Despite numerous forecasts that Bitcoin’s (BTC) price could surge to $120,000 before year-end, the coin has encountered a setback, now trading below $97,000. However, historical data indicates that such pullbacks often present an opportunity for new Bitcoin buyers to accumulate.

If this pattern holds true, Bitcoin’s price could close the year on a higher note. This on-chain analysis reveals how this scenario might play out.

Bitcoin Presents a Rare Chance Again

Bitcoin’s price has dropped by 12% over the past seven days, likely due to increased selling pressure as the holiday season ramps up.

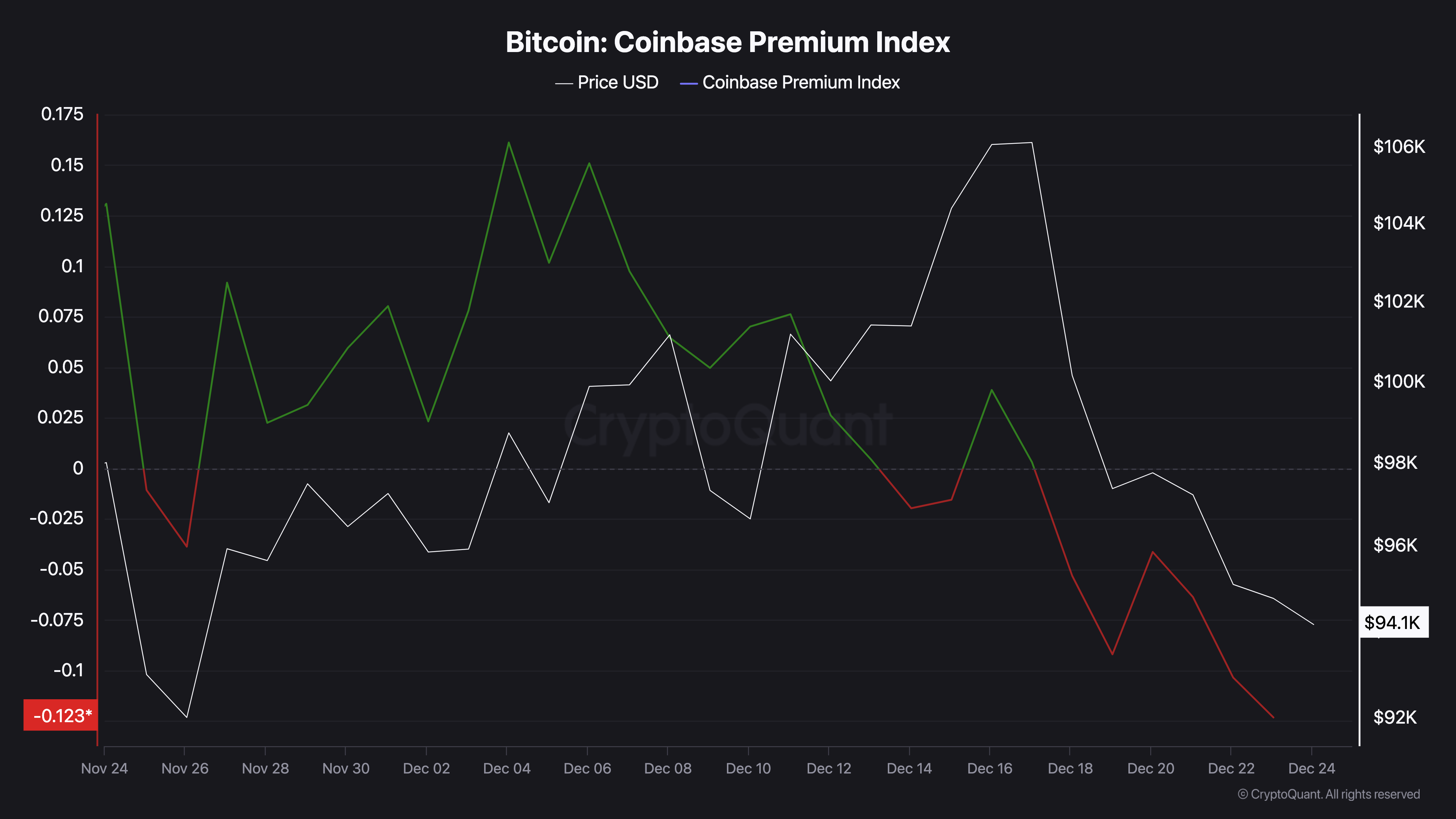

This pressure is reflected in the sharp decline of the Coinbase Premium Index, which gauges buying and selling activity in the US. A rising index signals strong buying pressure, while a decline indicates heightened selling.

Currently, the index points to significant selling pressure. However, in previous cycles, intensified selling often attracted new buyers eager to purchase Bitcoin at a discount. If this pattern repeats, BTC could experience renewed accumulation and potentially climb higher.

