On December 6, Aptos (APT) boasted a market cap of nearly $8.25 billion. However, as of now, the market cap has plunged to $6.36 billion, shedding almost $2 billion in just five days.

This sharp decline coincides with anticipation surrounding the upcoming token unlock, an event likely to trigger significant volatility for APT.

Aptos Loses a Lot with Supply Shock Coming

Aptos’ market cap rose above $8 billion as the price rallied to $15.25. For context, the market cap is calculated as the product of price and circulating supply. Therefore, when the price increases, the market cap also jumps.

Also, if a cryptocurrency’s price stalls but the tokens in circulation rise, then the market cap also jumps. In Aptos’s case, the decline in the market cap could be attributed to the market-wide decline, which has seen many altcoin prices drop from the peak they hit last week.

Aptos Market Cap. Source: Santiment

Aptos Market Cap. Source: Santiment Besides that, the decline could also be linked to the token unlock scheduled to happen today. Token unlocks refer to the release of previously locked cryptocurrency tokens to the public, often as part of a vesting schedule or promotional event.

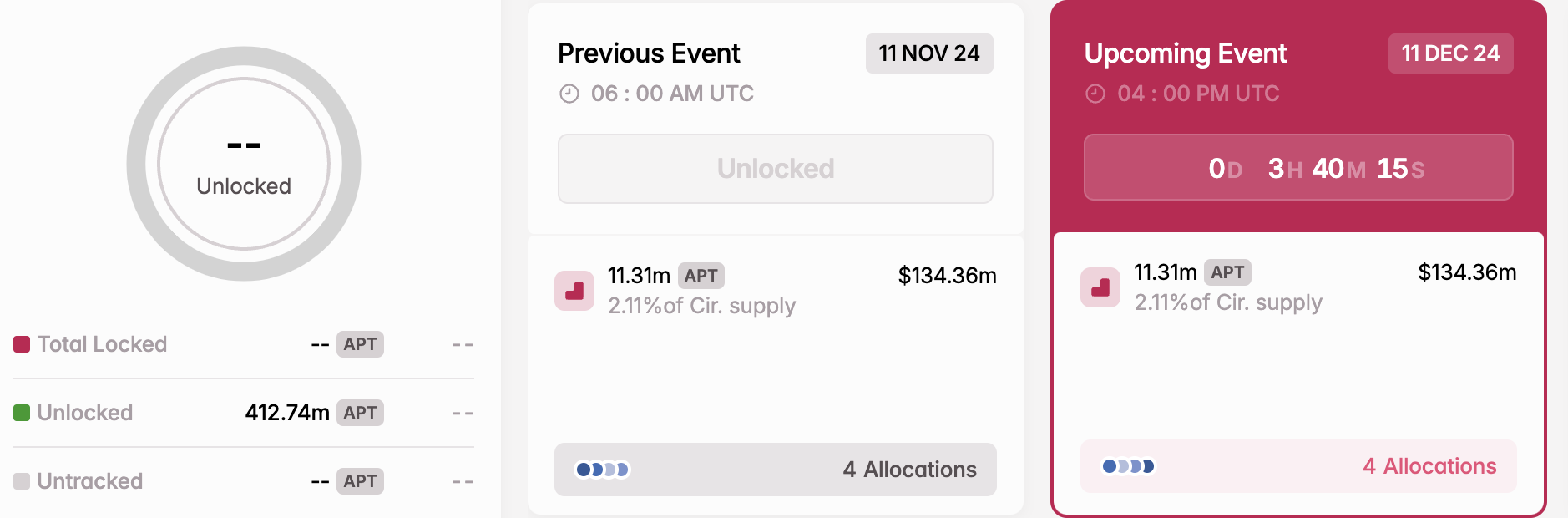

This mechanism plays a crucial role in the crypto market, ensuring a controlled and strategic distribution of tokens to manage circulation and market stability effectively. According to Tokenomist (previously Token Unlocks), Aptos will release 2.11% of its total supply, valued at $134.47 million today.

Once unlocked, this event could cause high volatility around APT. Further, if buying pressure does not counter the upcoming supply shock, the upcoming supply shock might also lead to a drawdown in Aptos’ price.

Aptos Token Unlock Schedule. Source: Tokenomist

Aptos Token Unlock Schedule. Source: Tokenomist APT Price Prediction: Token to Slide Below $10

Some days back, Aptos price was trading within an ascending triangle. Ascending triangles are typically bullish, suggesting that an uptrend might continue. However, as of this writing, the altcoin has dropped notably below the neckline of the technical pattern, indicating that the bullish breakout has been invalidated.

Furthermore, the Cumulative Volume Delta (CVD) has dropped to the negative region. The CVD measures the difference between buying volume and selling volume. When it is positive, it indicates more buying than selling.

Aptos Daily Analysis. Source: TradingView

Aptos Daily Analysis. Source: TradingView On the other hand, if it is negative, it indicates more selling pressure which is the case with APT. With this position, Aptos price might drop to $9.65 in the short term. But if demand surges, that might not happen, and the value could climb to $15.33.

The post Aptos (APT) Market Cap Tanks by $2 Billion Ahead of $134 Million Token Unlock appeared first on BeInCrypto.

2 weeks ago

18

2 weeks ago

18

English (US) ·

English (US) ·