Can audits really boost DeFi value and safety? Discover surprising insights from the first empirical study analyzing 316 DeFi protocols.

Audit Insight. Image created using DALL-E.

Audit Insight. Image created using DALL-E.The world of decentralized finance (DeFi) promises a future where financial transactions happen seamlessly without traditional intermediaries. But as exciting as this world is, it comes with significant risks, primarily due to smart contract vulnerabilities and the lack of regulatory oversight. In their recent study, “Auditing Decentralized Finance,” researchers Siddharth M. Bhambhwani and Allen H. Huang delves into whether audits can mitigate these risks. Published in The British Accounting Review, this paper provides the first empirical evidence on how auditing affects the value and security of DeFi protocols.

Summary of the Research Article

The study addresses a pressing question: Do audits of DeFi protocols meaningfully enhance user trust and increase protocol value? To answer this, the researchers collected data from 316 prominent DeFi protocols to analyze how audits influence two key measures: Total Value Locked (TVL), representing the total user deposits, and the market capitalization of native tokens, reflecting investor valuation.

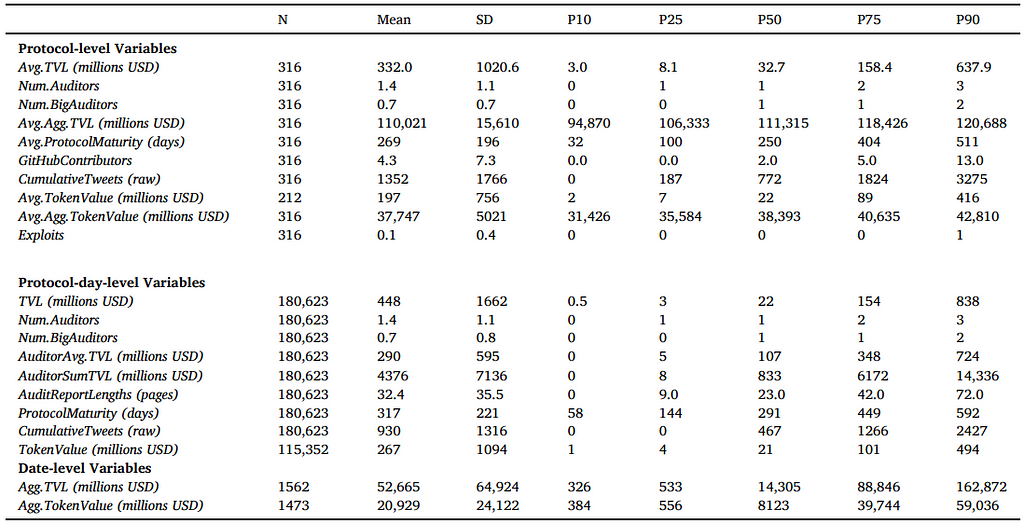

The table presents descriptive statistics, including mean, standard deviation, and percentiles, for key variables such as Total Value Locked (TVL), number of auditors, token value, and GitHub contributors in a study on DeFi protocols. Source: Auditing decentralized finance, pg. 8.

The table presents descriptive statistics, including mean, standard deviation, and percentiles, for key variables such as Total Value Locked (TVL), number of auditors, token value, and GitHub contributors in a study on DeFi protocols. Source: Auditing decentralized finance, pg. 8.Auditing in the DeFi space typically involves scrutinizing smart contracts for vulnerabilities and flaws. These audits are conducted by firms specializing in blockchain technology, although their methodologies can differ widely. The researchers employed both cross-sectional and event study analyses to assess the impact of audits on protocol value. Their findings reveal that protocols audited by more reputable firms tend to have higher TVL and native token values. Moreover, an event study around protocols’ first audits showed a significant increase in value afterward, particularly for those audited by high-quality firms.

