AI-generated Image

AI-generated ImageBitcoin and the overall crypto market have begun to pump aggressively, and it’s crazy to witness large price pumps on most of the coins within a few days. The early investors who entered the bear market during 2022 or survived the bearish winter are enjoying their portfolios climbing to the moon!

As of the time of writing, Bitcoin is trading at approximately $91,155. And it’s just the beginning of the ultimate bull run. If we look at the overall economic cycle of the cryptocurrency market over a decade, Bitcoin is the leader of all cryptos and has a 4-year bull and bear market cycle. We are at the beginning of the Bitcoin bull cycle, which normally kicks off post-halving events approximately 200 days after the event.

Bitcoin’s 4-Year Cycle and Market Dynamics:

Bitcoin 4-year economic cycle | Stockmoney Lizards/X

Bitcoin 4-year economic cycle | Stockmoney Lizards/XEverything is as per the concepts of cryptocurrency economics and unfolding geopolitical events. We are 100% aligned with the Bitcoin market cycle. For those who are wondering whether it’s too late to join and invest in Bitcoin or altcoins, things are just at the beginning because if we compare it to the previous Bitcoin bull market cycle, we can see the peak was around March or April of 2021, and the next projected Bitcoin price peak will be around the same month of 2025 with price expectancy above $100,000!

This bull run is certainly different because, unlike previous bull runs, we have a lot more participants… Big Institutes buying Bitcoin, more crypto projects revolving in the Web 3.0, Defi, AI space aimed to enhance efficiency, and a lot more options for expanding the decentralized finance ecosystem.

This bull run will certainly see few Altcoins outperforming Bitcoin in terms of return on investments (10x returns on investment). Be aware and look out for such projects in the crypto space because this is just the beginning of an epic run!

Why Bitcoin and Cryptocurrency is Still a Strong Investment Opportunity?

Remember, it’s never too late to invest, but it’s best to observe and make decisions to invest in cryptos that will provide you and everyone with some solid returns that even other asset classes cannot provide within a short time. It’s just crypto’s raw nature over decades.

Let me explain on why we still have time to enter the bull run:US Elections Results:

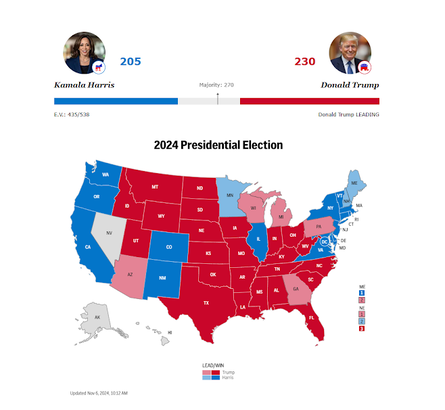

Image Source: Economic Times

Image Source: Economic TimesOn 11 November 2024, the day when the US election results were declared, the direction of Bitcoin price was uncertain and waiting to move either bullish or bearish. The crypto markets favored Trump’s side and had already priced in millions and billions to move super bullish if Trump wins.

With passing time on 11th November 2024, as the results progressed each hour to its final destination, we saw Trump taking a massive lead. Since he showed strong support and desire to make crypto great again in the USA, followed by crypto-friendly representatives in his cabinet, Bitcoin and the overall crypto market became absolute winners for everyone with stronger support from the political and superpower governments.

Retail Investor Interest Surging After Elections:

Just after the election results, from 12th November, we saw Bitcoin break its previous all-time high records, pumping 5 to 10% bullish for consistent days this week, which made retail investors and people raise interest in Bitcoin.

When everyone doubted Bitcoin or crypto would be dead during the 2022 bear cycle, and everyone was pessimistic after Bitcoin hit rock bottom of $16k, that was the time when retail interest completely died out, and none of the common people were looking to enter the market for fear of losing more money. But remember, when everyone’s in extreme fear, jump into the market for the long term.

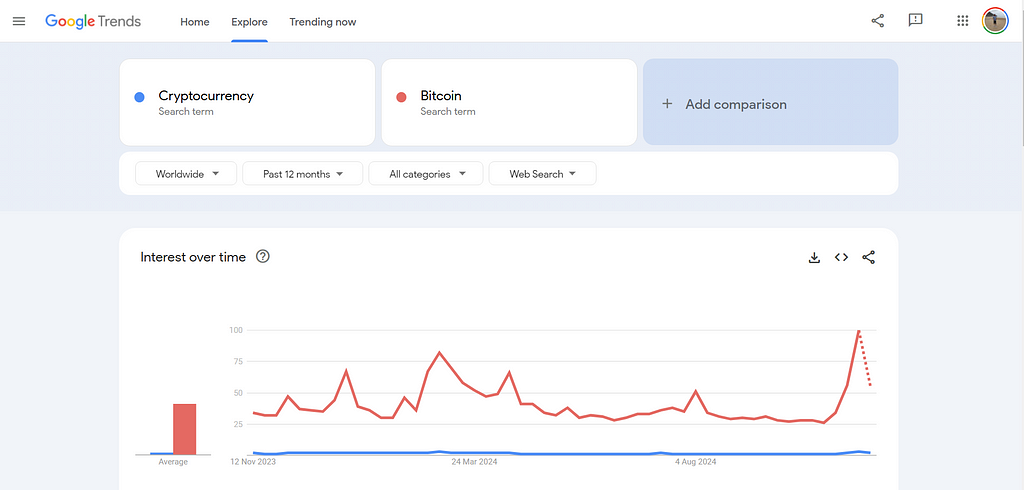

In the present moment, if we observe Google Trends analytics for Bitcoin and cryptocurrency terms being searched, we can clearly see the beginning of a rising graph, indicating more investors will be coming late and hopping onto this fast-moving crypto train to later grab cryptocurrencies for making fortunes.

