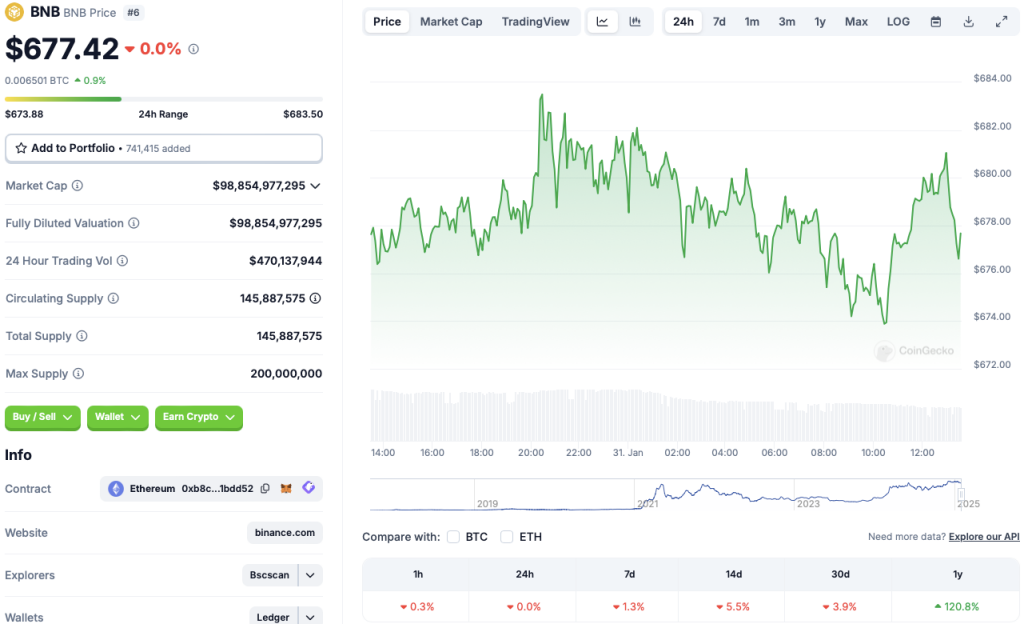

Binance’s BNB token has faced a important terms dip implicit the past fewer weeks. The coin has had nary terms alteration successful the regular charts but is down 1.3% successful the play charts, 5.5% successful the 14-day charts, and 3.9% implicit the erstwhile month. Despite the dip, BNB is up 120.8% since precocious January 2024.

Source: CoinGecko

Source: CoinGeckoAlso Read: XRP’s Big Leap: ETF Approval & $423K AMM Liquidity Surge—What’s Next?

BNB In The Red Zone

Source: Binance

Source: BinanceBNB’s latest dip follows the wide market’s lackluster performance. Bitcoin (BTC) continues to commercialized astatine the $104,000 level. The planetary crypto marketplace headdress has dipped 1.8% successful the past 24 hours to $3.69 trillion.

The dip is apt owed to investors putting their wealth successful safer assets arsenic the US dollar gains strength. The Federal Reserve paused involvement complaint hikes but is yet to denote a complaint cut. The Fed has announced lone 2 involvement complaint cuts successful 2025 alternatively of three. The determination whitethorn person wounded crypto investors’ sentiment. BNB and different assets are apt suffering owed to this development.

Also Read: Dogecoin Weekend Price Prediction: DOGE Eyes $0.36 In A Fresh New Ascent

New All-Time High For The Asset

Binance’s BNB deed an all-time precocious of $788.84 connected Dec. 4, 2024. The asset’s terms has fallen by much than 14% since its December 2024 peak. Although BNB has struggled to summation momentum implicit the past fewer weeks, the plus is predicted to rally implicit the adjacent fewer months.

According to CoinCodex, BNB volition interruption into a rally implicit the adjacent fewer months. The level anticipates the plus to breach the $1000 people successful aboriginal April 2025. CoinCodex predicts BNB volition deed a caller all-time precocious of $1069.21 connected April 26, 2025. Hitting $1069.21 from existent terms levels volition entail a rally of astir 57.84%.

Source: CoinCodex

Source: CoinCodexThere is besides a anticipation that BNB volition alternatively look a correction. Investor sentiment could instrumentality a deed if the Fed does not denote an involvement complaint chopped soon.

Also Read: De-Dollarization: Trump Threatens 100% Tariffs connected Nations Ditching the US Dollar

8 months ago

67

8 months ago

67

English (US) ·

English (US) ·