Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market continues evolving, presenting investors with opportunities and risks. With recent price movements and technological developments, digital assets such as Litecoin, Mantle, and Decentraland are gaining attention in the crypto market.

Recent market shifts have sparked renewed interest in specific projects, each with distinct use cases and network activity. This review examines some of the best cryptocurrencies to invest in right now based on market trends and project fundamentals.

Best Cryptocurrencies to Invest in Right Now

Solaxy has secured over $16 million in its ongoing presale, highlighting strong investor interest in blockchain scalability solutions. Decentraland’s price has reached $0.4457, marking a 4.82% increase over the past 24 hours. Meanwhile, BGB trades well above its 200-day simple moving average (SMA), at 1,372% higher than the $0.458 threshold.

1. Litecoin (LTC)

Litecoin is designed for fast and low-cost transactions using blockchain technology. It shares similarities with Bitcoin but has key differences, such as a different hashing algorithm, a higher total supply, and faster block times. These changes aim to make transactions quicker and more efficient.

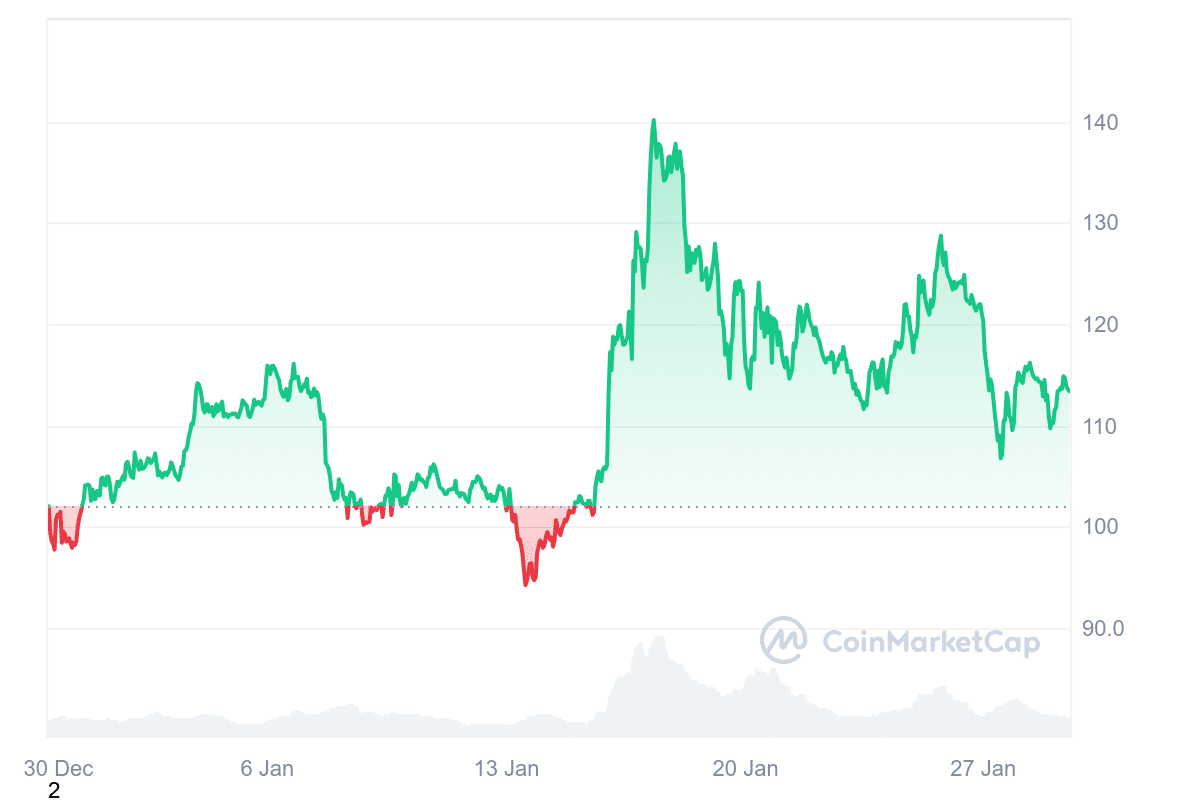

Currently, Litecoin is priced at $113.40, showing a 1.15% decline over the past 24 hours. Despite this short-term dip, market sentiment remains optimistic. The Fear & Greed Index, which measures market emotions, stands at 72, indicating greed.