Institutional FOMO:

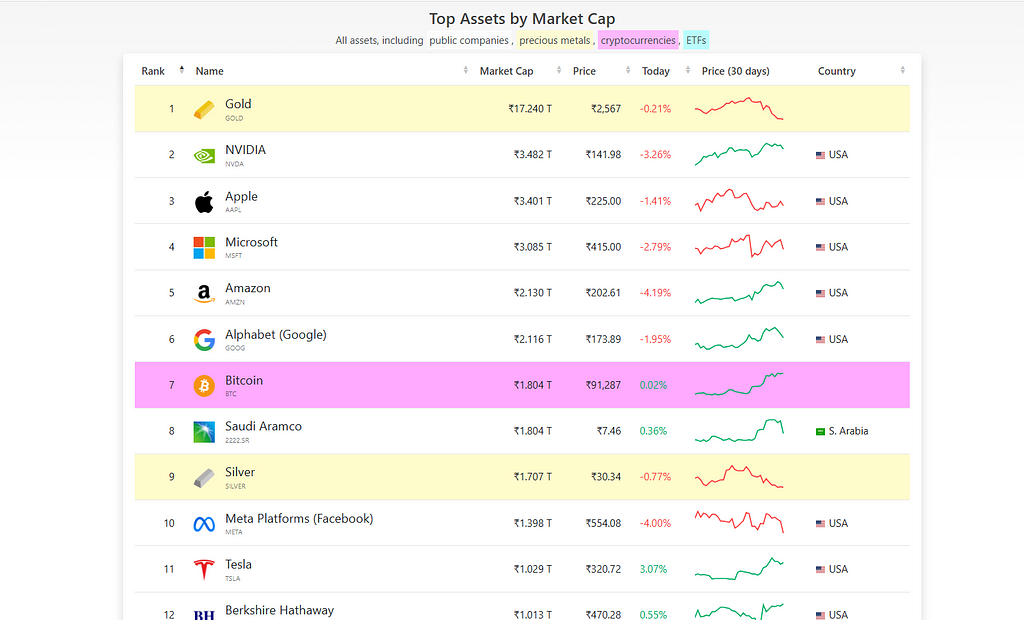

Image source: https://companiesmarketcap.com/inr/assets-by-market-cap/

Image source: https://companiesmarketcap.com/inr/assets-by-market-cap/Institutional interest in Bitcoin has surged significantly, with large entities aggressively increasing their Bitcoin holdings, especially after recent pivotal events. The total Bitcoin under institutional custody has grown to staggering levels as these players prepare to meet the increasing demand for Bitcoin ETFs and other investment vehicles. This wave of institutional Bitcoin FOMO has inspired multiple major players to accumulate Bitcoin, leading to a sharp uptick in wallet activity.

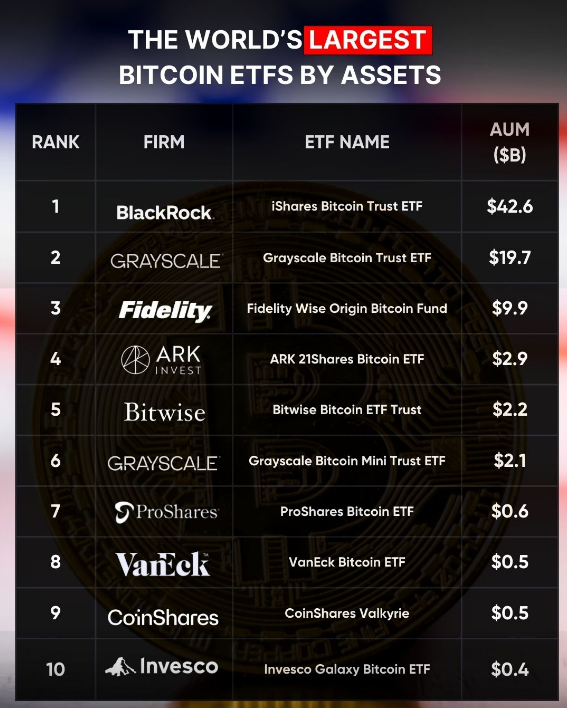

Image source: https://www.linkedin.com/posts/eddie-donmez-538b55b5_the-worlds-largest-bitcoin-etfs-bitcoin-activity-7262794647930867713-7pRX?utm_source=share&utm_medium=member_desktop

Image source: https://www.linkedin.com/posts/eddie-donmez-538b55b5_the-worlds-largest-bitcoin-etfs-bitcoin-activity-7262794647930867713-7pRX?utm_source=share&utm_medium=member_desktopWith ambitious plans to significantly expand Bitcoin holdings over the coming years, these institutions are positioning themselves strategically. Given Bitcoin’s limited supply capped at 21 million, such large-scale acquisitions are expected to drive its price higher and potentially propel it past the total market capitalization of the top five global assets.

As of now, Bitcoin is already the 7th largest asset in the world by valuation, surpassing giants like Saudi Aramco. Its value is only set to grow further, underpinned by its strong Bitcoin fundamentals and increasing adoption. This institutional momentum strongly reinforces the bullish case for Bitcoin’s future.

Bottom Line:

The Bitcoin bull run is the most optimistic time to be alive and active in the cryptocurrency market. For any asset class, with every small retracement to low prices, many new buyers are waiting to enter the market at any discount being offered, and over time, early Bitcoin investors will see big profits within a few months, provided having proper risk management plans.

Thanks for reading the article, for more updates and insights, follow my profile by clicking the below link and clap for the efforts.Check my profile page for more articles below:Bitcoin Breaks Records Again: The Start of an Epic Bull Run was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

33

2 months ago

33

English (US) ·

English (US) ·