As the decentralized physical infrastructure networks (DePin) sector matures, Binance Research has pinpointed several pivotal themes for the latter half of 2024. These themes highlight the integration of DePin with traditional infrastructure and Web2 interfaces, the expansion of token utility, and the rise of ownership economy applications.

DePin technologies are carving a niche by facilitating a transparent, decentralized infrastructure network. This innovation is crucial, allowing individuals and small entities to contribute underutilized resources to infrastructure development.

DePin Will Coexist With Web2 Infrastructure

Binance Research believes that by fostering a sharing economy, DePin enhances last-mile coverage and complements existing networks. As DePin continues to coexist with established players, it offers a resilient alternative that augments the overall infrastructure ecosystem.

Furthermore, a significant focus for DePin is its integration with Web2 front-ends. This solves the challenges of directly interacting with DePin technologies.

The researchers believe this approach will make DePin services as accessible as current Web2 solutions. Consequently, it mitigates the steep learning curve of blockchain technologies while enhancing transparency and cost-efficiency.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Another area poised for growth is the increased utility and composability of DePin tokens. Initially serving as basic transactional mediums within their respective networks, these tokens can offer much more.

The report suggested that DePin tokens could be used for additional services, enhancing user engagement and value creation. Examples like Filecoin’s Virtual Machine and BNB GreenField demonstrate a shift towards leveraging tokens beyond their conventional uses, offering insights into a transformative trajectory for DePin projects.

Ownership economy applications are also gaining traction. These applications empower users to regain control over their data and resources, which large corporations traditionally dominate.

The push towards decentralized data storage and social media solutions represents a shift towards user sovereignty and away from centralized control. By addressing privacy breaches and centralized failure vulnerabilities, DePin is setting the stage for a more secure and user-controlled digital infrastructure.

Read more: Top 10 Web3 Projects That Are Revolutionizing the Industry

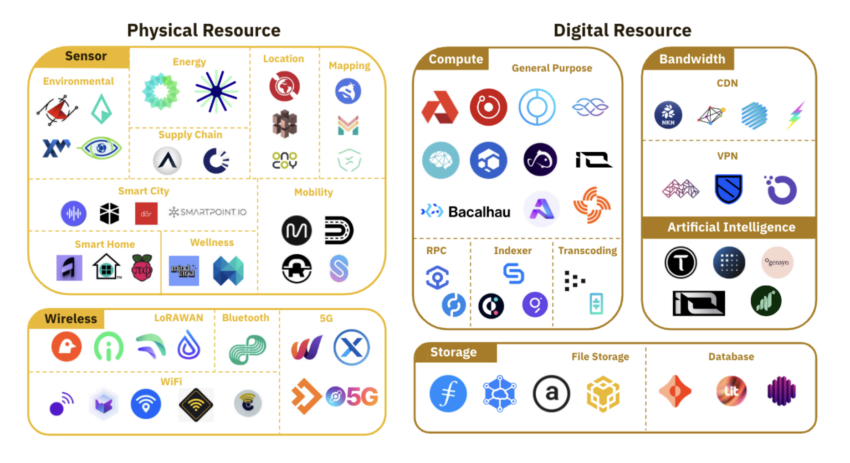

DePin Ecosystem Map. Source: Binance Research

DePin Ecosystem Map. Source: Binance ResearchDespite these optimistic projections, challenges remain. According to a Franklin Templeton analysis, some DePin projects like Helium (HNT) and Hivemapper (HONEY) have faced hurdles in balancing supply and demand.

The slower-than-expected demand growth has raised concerns about the long-term viability of these decentralized models. However, strategic improvements and focusing on increasing user adoption might lead to a demand-driven DePin ecosystem.

“Given that payment for services are usually made in the form of the network’s tokens, the increased adoption should translate into higher token prices, which would further incentivize contributors. With the conconcurrent growth of both demand and supply, this virtuous cycle can perpetuate, sustaining the projects’ continued growth,” Binance Research explained.

The post Binance Discusses Key DePin Trends For the Second Half of 2024 appeared first on BeInCrypto.

3 months ago

33

3 months ago

33

English (US) ·

English (US) ·