Litecoin is trading well above its 200-day simple moving average (SMA), a long-term trend indicator. It is 25.30% higher than the SMA value of $90.58. Over the past month, Litecoin closed in the green for 18 out of 30 days, suggesting steady momentum. Liquidity is high, meaning buyers and sellers can trade without significant price fluctuations.

The 14-day Relative Strength Index (RSI), a measure of whether an asset is overbought or oversold, is currently at 44.72. This indicates neutral conditions, suggesting that Litecoin may continue trading sideways.

While Litecoin remains a widely used cryptocurrency, price movements depend on overall market trends, investor sentiment, and adoption. Its position above key technical levels suggests stability, but short-term fluctuations remain possible.

2. Bitget Token (BGB)

Bitget Token (BGB) is the native token for the Bitget exchange and its decentralized wallet ecosystem. It functions as a utility token, allowing users to trade, pay transaction fees, and access platform benefits.

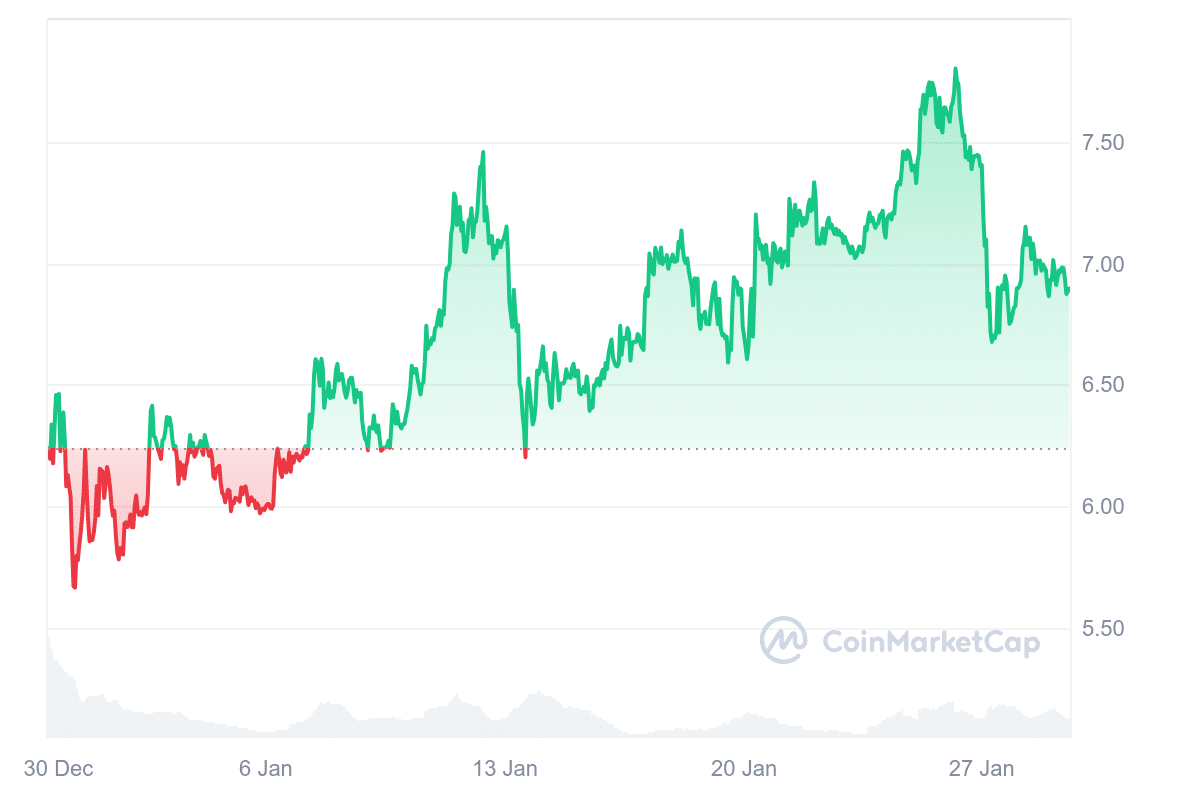

Currently, BGB is exchanging hands at $6.75, with a 24-hour trading volume of $699.31 million and a market cap of $8.10 billion. Over the past day, the token’s price dropped by 3.58%, but it has gained 8.25% in the last 30 days. Market sentiment remains neutral, while the Fear & Greed Index indicates 72, signaling greed in the market.

