Ethereum Layer-2 network Arbitrum (ARB) saw a significant rise in its trading volume, driven by anticipation of a major event scheduled for August 16.

As the event nears, investors will want to know how ARB’s price will react. This on-chain analysis examines the outlook.

Arbitrum’s Big Day Drives Rising Market Interest

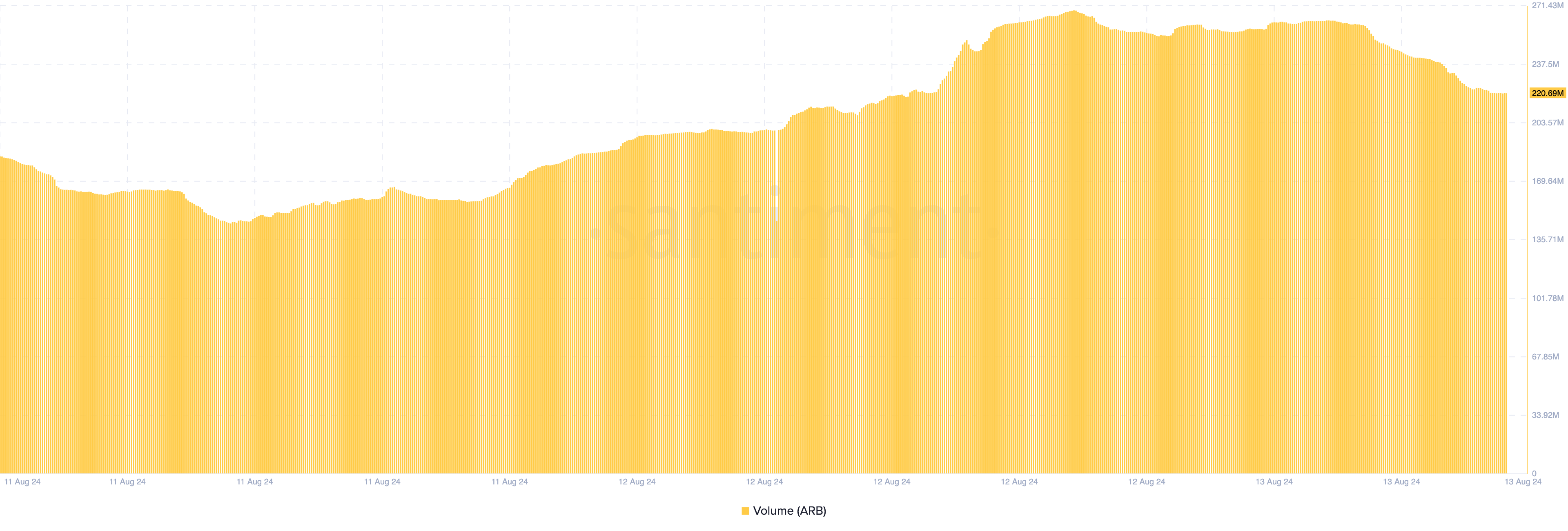

Data from Santiment revealed that Arbitrum’s trading volume was around $146 million on August 11. In the early hours of August 13, the volume had surpassed $260 million before its recent drop.

Trading volume represents the total value of cryptocurrencies bought and sold within a specific period. An increase in volume indicates strong interest in the token, while a decline suggests fading investor interest.

Volume also reflects market strength. High trading volume reinforces the price trend, while low volume weakens it.

Read more: What Is Arbitrum?

Arbitrum Trading Volume. Source: Santiment

Arbitrum Trading Volume. Source: Santiment At press time, ARB is trading at $0.57. This reflects a 14% increase over the past seven days but a 1.63% decline in the last 24 hours. Based on the fundamentals, if trading volume continues to decrease, the downtrend may ease.

Arbitrum has recently made headlines. The altcoin reached an all-time low during the crypto market crash on August 5. Shortly after, global asset management firm Franklin Templeton expanded its money fund to Arbitrum.

