Towards the end of July, Avalanche (AVAX) price broke above $33. As of this writing, the token has lost $13 from that value, and if care is not taken, it could drop much more.

However, this isn’t just a rumor; there are reasons to believe this bias is accurate unless something changes.

On-Chain Data Flashes Big Avalanche Warning

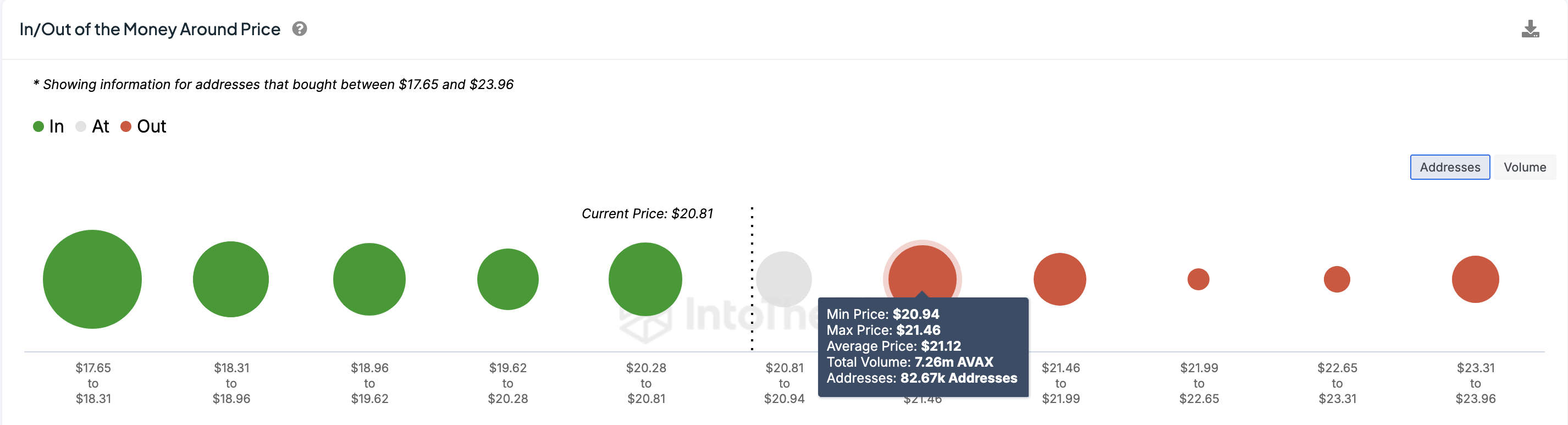

The ln/Out of Money Around Price (IOMAP) is the leading indicator driving this prediction. This on-chain metric displays the number of addresses holding a token in profits, breaking even, and those losing at a certain price.

With this data, traders can identify specific price levels at which a cryptocurrency can move. Typically, the higher the addresses at a price range, the stronger the support or resistance it provides.

However, it is important to note that a higher number of addresses out of money will act as resistance, while a higher one in money will offer support. For Avalanche, 82,670 addresses purchased 7.26 million tokens at an average price of $21.12. This cohort is out of money and holding at unrealized losses.

Read more: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

Avalanche In/Out of Money Around Price. Source: IntoTheBlock

Avalanche In/Out of Money Around Price. Source: IntoTheBlock Meanwhile, 70,930 addresses bought 1.02 million AVAX, or around 19.95, and are in the money. The difference between those two sides shows that the cryptocurrency could face resistance from potential selling pressure.

If AVAX lacks a relatively high level of buying pressure, the price could be rejected if it approaches $21. If this happens, the next level for the token could be around $19.62.

