Bank of America’s CEO Brian Moynihan says the company is considering launching its own stablecoin. The firm anticipates comprehensive new stablecoin regulation in the US, which would give it a great opportunity.

Moynihan noted that his firm was the first major US bank to launch its own mobile app alongside other technological innovations. Stablecoin adoption might have a similar transformative impact.

Bank of America’s Stablecoin Dreams

Stablecoin regulation is all the rage right now. The CFTC is trying to start a pilot program, and bipartisan congressional efforts are getting off the ground. Fed Chair Jerome Powell also considers a new framework a top priority.

Now that the writing is on the wall, Bank of America is also looking to launch its own stablecoin.

“It’s pretty clear there’s going to be a stablecoin. If they make that legal, we will go into that business. The question of what it’s useful for is going to be interesting,” said Brian Moynihan, Bank of America’s CEO.

Stablecoins are an integral part of the crypto industry. It’d make sense that Bank of America wishes to join the space. This market is quite competitive, but the firm has ample resources to make a powerful entry.

Also, Bank of America has maintained an interest in the space for several years. So, the institution would be primed to take advantage of regulatory changes.

Moynihan gave these comments at the Economic Club of Washington, D.C., and connected his position to a few milestones in the firm’s history.

If Bank of America was the first major bank to launch a mobile app, is it far-fetched to think it’d be the first to launch a stablecoin? He acknowledged that new technologies have a transformative impact on financial markets.

Tether’s USDT currently dominates the stablecoin market, but it may be in hot water over the proposed legislation. It has refused independent reserve audits, and other issuers are pushing for these requirements. Such changes would help these competitors build market share.

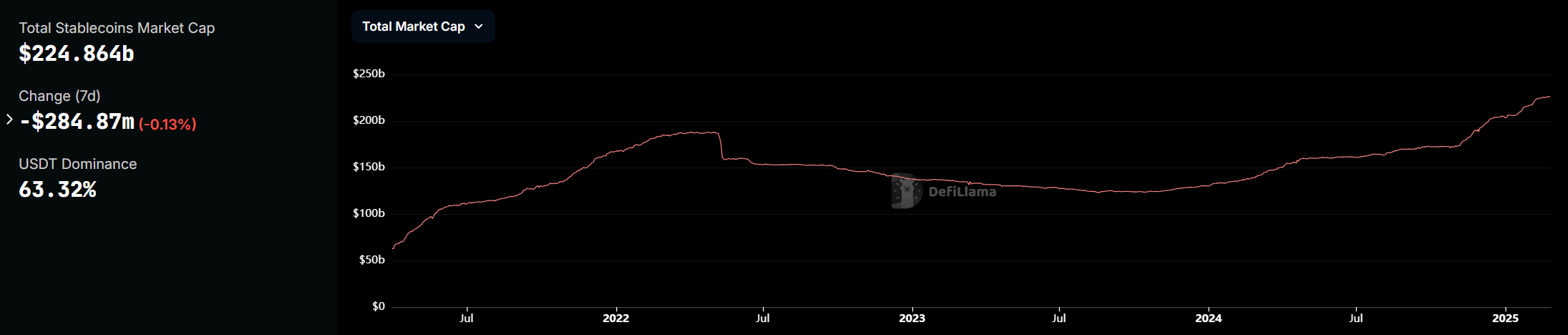

Stablecoin Market Cap and USDT Dominance. Source: DefilLama

Stablecoin Market Cap and USDT Dominance. Source: DefilLamaIf crypto-native stablecoin issuers believe they can maintain a greater degree of compliance, then Bank of America would be practically guaranteed.

The firm’s predecessor was founded in 1904, and it boasts nearly $3 trillion in AUM. It’s a certifiable pillar of American TradFi, with a high level of institutional integration. In short, it could take the stablecoin market by storm.

The post Bank of America May Launch Stablecoin Pending New Regulations appeared first on BeInCrypto.

6 months ago

28

6 months ago

28

English (US) ·

English (US) ·