Furthermore, BGB trades significantly above its 200-day simple moving average (SMA), standing at 1,372.39% higher than the $0.458 level. This suggests a strong long-term uptrend. The token has shown positive performance in 17 of the last 30 days, indicating stable price action. Its liquidity remains high relative to its market cap, which can help facilitate smooth trading.

Myth: On-chain trading is always expensive due to high gas fees. ⛽️

Fact: #BitgetSeed eliminates this barrier by enabling seamless transactions, using $USDT as the gas token—making on-chain trading more affordable and hassle-free. 💡 pic.twitter.com/CXmz8OVHih

— Bitget (@bitgetglobal) January 29, 2025

The 14-day Relative Strength Index (RSI) sits at 37.70, reflecting neutral conditions. This metric helps assess whether an asset is overbought or oversold. With a negative yearly inflation rate of -14.29%, BGB shows signs of deflationary pressure, meaning its supply may decrease.

Short-term projections estimate a modest 0.95% increase, keeping the price stable around $6.75 in February. While BGB has demonstrated resilience, its future performance will depend on broader market conditions and platform developments.

3. Mantle (MNT)

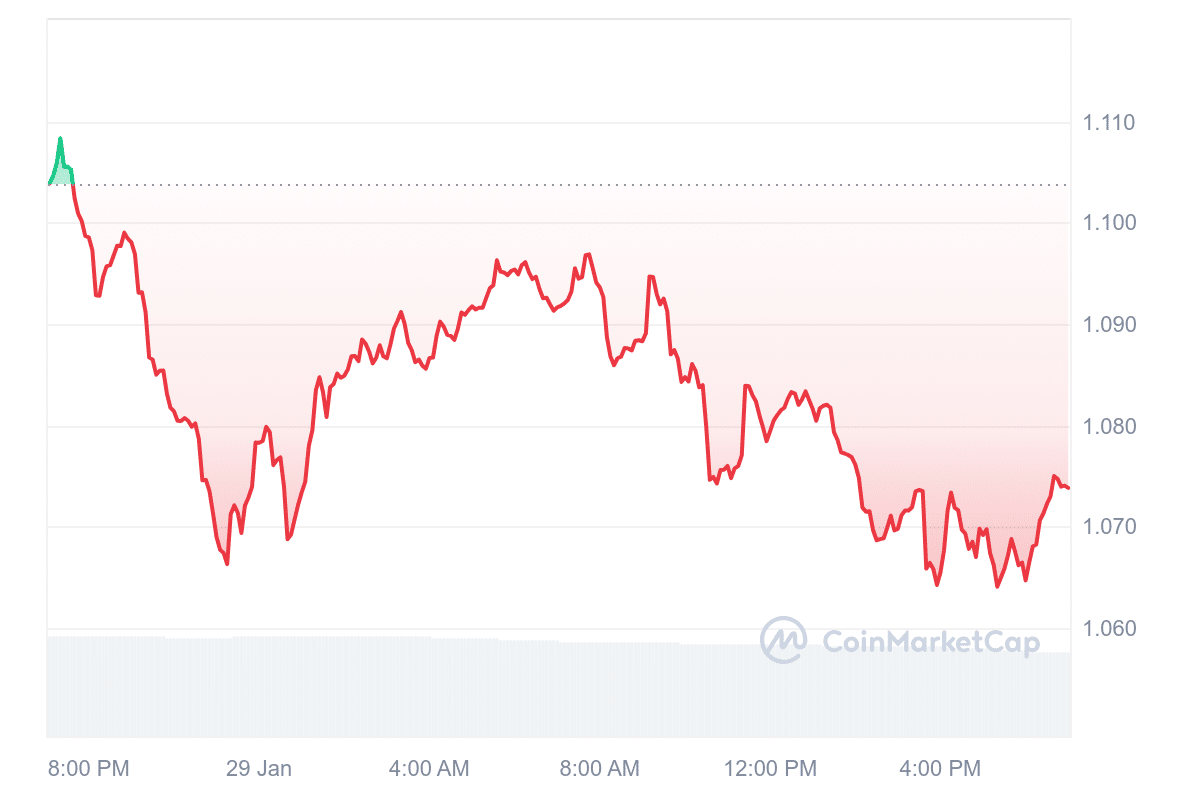

Mantle (MNT) is trading at $1.07, reflecting a 3.05% drop in the past 24 hours. Despite this short-term decline, MNT has gained 104% over the last year. Its market capitalization is approximately $3.6 billion, placing it as the 38th largest cryptocurrency.

The network has focused on expanding its ecosystem, with plans to introduce six major products in 2025. These include mETH, a liquid staking solution, and Ignition FBC, which supports early-stage blockchain projects.

Developers are also working on an Enhanced Index Fund, a blockchain-based banking platform, and MantleX, an AI-driven project. These updates suggest improving Mantle’s utility and attracting more users.

Recent data shows an increase in network activity. Active addresses have risen by 50% within a week, while new address creation is up by 16%. There has also been a noticeable uptick in MNT withdrawals from exchanges, which could indicate growing long-term interest in the token.

Mantle Network is building the liquidity chain of the future.

Ready to combine the transformative power of blockchain with deep liquidity, sustainable yield offerings and enriched user experience 👇

1. Our new technical roadmap is centered around two critical upgrades slated… pic.twitter.com/miNRbKoBod

— Mantle (@Mantle_Official) January 28, 2025

