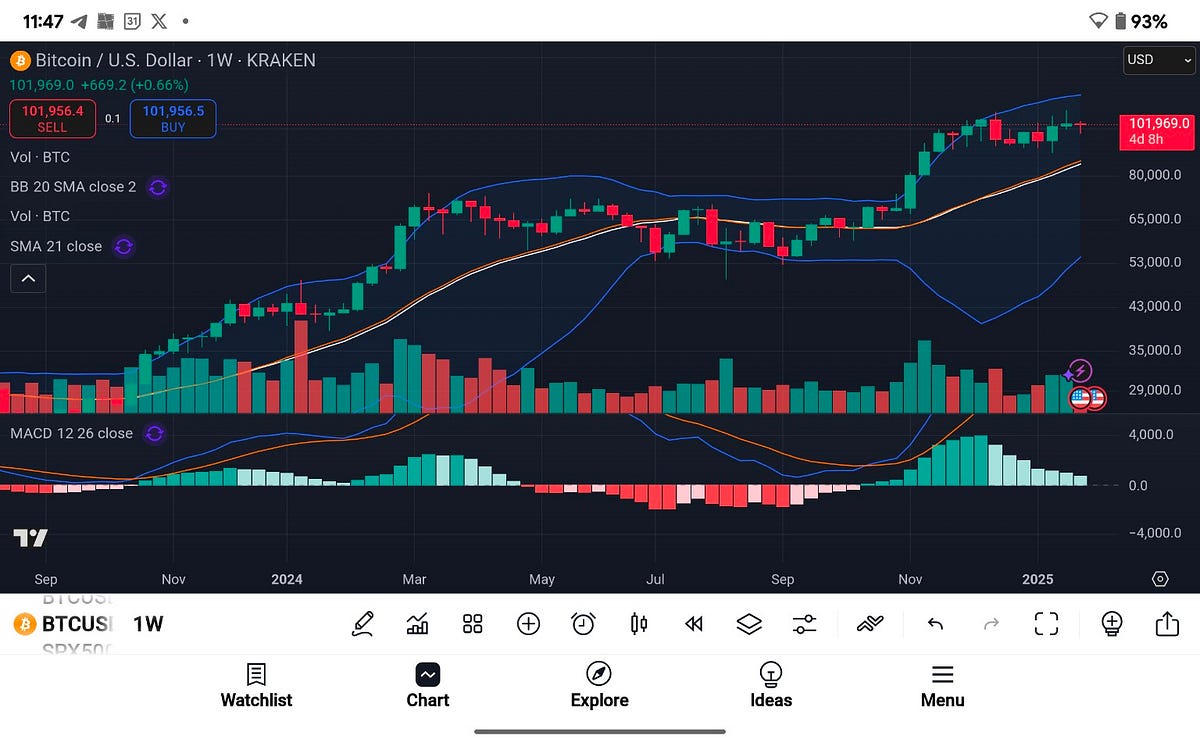

For years, hitting $100,000 was the dream for Bitcoin enthusiasts — an almost mythical goal that symbolized the mainstream arrival of cryptocurrency. Now, that dream is reality.

Bitcoin has officially crossed the six-figure mark, a moment fueled by a combination of market forces, political shifts, and institutional buy-in.

Let’s unpack what brought us here and why this is about much more than price charts.

Photo by Choong Deng Xiang on Unsplash

Photo by Choong Deng Xiang on UnsplashHow Did Bitcoin Reach $100K?

1. Regulatory Optimism Sparks Confidence

A key driver behind Bitcoin’s surge has been the political climate. The recent election of President-elect Donald Trump brought renewed optimism to the crypto market, largely due to his appointment of Paul Atkins as the SEC head. Atkins is a strong supporter of cryptocurrency and blockchain innovation, signaling the potential for a friendlier regulatory environment.

Investors have interpreted these changes as a green light for Bitcoin, sparking renewed confidence in the market.

2. Institutional Adoption Hits New Heights

Bitcoin’s path to $100,000 has been paved by growing institutional adoption. Major players like BlackRock and Fidelity have launched spot Bitcoin ETFs, making it easier for retail and institutional investors to access the asset.

This influx of capital from traditional finance has legitimized Bitcoin as a serious asset, increasing demand and reducing supply — a perfect recipe for price growth.

3. Global Accumulation Fuels Scarcity

Beyond institutions, governments and corporations have been quietly accumulating Bitcoin. El Salvador, which made Bitcoin legal tender in 2021, continues to bolster its reserves, while companies like MicroStrategy have doubled down on their Bitcoin holdings.

This large-scale accumulation creates scarcity, one of Bitcoin’s defining features, and drives prices higher as demand outstrips supply.

Why $100K Is a Game-Changer

Breaking through $100,000 isn’t just a psychological barrier — it’s a major milestone that changes how Bitcoin is perceived by skeptics and believers alike.

1. Solidifies Bitcoin’s Role as Digital Gold

For years, Bitcoin has been compared to gold as a store of value. Crossing $100K cements its position as a legitimate hedge against inflation and economic uncertainty. It’s no longer just an experiment — it’s a core part of the global financial conversation.

2. Boosts Market Sentiment

Bitcoin’s six-figure valuation has sent shockwaves of excitement through the crypto market. Bullish sentiment is contagious, and this milestone could fuel further investment, drawing in both seasoned traders and curious newcomers.

3. Puts Crypto in the Spotlight

While this milestone is a win for Bitcoin, it also brings scrutiny. Regulators and governments will likely increase their focus on the crypto space, debating how to integrate it into the broader financial system while managing risks.

What’s Next for Bitcoin?

Bitcoin crossing $100K feels monumental, but many are already asking: what’s next?

- Institutional Acceleration: With ETFs now live and major financial institutions embracing Bitcoin, we’re likely to see even greater capital inflows.

- Regulatory Developments: A favorable regulatory climate could supercharge Bitcoin’s growth, but harsher rules might dampen momentum.

- New All-Time Highs: Some analysts predict Bitcoin could hit $150K or more within the next year, particularly if adoption continues at its current pace.

A Turning Point for Crypto

Bitcoin breaking $100K isn’t just about a price — it’s about validation. It’s a signal to the world that cryptocurrency is no longer niche or experimental. It’s a maturing asset class with real-world utility and global demand.

Sure, risks remain. Volatility, regulatory challenges, and market corrections are all part of the journey. But this milestone proves one thing: Bitcoin is here to stay.

Bitcoin Breaks $100K: Why This Historic Milestone Matters for the Future of Crypto was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

37

1 month ago

37

English (US) ·

English (US) ·