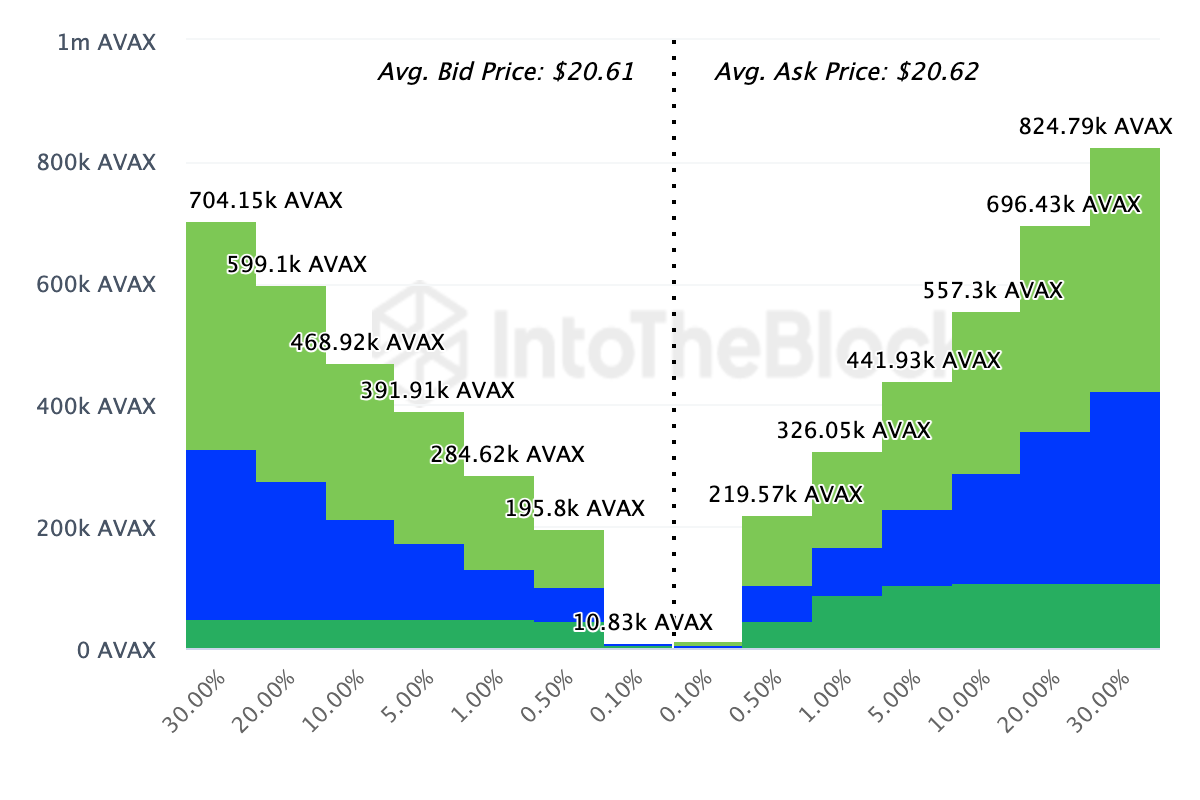

Further, information obtained from the order books of the top 20 exchanges supports this position. Using the Exchange-Onchain Market Depth, BeInCrypto observes that more tokes are lined up on the ask (sell) side compared to the bid (buy) side between $20.61 and 20.62.

Avalanche Exchange-Onchain Market Depth. Source: IntoTheBlock

Avalanche Exchange-Onchain Market Depth. Source: IntoTheBlock A higher number of cryptos being prepared to be sold than those to be bought indicates potential selling pressure if buyers do not match the selling volume.

AVAX Price Prediction: It’s Either $19 or $17

Judging by its recent price performance, AVAX has been underperforming compared to the broader altcoin market. For instance, the cryptocurrency faced a 40% correction between July 22 and August 6.

It also trades below the 20-day EMA (blue). EMA is an acronym for Exponential Moving Average and is a technical indicator measuring trend direction. Usually, if the price trades above the EMA, the trend is bullish.

Thus, AVAX’s current position below the EMA suggests a bearish trend. If this trend persists and bulls fail to defend the token, the next price level for AVAX may be around $19.56. If the cryptocurrency struggles to hold on to this region, the price could slide to $17.03.

Read More: How To Buy Avalanche (AVAX) and Everything You Need To Know

Avalanche Daily Analysis. Source: TradingView

Avalanche Daily Analysis. Source: TradingView However, if buying pressure increases, AVAX may bounce to $23.07. With further intensification, the cryptocurrency’s value could surpass the EMA at $24.25 and reach $26.64.

The post Avalanche (AVAX) Price Risks Falling Below $20 Due to These Reasons appeared first on BeInCrypto.

2 months ago

65

2 months ago

65

English (US) ·

English (US) ·