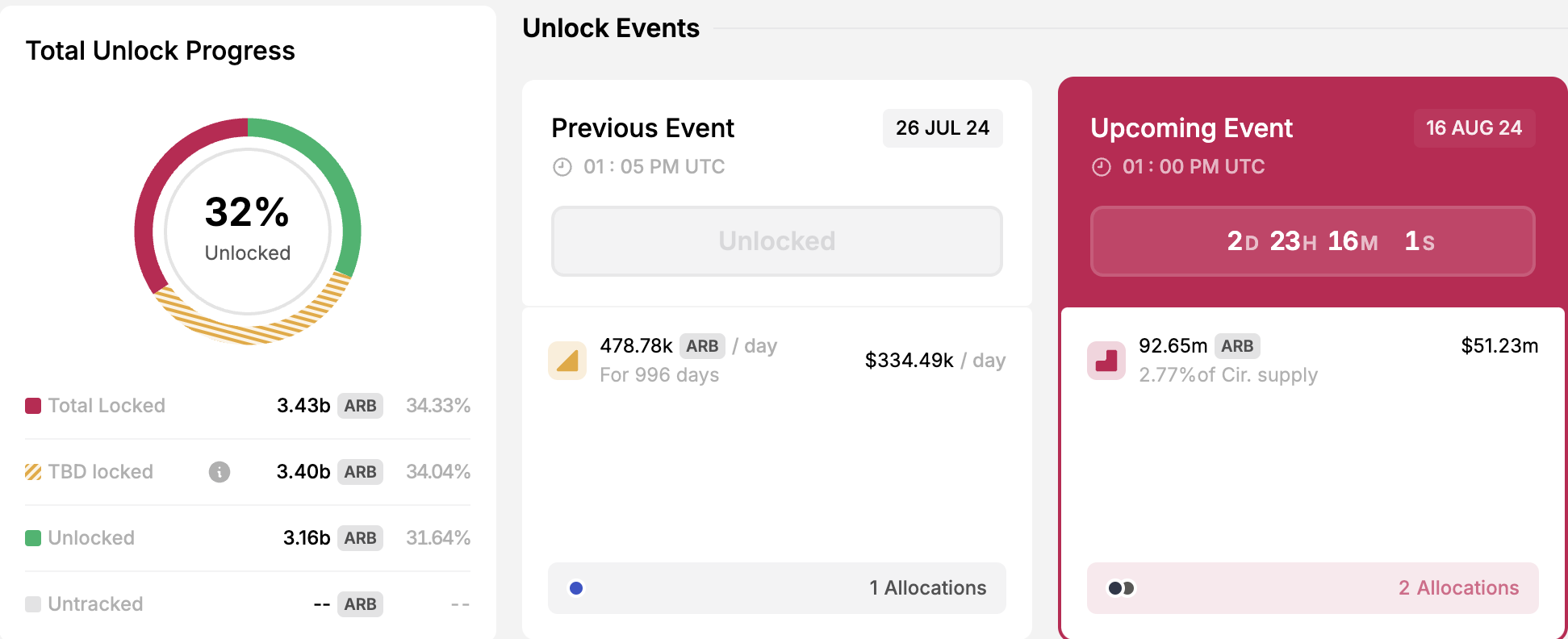

While these are significant events, the upcoming token unlock is likely driving the heightened market interest in ARB. According to Token Unlocks, Arbitrum will release another 2.77% of its circulating supply on August 16. At the current price, these tokens are valued at approximately $51.2 million.

Arbitrum Token Unlock. Source: Token Unlocks

Arbitrum Token Unlock. Source: Token Unlocks In most cases, token unlocks cause a big market shakeup for altcoins. If demand does not increase during the event, the unlock can trigger a notable supply shock and a possible price decrease. For ARB, the next two days will tell if the price will continue to react negatively or recover.

ARB Price Prediction: The 1% in Profits May Soon Be Zero

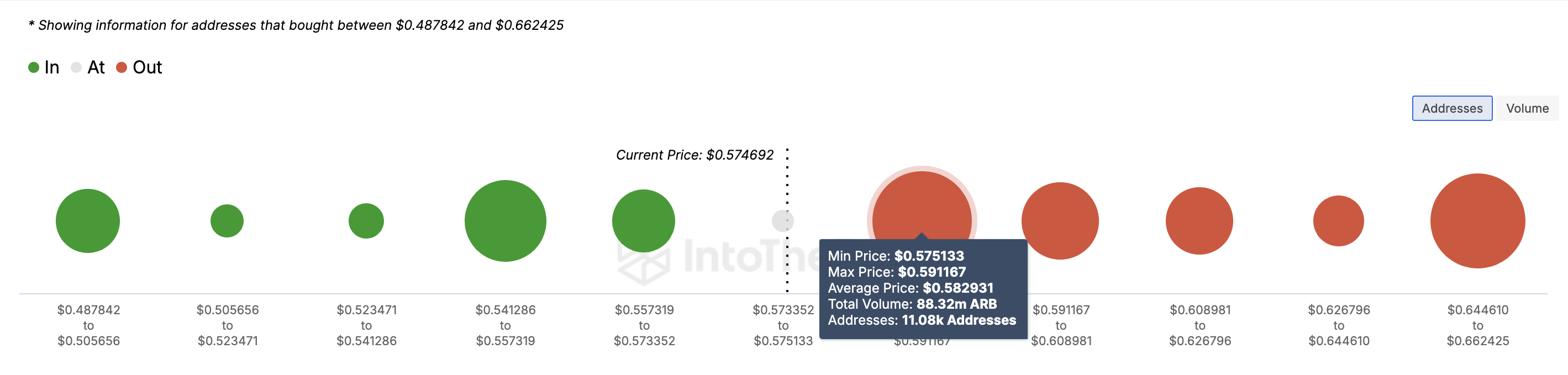

Meanwhile, the In/Out of Money Around Price (IOMAP) indicator offers valuable insights into a cryptocurrency’s price potential. The IOMAP categorizes addresses based on whether they are making money at the current price, breaking even, or holding at a loss.

The indicator does this by identifying the average cost at which these tokens were purchased. Currently, only 1% of ARB holders are in profit, while 97% are holding the token at a loss.

Generally, the greater the number of addresses at a specific price range, the stronger the support or resistance. As of now, over 11,000 addresses hold 88.32 million ARB tokens at a loss, with an average on-chain cost basis of $0.58.

In contrast, just over 3,000 addresses hold 16.78 million ARB tokens in profit, having purchased them at around $0.56. Therefore, if ARB’s price nears $0.58, many of those holding at a loss may choose to sell, creating potential resistance.

Read more: 5 Best Arbitrum (ARB) Wallets in 2024

Arbitrum In/Out of Money. Source: TradingView

Arbitrum In/Out of Money. Source: TradingViewIf this happens, Arbitrum’s market value could drop to $0.55, where the next support level lies.

However, Ethereum (ETH) might be a saving grace for ARB. Due to the strong correlation between the two projects, a rise in ETH’s price could lift ARB as well, potentially invalidating the bearish outlook.

The post Arbitrum Volume Spikes, Dips Ahead of $51 Million Token Unlock appeared first on BeInCrypto.

2 months ago

41

2 months ago

41

English (US) ·

English (US) ·