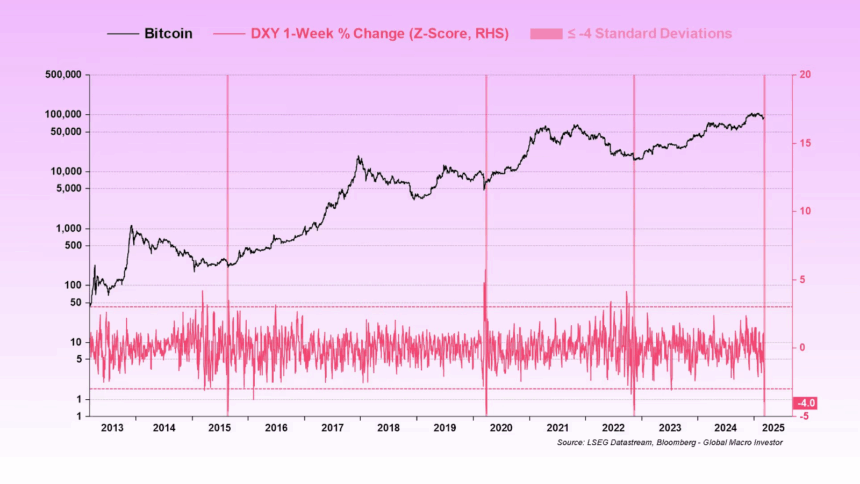

The U.S. Dollar Index (DXY) has experienced 1 of its sharpest one-week declines since 2013, exceeding a antagonistic 4 modular deviation move—a uncommon lawsuit that has present occurred lone 4 times successful implicit a decade.

According to Bloomberg information from Global Macro Investor, humanities instances successful 2015, 2020, and 2022 were each accompanied by large Bitcoin bottoms, followed by robust terms bounces.

Historically, a -4 modular deviation diminution successful the DXY Index has accompanied important Bitcoin bottoms. This occurred successful November 2022, erstwhile Bitcoin plummeted to $15,500 during the FTX debacle.

It besides happened successful March 2020, erstwhile Bitcoin concisely fell beneath $5,000 during the COVID-19 downturn. A akin lawsuit took spot during the 2015 carnivore marketplace erstwhile Bitcoin was trading astir $250.

Each of these situations was preceded by a ample Bitcoin terms bounce, which indicates determination whitethorn beryllium an humanities inclination with abrupt DXY drops coinciding with Bitcoin locating a marketplace low.

DXY 1-Week % Change, Source: Bloomberg, Global Macro Investor

DXY 1-Week % Change, Source: Bloomberg, Global Macro InvestorA declining dollar tends to payment hazard assets specified arsenic stocks and Bitcoin arsenic it makes them much appealing arsenic opposed to being successful cash. Still, arsenic beardown arsenic it is, its caller diminution did instrumentality the DXY beneath 100, leaving it astatine 103.8 currently, and frankincense the dollar is inactive comparatively strong.

With White House each acceptable to clasp the 1st ever crypto acme nether Trumps caller administration, the marketplace is already optimistic connected the aboriginal of bitcoin for the clip being.

Also Read: Trump’s Bitcoin Reserve Excludes XRP, but Bulls Stay Strong

7 months ago

32

7 months ago

32

English (US) ·

English (US) ·