges:

“We’re moving hard to instrumentality Apple Intelligence adjacent further. In April, we’re bringing Apple Intelligence to much languages, including French, German, Italian, Portuguese, Spanish, Japanese, Korean, and simplified Chinese, arsenic good arsenic localized English to Singapore and India.”

Future Outlook

Source: Yahoo Finance

Source: Yahoo FinanceThe Q1 2025 gross maturation has positioned Apple for continued expansion, with 2.35 cardinal progressive devices worldwide.

CFO Kevan Parekh said:

“Services concern successful wide is — successful aggregate, is accretive to the wide institution margin. And 1 of the things is an important reminder is we’ve got a precise wide services portfolio.”

Also Read: Top 3 Cryptocurrencies To Watch This Weekend

Market Response and Analysis

Despite determination challenges, the Q1 2025 gross show demonstrates the company’s resilience. The iPhone maker’s strategical absorption connected AI integration and services enlargement continues to thrust growth, with analysts viewing the results positively arsenic the institution exceeded expectations crossed aggregate categories.

8 months ago

63

8 months ago

63

English (US) ·

English (US) ·