Bitcoin Coinbase Premium Index. Source: CryptoQuant

Bitcoin Coinbase Premium Index. Source: CryptoQuant Interestingly, crypto analyst MAC_D also agrees with the sentiment, noting that the cryptocurrency might soon experience a bounce.

“Historically, this phenomenon has been temporary during bull markets, often attracting new buyers who saw it as an opportunity. While it’s uncertain whether the price following this sharp decline represents the bottom, if the bull market continues, a bottom may form soon, potentially leading to a rebound.” MAC_D pointed out on CryptoQuant.

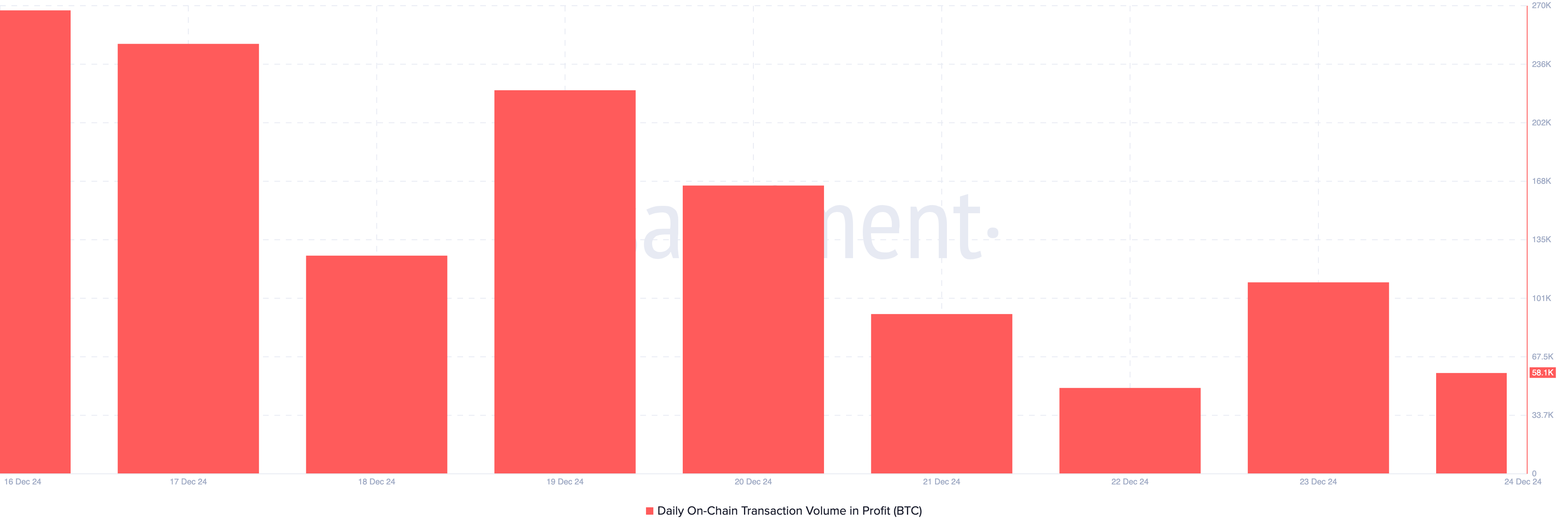

Furthermore, the rate of profit-taking among Bitcoin holders also supports this outlook. On December 16, the on-chain transaction volume in profit was over 250,000 BTC.

As of this writing, the value has decreased to 58,1000, indicating that the decline in Bitcoin’s price has forced investors to keep HODLing instead of liquidating their assets. Should this value continue to decrease, then a BTC rebound could likely occur.

Bitcoin Daily On-Chain Transaction Volume in Profit. Source: Santiment

Bitcoin Daily On-Chain Transaction Volume in Profit. Source: Santiment BTC Price Prediction: Back Above $100,000 Soon

Based on the 4-hour chart, Bitcoin has found support at $92,888. As a result, the price has found another stronger support at $95,871. However, the Awesome Oscillator (AO) has remained negative, which suggests bearish momentum.

However, with green histogram bars appearing, BTC could evade another notable decline and trade higher. If that is the case, Bitcoin’s price could reach $104,299 in the short term. In a highly bullish market condition, the value could rise to $108,386.

Bitcoin 4-Hour Analysis. Source: TradingView

Bitcoin 4-Hour Analysis. Source: TradingView On the other hand, a decline below the support level mentioned above could invalidate this prediction. If that were to happen, Bitcoin’s price might decline to $92,144.

The post Bitcoin (BTC) Fall Below $97,000 Could Open Doors for New Buyers, Data Suggests appeared first on BeInCrypto.

13 hours ago

21

13 hours ago

21

English (US) ·

English (US) ·