- Bitcoin remains under pressure, struggling after three weeks of losses and hitting a four-month low.

- Trump’s recession comments and trade war fears have rattled markets, keeping crypto in the red.

- Altcoins and meme coins also dropped, with Ethereum down 8% and Trump’s TRUMP token falling 7%.

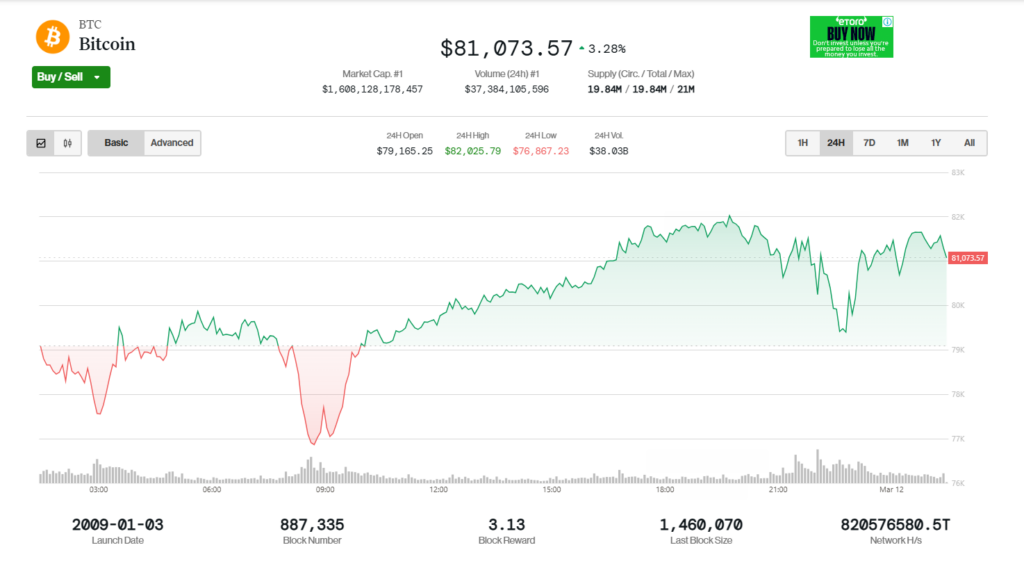

Bitcoin steadied on Tuesday after briefly hitting a four-month low, as concerns over a U.S. recession and potential new trade tariffs under President Donald Trump continued to weigh on investor sentiment.

Market Pressures Keep Bitcoin Down

Despite Trump’s Bitcoin reserve initiative, the market has shown little enthusiasm. Bitcoin remains under pressure after three straight weeks of losses, with major cryptos like Ethereum and XRP also in decline.

Bitcoin edged up 0.5% to $80,480 after briefly dropping to $76,677, but analysts warn that risk appetite remains low.

Recession & Tariff Fears Weigh on Crypto

Trump’s recent comments declining to rule out a U.S. recession, along with escalating trade war concerns, have spooked markets. Bitcoin tends to react strongly to economic uncertainty, and the negative macro outlook has kept the entire crypto market in the red.

“Crypto is still a risk asset, and the broader market fears aren’t helping,” said an analyst at eToro.

Strategy’s $21B Bitcoin Fundraising Plan Sparks Mixed Reactions

Bitcoin also found little support from Strategy’s (NASDAQ:MSTR) plan to raise $21 billion through a stock offering, with proceeds earmarked for Bitcoin purchases.

However, Strategy’s $4 billion unrealized loss on previous Bitcoin purchases has raised concerns. Since late 2024, the firm has spent $21 billion on Bitcoin, but declining prices have reduced the value of those holdings to $17 billion.

Ark Invest Doubles Down on Coinbase Despite Market Slump

Meanwhile, Cathie Wood’s Ark Invest made another $11.5 million purchase of Coinbase (NASDAQ:COIN) shares, even as the stock fell 17.6% during a broad sell-off. Ark has now accumulated $28.2 million in Coinbase stock over three weeks.

Coinbase also moved closer to re-entering the Indian market, securing registration with India’s Financial Intelligence Unit (FIU) after previously withdrawing due to regulatory issues.

Crypto Prices Struggle Across the Board

Altcoins saw widespread losses:

- Ethereum (ETH) dropped 8% to $1,871, its lowest since late 2021.

- XRP, Solana, and Cardano fell between 0.5% and 2.3%.

- Meme coins took a hit, with Dogecoin down 6.5% and Trump’s Solana-based TRUMP token falling 7% to $10.15.

What’s Next?

With economic uncertainty, trade tensions, and weak crypto sentiment, Bitcoin remains vulnerable. If macro conditions continue to deteriorate, further downside is possible—but any signs of policy clarity or institutional buying could trigger a rebound.

7 months ago

58

7 months ago

58

English (US) ·

English (US) ·