Demand for Bitcoin (BTC) price to form a new all-time high has been keeping investors’ hopes alive.

However, the actual demand for BTC is showing a massive decline. However, there is one cohort of investors that could prevent a drawdown in price.

Bitcoin Demand Dwindles

Since the beginning of August, Bitcoin’s price has struggled to rise above $60,000. This is delaying the recovery of investors’ losses from the July crash.

While the crypto asset’s movement defines the structure of a broadening ascending wedge, the breakout from this pattern takes a lot of time. The reason behind this is the decline in demand for BTC among investors.

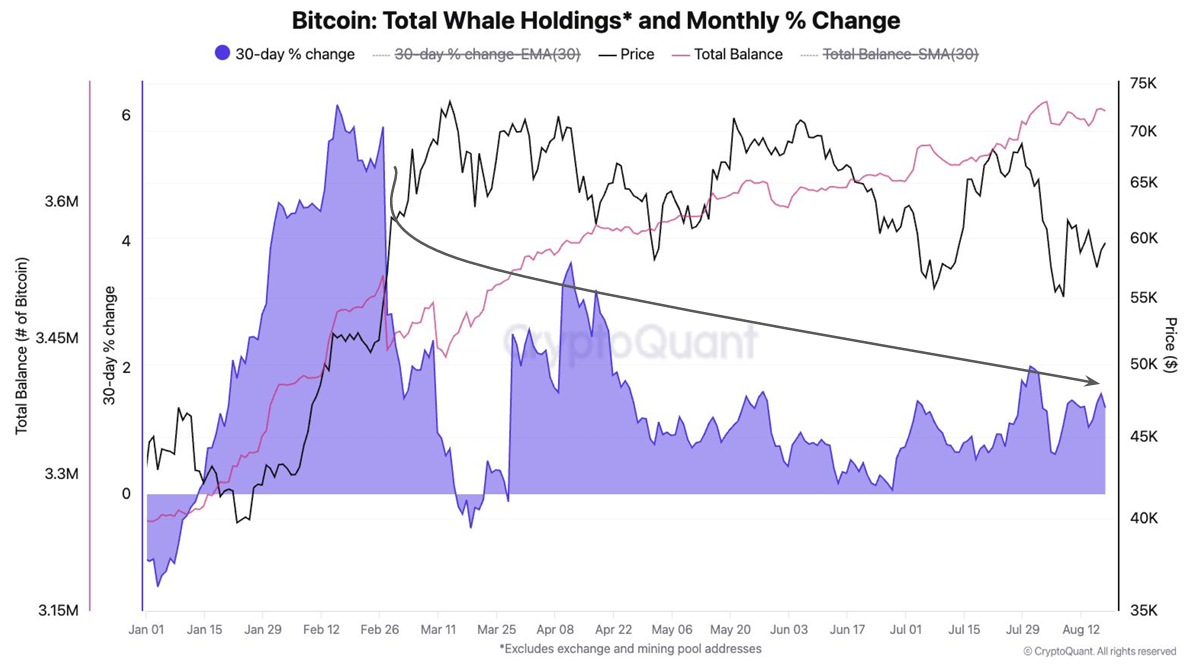

An exclusive report from CryptoQuant shared with BeInCrypto shows that large BTC holders’ holdings have declined considerably. As noted in the report, the 30-day percentage change in whale holdings has decreased from 6% in February to just 1% currently.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Generally, a 3% rise in the holdings of addresses with 1,000 to 10,000 BTC in their wallets is a positive sign. This is a signal of Bitcoin’s price increase, which does not seem to be the case presently.

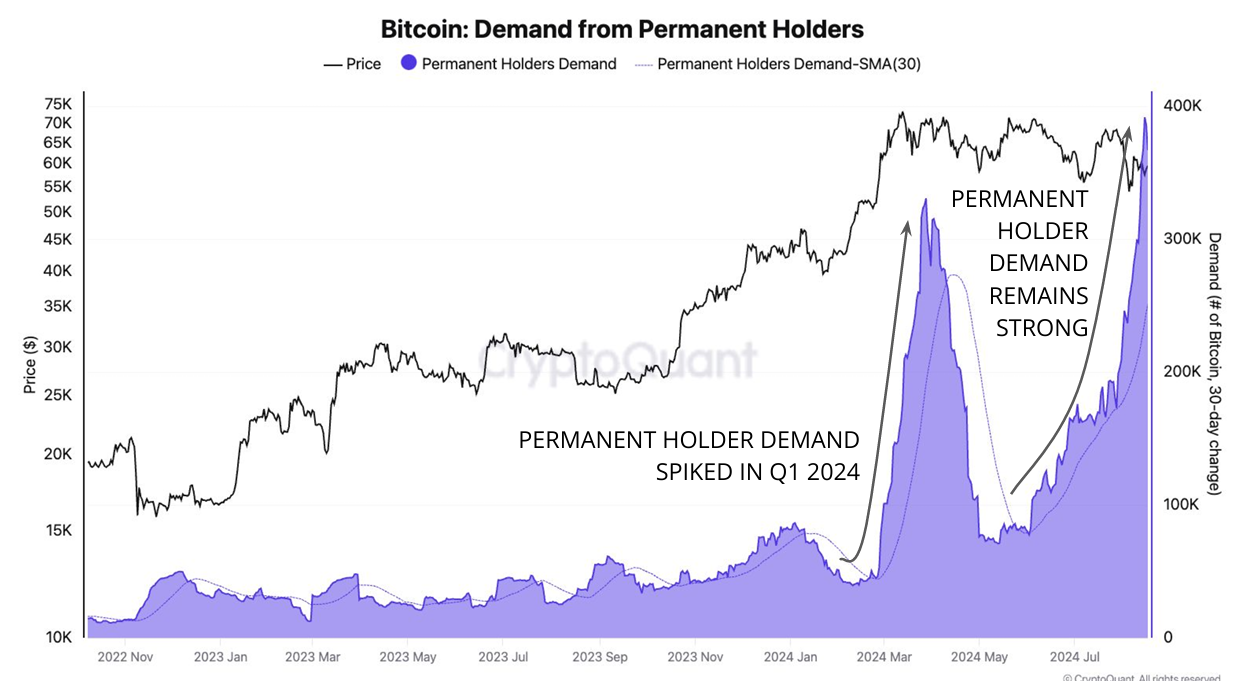

Nevertheless, Bitcoin’s lack of sustained price growth has not impacted its most loyal holders. The permanent holders, i.e., those who only accumulate BTC and have never spent or sold their holdings, are still buying.

The total balance of these permanent holders is rising consistently every month at a rate of 391,000 BTC. Interestingly, this rise in accumulation came after the price decline began towards the end of May.

Thus, these mixed cues could keep Bitcoin’s price from falling lower but might also delay a rise.

BTC Price Prediction: Time Under $65,000

Bitcoin’s price, at $59,280 at the time of writing, will likely continue its consolidation under $60,000. The ongoing trend since early March shows BTC tends to move sideways in a fixed range before drastically rallying or falling.

If BTC finds bullish cues dominating bearish cues, it could shoot up to $65,000, but breaching this level could take a while. Thus, before the end of Q3, witnessing a break out of the pattern and a rally to $80,000 both seem slightly unlikely.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if Bitcoin’s price does manage to breach $65,000, it could break out above $71,500. This would enable a rise for BTC, potentially rallying past the all-time high of $73,800, invalidating the bearish-neutral thesis.

The post Bitcoin (BTC) Price Breakout to $80,000 Delayed by Macro Trends appeared first on BeInCrypto.

2 months ago

31

2 months ago

31

English (US) ·

English (US) ·