Bitcoin is struggling to shake off weakness, judging by its performance in the last few trading days. After the dump on June 24, the overall sentiment has been bearish, and sellers will likely double down, wiping gains posted in the last two days.

As things stand, the sale of 4,000 BTC by the United States government is a dent for buyers. It comes hours after the German government dumped thousands of BTC early this week, forcing prices to lower.

Bitcoin Trending At Oversold Territory

One analyst is upbeat even amid this sense of unease across the crypto and Bitcoin markets. Citing formation in the RSI indicator, a tool for gauging momentum, the analyst is convinced prices could recover strongly going forward.

Bitcoin is at its lowest overbought level in over 300 days at spot rates. This formation echoes a similar situation in 2023 when prices were stuck below $30,000.

Once BTC swung to the oversold territory, prices rebounded strongly, breaking above $50,000 and reaching an all-time high in the coming months through March 2024.

Thus far, Bitcoin finds itself in the oversold territory after consolidating for roughly three months after peaking in March 2024. Then prices shot to as high as $73,800 before dumping sharply, reaching $56,500 by May 2024. Though prices have recovered, finding another ceiling at $72,000, the path of least resistance in the short term is bearish.

Bitcoin is testing its horizontal range’s lower boundary for the fifth time since March. For bulls to take charge, prices must hold above the $56,500 and $60,000 zones for the bullish bias to remain.

However, a confirmed breakdown below the range low might see BTC crater dropping to as low as $50,000-$52.

Will BTC Bounce Higher? Capital Flow To Spot ETFs

Another analyst also expects prices to recover, emphasizing the importance of the bull market support band. Sharing on X, the analyst said this support band has served as a reliable loading zone in the past bull cycle.

Its successful defense in January 2024 offers a positive precedent. With BTC at the same level, the probability of a refreshing bounce is high on the cards, providing a glimmer of hope.

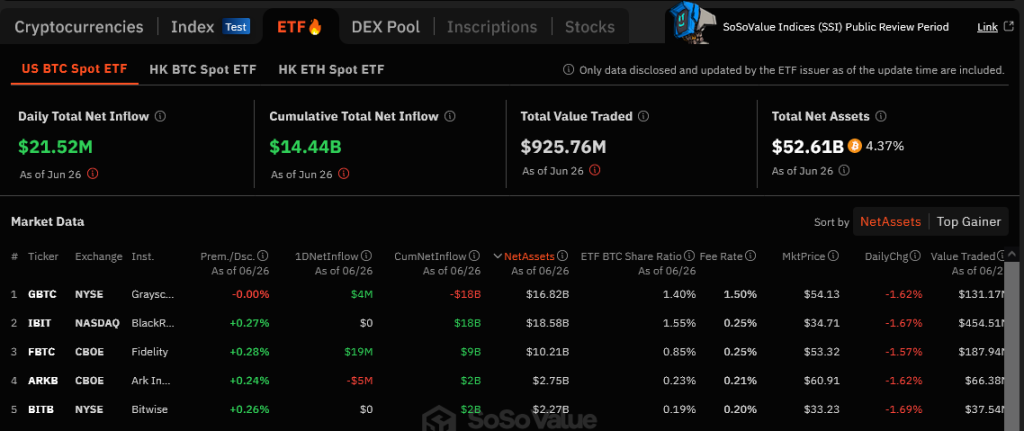

Despite the recent price decline and days, if not weeks, of outflows, interest in spot Bitcoin exchange-traded funds (ETFs) is increasing.

On June 26, there was $21.5 million into these products. Out of this, Fidelity and Grayscale saw inflows, according to SosoValue data.

4 months ago

47

4 months ago

47

English (US) ·

English (US) ·