TL;DR

- Bitcoin fell below $55,000, now at $54,200, potentially influenced by several elements.

- The market crash led to $670 million in liquidations, with the largest liquidated order happening on crypto exchange Binance.

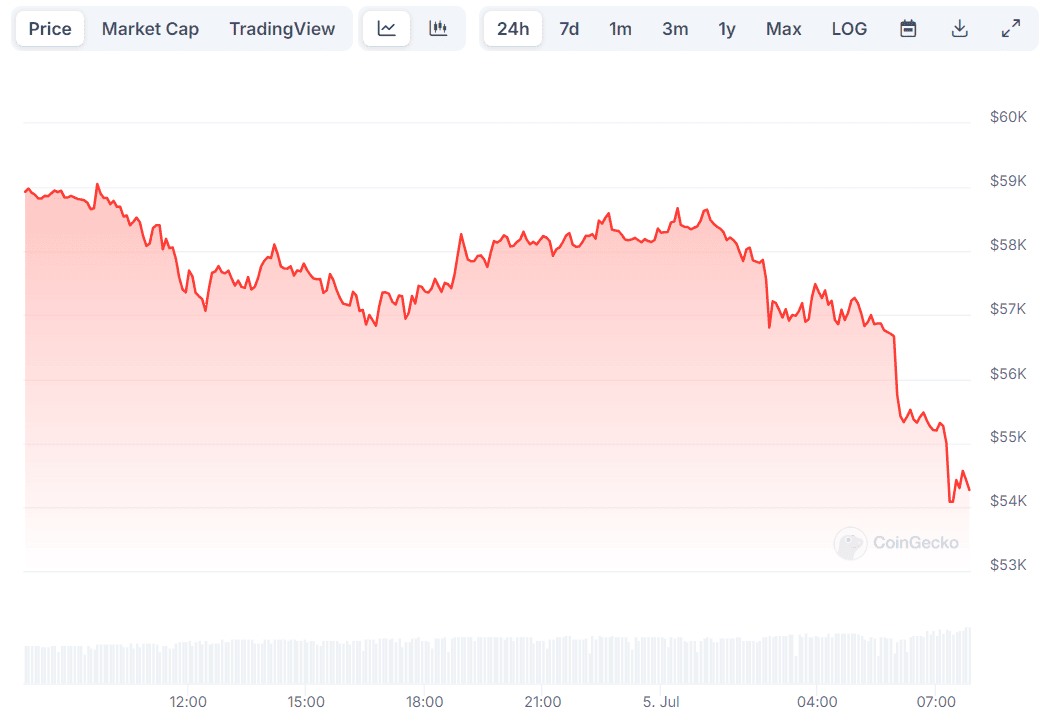

The primary cryptocurrency continues its freefall, dipping under the $54,000 mark today (July 5). Currently, it trades at around $54,200 (per CoinGecko’s data), which is the lowest level observed in the past five months.

BTC Price, Source: CoinGecko

BTC Price, Source: CoinGeckoBitcoin’s decline could be attributed to several important factors. One example is the German government’s decision to liquidate a substantial amount of its BTC holdings.

The impending repayments of creditors of the now defunct crypto exchange Mt. Gox and the confusion surrounding the US Presidential elections (scheduled for November this year) might also play a role. The defunct crypto exchange has just transferred over $2.7B worth of BTC to a new address, adding more fuel to the fire.

Somewhat expectedly, the latest market crash negatively affected over-leveraged traders. CoinGlass data shows total liquidation in the past 24 hours surged to approximately $670 million. Bitcoin (BTC) trades accounted for around 35% of the share, while Ethereum (ETH) ranked second.

Leading altcoins, such as Solana (SOL), Dogecoin (DOGE), Ripple (XRP), Shiba Inu (SHIB), and many more, are also well in the red, contributing to the massive liquidations.

The largest single liquidated order happened on Binance. It was worth almost $19 million and involved the ETH/USDT trading pair, according to CoinGlass.

The post Bitcoin (BTC) Price Slips Below $54K, Triggering Almost $700 Million in Liquidations appeared first on CryptoPotato.

3 months ago

41

3 months ago

41

English (US) ·

English (US) ·