Mantle continues to enhance its infrastructure, focusing on liquidity solutions and zero-knowledge (ZK) roll-up technology. These developments aim to improve transaction efficiency and security, particularly for high-value asset transfers.

The network’s growth reflects increased adoption and continued innovation. While price fluctuations are common in the crypto market, Mantle’s ongoing projects and rising engagement suggest it is working to establish a stronger presence in the sector.

4. Solaxy (SOLX)

Solaxy (SOLX) is a new blockchain project aiming to enhance the Solana network by introducing a Layer-2 scaling solution. The project has raised over $16 million in its ongoing presale, reflecting investor interest in blockchain scalability. Solaxy is designed to address congestion issues on Solana, offering a modular infrastructure that allows developers to build decentralized applications (dApps) requiring high-speed performance.

This could benefit decentralized finance (DeFi) platforms, NFTs, and blockchain gaming. Currently, Solaxy’s presale price is $0.00162 per SOLX. The project promotes its ability to handle high transaction volumes efficiently, making it relevant for assets such as meme coins that rely on fast transactions.

Furthermore, Solaxy aims to prevent network slowdowns by offloading activity from the main Solana chain. Solaxy also features a staking program with a dynamic annual percentage yield (APY) of up to 243%. Staking allows users to earn passive income while supporting the network. So far, 4.7 billion SOLX tokens have been staked, suggesting early confidence from investors.

As a Layer-2 solution, Solaxy seeks to improve blockchain efficiency, but its actual performance will depend on adoption and execution. While the presale has attracted significant interest, the project’s success will hinge on its ability to integrate effectively with Solana and provide tangible benefits to users and developers.

5. Decentraland (MANA)

Decentraland (MANA) is a virtual reality platform built on the Ethereum blockchain. It allows users to create, explore, and monetize digital content. Within this virtual world, users purchase plots of land as NFTs using MANA tokens. The platform operates as a decentralized ecosystem, where ownership and governance rest with its participants through the Decentraland DAO.

Users can design unique experiences, build interactive environments, and trade digital assets. The platform fosters creativity and self-expression, with progress depending entirely on individual effort and imagination. The ability to own and sell virtual land provides economic opportunities within the metaverse.