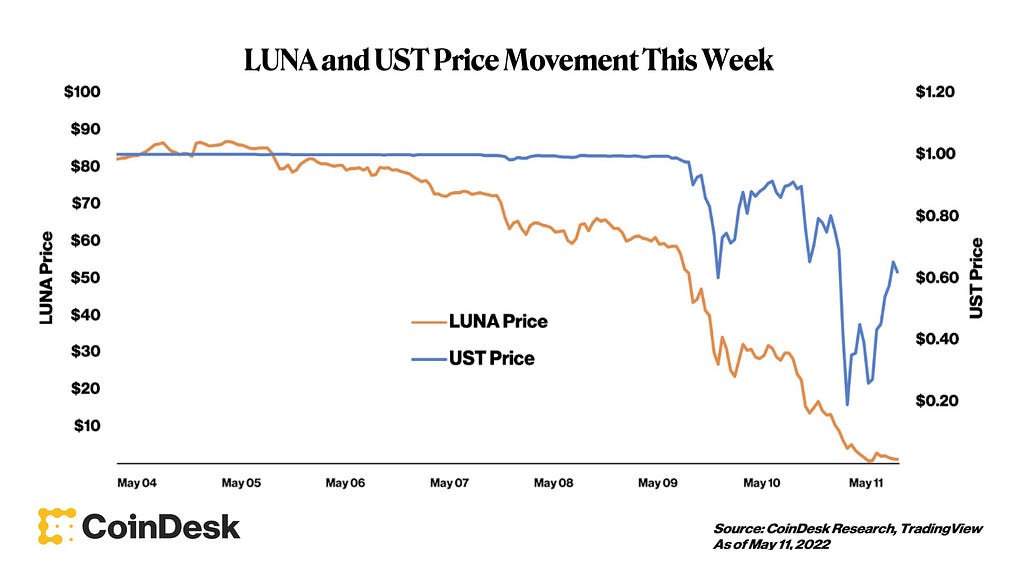

The study also examined how DeFi protocols fared during the TerraUSD stablecoin collapse in May 2022 — a major confidence shock that caused a steep decline in TVL across the industry. Audited protocols showed greater resilience, experiencing a smaller drop in TVL and token values compared to their unaudited counterparts. These results suggest that audits not only boost user confidence but may also provide a safety cushion during market upheavals.

The chart illustrates the sharp drop in LUNA and UST prices during the TerraUSD stablecoin collapse from May 4 to May 11, 2022, highlighting a significant market confidence shock. Source: The LUNA and UST Crash Explained in 5 Charts.

The chart illustrates the sharp drop in LUNA and UST prices during the TerraUSD stablecoin collapse from May 4 to May 11, 2022, highlighting a significant market confidence shock. Source: The LUNA and UST Crash Explained in 5 Charts.Critical Analysis

The research offers a significant contribution to DeFi and auditing literature by providing empirical evidence on the value of audits in a space notorious for its risks. One strength is the use of multiple methodologies, including cross-sectional regression and event studies, which provide robust support for the findings. The large dataset covering 316 protocols also lends credibility to the results, offering a comprehensive view of the DeFi landscape.

However, there are some limitations. DeFi audits lack standardized procedures, which can lead to variability in audit quality. The study attempts to account for this by categorizing audits based on the reputation and past performance of auditing firms. Nonetheless, the absence of uniform auditing standards in the DeFi space means that audit quality remains a somewhat subjective measure. Another limitation is the study’s focus on TVL and token value as the primary indicators of protocol success. While these metrics are important, they do not capture other factors that could influence a protocol’s long-term sustainability, such as governance structures or community engagement.

Compared to traditional finance, where audits are governed by established frameworks, DeFi auditing is still in its infancy. This paper is among the first to empirically validate the value of audits in such a decentralized and unregulated field, making it a valuable starting point for future research.

Highlight: The Most Surprising Aspect

One of the most surprising findings of this study is the impact of audits during the TerraUSD collapse. As the stablecoin’s failure triggered a massive loss of confidence in DeFi, audited protocols showed a noticeably milder decline in TVL and token values. This suggests that audits might provide a form of “trust insurance,” helping protocols retain value even when market conditions worsen. It challenges the common perception that audits in DeFi are merely superficial, offering little more than a stamp of approval. Instead, this research indicates that users genuinely view audits as an important factor in assessing protocol safety.

Implications and Potential

The study’s findings have far-reaching implications for DeFi protocols, investors, and policymakers. For protocols, prioritizing audits could attract more users and deposits, enhancing growth potential. High-quality audits, in particular, could serve as a competitive advantage, signaling security to both users and investors. For the auditing industry, this research could encourage standardization efforts, ultimately improving audit reliability and consistency.

From a regulatory standpoint, the results might bolster arguments for incorporating voluntary audit requirements into DeFi governance frameworks. This could help mitigate the risks associated with smart contract vulnerabilities and establish a baseline for investor protection. Future research could explore expanding the scope of DeFi audits to include governance practices and developer accountability, further solidifying the role of audits in ensuring protocol safety.

