Bitcoin has seen unpredictable and volatile activity recently, with price action testing both psychological and technical boundaries. The cryptocurrency failed to break above the coveted $100,000 mark while showing resilience by holding firmly above the $90,000 level. This tight range has left traders and investors on edge, watching closely for a decisive move.

Amid this volatility, the broader crypto market is experiencing unprecedented demand, signaling a bullish outlook that could keep the “BTC party” alive in the coming months.

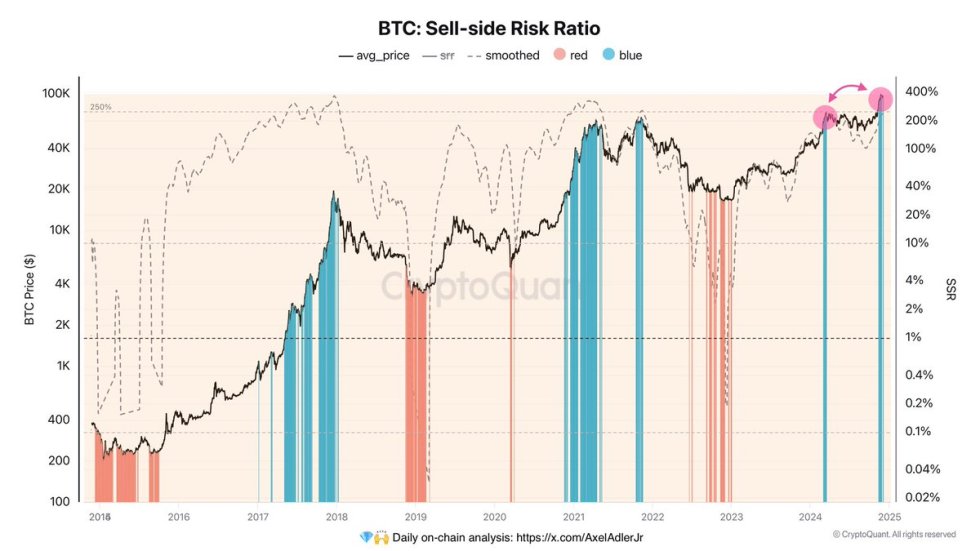

However, challenges remain, as key data from CryptoQuant indicates elevated risks of coin sales by current holders. This suggests potential headwinds, even as demand drives the market forward.

As Bitcoin consolidates, the market appears poised for its next major move. Whether BTC can break above $100K or face a deeper retracement below $90K will depend on how these dynamics play out. The coming weeks will be critical as participants navigate this volatile phase and assess BTC’s capacity to lead the market to new heights.

Bitcoin Showing Selling Signals: What’s Different This Time?

Bitcoin has been on an impressive upward trajectory since November 5, surging by 50% as it approached key psychological levels, including the $100K mark. However, after reaching this monumental rally, BTC retraced over 8%, testing critical demand levels. Despite this pullback, the price remains exceptionally strong, supported by a solid base of new market participants.

According to CryptoQuant analyst Axel Adler, while there is a high risk of coin sales by holders—particularly those in the market for the long haul—the dynamics are different compared to similar situations in March.

At that time, the selling pressure from long-term holders outpaced demand, causing BTC’s price to retreat. Currently, however, the demand from new participants is effectively absorbing the sales of long-term holders, mitigating downward pressure and helping sustain the uptrend.

This suggests that BTC has the potential to push further, with analysts targeting $100K to sub-$110K levels in the short term. However, as prices rise, the likelihood of increased selling pressure grows, which could eventually trigger a significant correction.

In this cycle, it’s not a question of “if” but “when” Bitcoin will face its first major pullback. The combination of strong demand and mounting pressure from holders looking to cash out will likely result in a healthy correction, which could serve as a buying opportunity for those looking to capitalize on Bitcoin’s long-term potential. The key will be monitoring how demand continues to absorb these sell-offs.

Testing Demand Before A Breakout

Bitcoin is currently testing a key demand level around $95,000, which needs to hold in the coming days for BTC to continue its push toward the $100,000 mark. This price level has proven to be significant for short-term strength, and if it holds, Bitcoin could break above $100,000, signaling a continuation of the bullish trend.

The $95,000 level acts as a crucial support on the 4-hour chart, and maintaining it would suggest that there is enough buying pressure to propel Bitcoin to new highs. However, if Bitcoin fails to hold this level, the price could see further downward pressure, potentially testing demand around $90,700 or even $87,602. The latter price range aligns with the 4-hour 200 exponential moving average (EMA), a key technical indicator that often signals areas of support during pullbacks.

In the next few hours, all eyes will be on this support level, as a break below $95,000 would shift the momentum to the downside. On the other hand, holding above this level could pave the way for Bitcoin to surge past $100,000, continuing its impressive bull run. The price action around $95,000 will be critical in determining Bitcoin’s next move.

Featured image from Dall-E, chart from TradingView

2 months ago

35

2 months ago

35

English (US) ·

English (US) ·