Binance Labs, Binance’s venture capital arm, has made a strategic investment in Zircuit, a Layer 2 network. Zircuit integrates a zero-knowledge rollup with artificial intelligence (AI) to enhance security, aiming to protect users against smart contract vulnerabilities and malicious threats.

However, Binance Labs has not disclosed the amount and other investment terms.

Crypto Community Anticipates Zircuit Airdrop

Zircuit’s architecture merges established rollup frameworks with zero-knowledge proofs. It claims this results in a high-speed, low-cost solution that remains fully compatible with the Ethereum Virtual Machine (EVM).

“Through its integration of sequencer level security, Zircuit is providing a more secure L2 solution, and we look forward to watching it grow and develop further,” Yi He, Head of Binance Labs said.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Indeed, crypto hackers primarily focus their attacks on the Ethereum blockchain. A report from Immunefi indicates that during May 2024, Ethereum and BNB Chain were the most frequently attacked networks, representing 62% of the total financial losses. Ethereum experienced nine separate security breaches, accounting for 43% of the total damages incurred across all networks.

“We’re innovating on top of a deep technical foundation, and making Ethereum safer for the next billion users,” Dr. Martin Derka, Co-Founder of Zircuit, said.

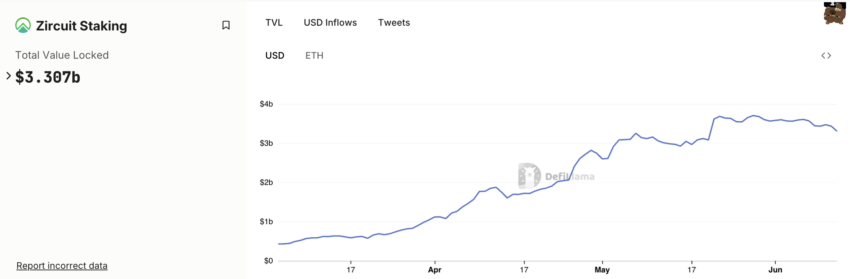

As Zircuit prepares for its mainnet launch this summer, it boasts over $3.5 billion in staked assets. Its “Build to Earn” program has attracted over 1,100 participants.

Hence, the community is buzzing, anticipating a potential airdrop to reward early adopters following the mainnet launch.

“Zircuit could be the next big airdrop. It’s still under the radar for most, but crypto whales (quietly) are farming it on Pendle, Fluid, and other protocols,” DeFi researcher Ignas said.

Zircuit Total Value Locked. Source: DefiLlama

Zircuit Total Value Locked. Source: DefiLlamaFurthermore, Binance has updated its trading operations. After a routine evaluation, several trading pairs, including ALPACA/BTC and QUICK/BTC, have been delisted due to low liquidity and trading volume.

These changes, effective from June 14, 2024, at 03:00 UTC, aim to maintain a high-quality trading market. Despite the delistings, users can continue trading these pairs’ base and quote assets on other available pairs at Binance.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Moreover, Binance has completed the integration of Curve (CRV) on the Arbitrum One and Optimism networks. Deposits and withdrawals for CRV are now open and expected to boost liquidity and user engagement on these networks.

The post Binance Invests in AI Layer 2 Token, Delists Trading Pairs, and Enables CRV Support appeared first on BeInCrypto.

4 months ago

50

4 months ago

50

English (US) ·

English (US) ·