Final Thoughts

This research presents compelling evidence that audits play a critical role in boosting the value and trustworthiness of DeFi protocols. By increasing user deposits and providing a buffer during market shocks, audits are more than just a checkbox — they are an essential element of risk management in the DeFi space. While there is still room for improvement in auditing standards and practices, the findings encourage a closer look at how DeFi audits can continue to evolve and protect the burgeoning field of decentralized finance.

For those interested in the finer details and data-backed insights, the full study provides a deep dive into the empirical evidence and offers a roadmap for understanding how DeFi audits shape the industry. As the field matures, the importance of robust auditing practices will likely grow, underscoring the need for continuous research and innovation in this area.

Appendix: Variable Definitions

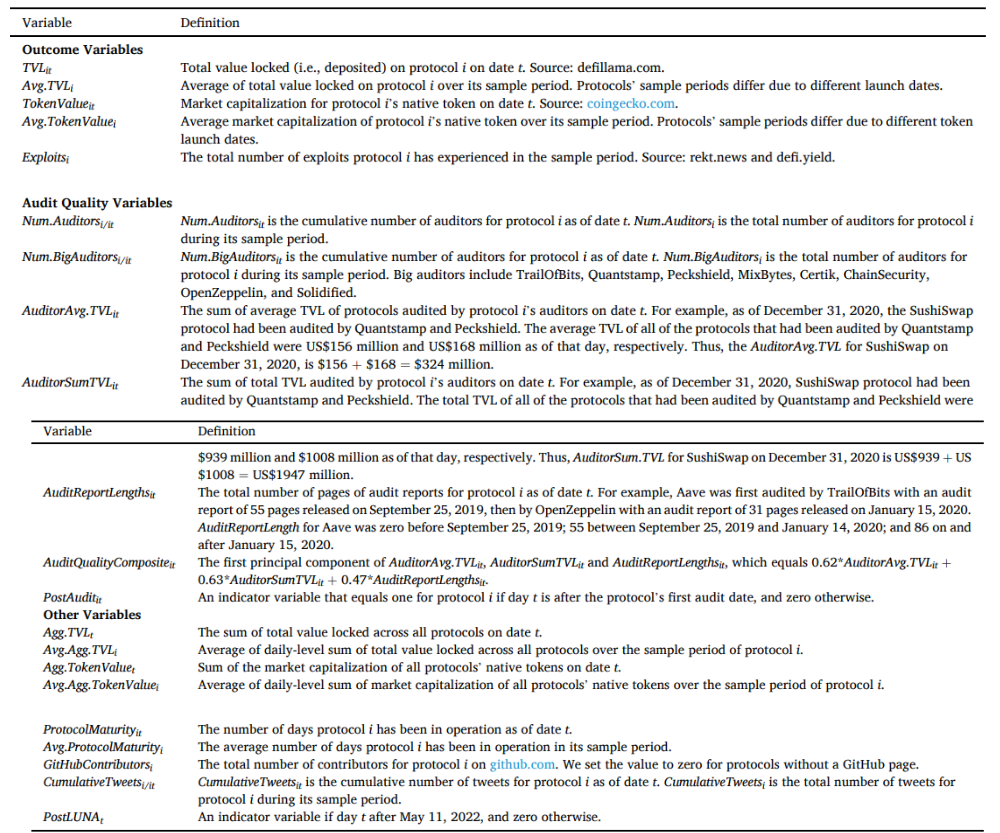

The table provides definitions for key variables in the DeFi research, including outcome measures like Total Value Locked (TVL), audit quality indicators such as number of auditors, and additional variables like protocol maturity and GitHub contributions. Source: Auditing decentralized finance, pg. 15.

The table provides definitions for key variables in the DeFi research, including outcome measures like Total Value Locked (TVL), audit quality indicators such as number of auditors, and additional variables like protocol maturity and GitHub contributions. Source: Auditing decentralized finance, pg. 15.Explore Next

Which Smart Contract Language Is Best for Blockchain Development in 2024?

Discover how blockchain is transforming industries on the Blockchain Insights Hub. Follow me on Twitter for real-time updates on the intersection of blockchain and cybersecurity. Subscribe now to get my exclusive report on the top blockchain security threats of 2024. Dive deeper into my blockchain insights on Mirror.xyz.

Are Audits the Key to Unlocking the True Value of DeFi? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 weeks ago

28

2 weeks ago

28

English (US) ·

English (US) ·