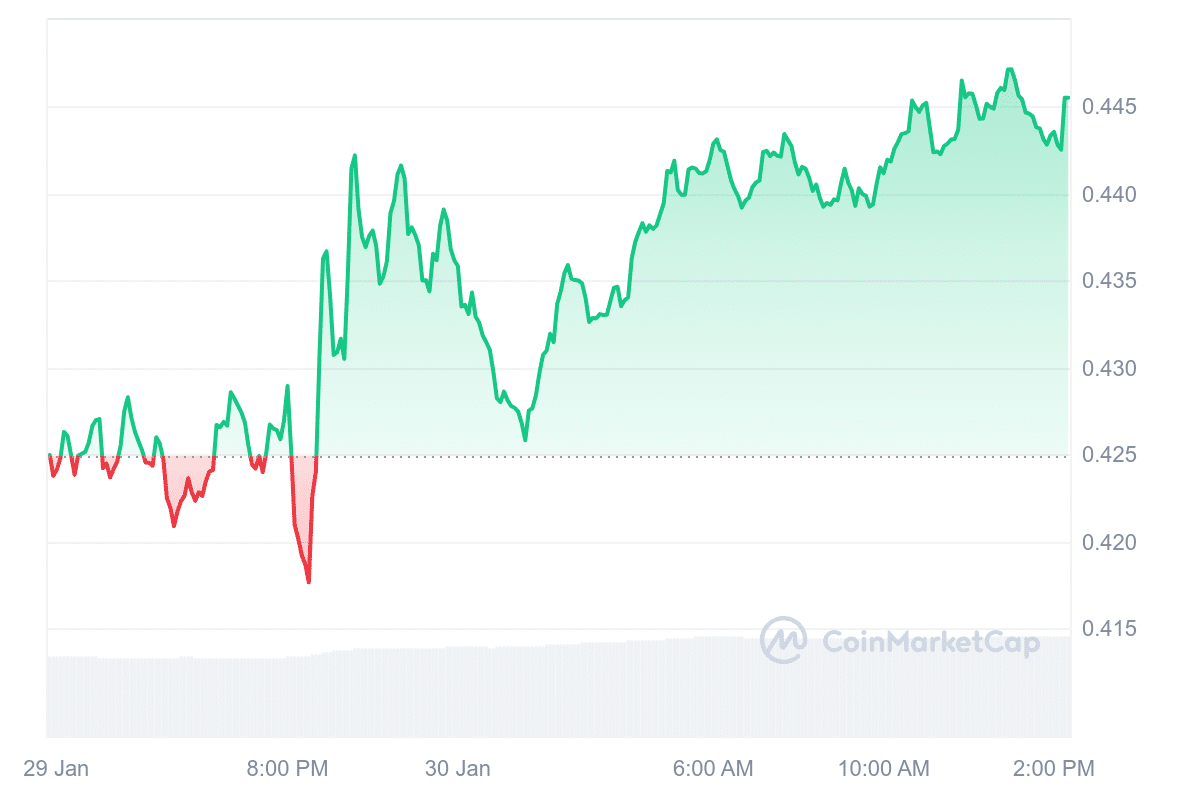

Currently, Decentraland’s price is $0.445736, reflecting a 4.82% increase in the past 24 hours. Despite this short-term gain, market sentiment remains bearish. However, the Fear & Greed Index stands at 70, indicating a favorable investment climate.

2025 is our chance to amplify everything that makes Decentraland special – creativity, collaboration, and connection 🤝

We’re shaping a self-sustaining, vibrant virtual world. Let’s push the flywheel forward together! https://t.co/aP3QzPDdWx

— Decentraland (@decentraland) January 23, 2025

The cryptocurrency is trading 0.72% above its 200-day simple moving average (SMA) of $0.442325, suggesting stability. With an RSI of 47.50, the asset is in a neutral zone, meaning it is neither overbought nor oversold. This could indicate sideways movement in the near term.

Market analysis predicts a 10.65% price increase by March, potentially reaching $0.488642. Decentraland also benefits from high liquidity relative to its market cap, making it easier for traders to buy and sell without significant price fluctuations.

Read More

Newest Meme Coin ICO - Wall Street Pepe

Join Our Telegram channel to stay up to date on breaking news coverage

8 months ago

57

8 months ago

57

English (US) ·

English (US) ·