Investor sentiment in the cryptocurrency market takes a hit as the U.S. Spot Bitcoin ETF witnesses a substantial drop in inflows, falling by 80.6% to $133 million on Thursday, March 14. Notably, this marks the lowest inflow over the last eight trading days, which have sparked discussions over a potential cooling interest from the Wall Street players.

Meanwhile, this decline comes amid a broader downturn in the crypto market, with Bitcoin prices retreating from recent highs.

Bitcoin ETF Inflow Plunges Amid Bitcoin Sell-Off

The recent slump in Bitcoin, coupled with heightened market volatility, has sparked market concerns amid a significant reduction in inflows to the U.S. Spot Bitcoin ETF. Following a record-breaking surge that propelled Bitcoin to surpass $73,000, the cryptocurrency faced a sharp decline, dipping below the $67,000 mark.

Notably, this current decline reflects the allaying risk-bet appetite of the investors, especially before the upcoming FOMC meeting. The FOMC meeting next week could shed some light on the potential move by the Federal Reserve towards their rate-cut plans.

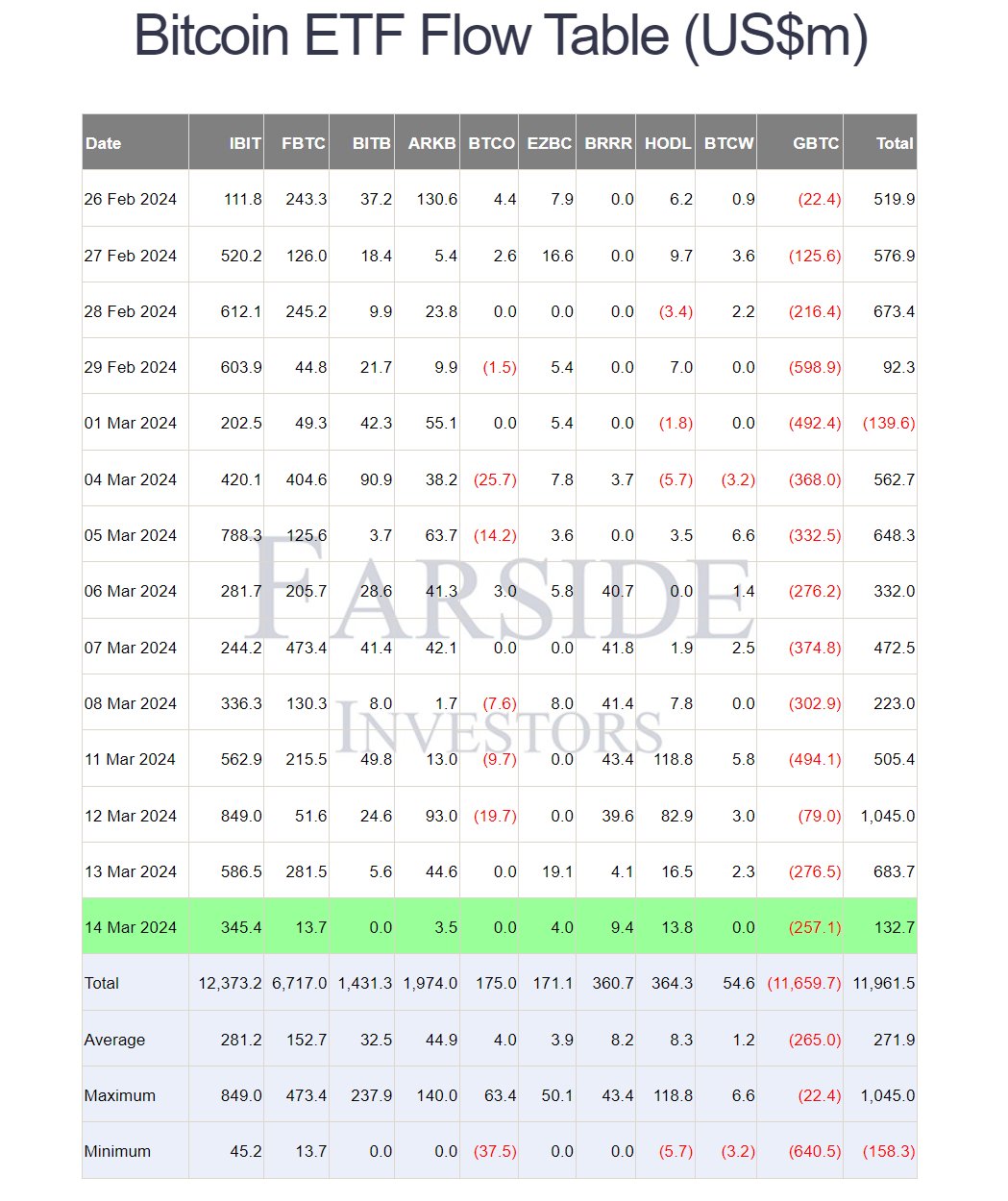

However, reports from Farside Investors indicate that the U.S. Spot Bitcoin ETF experienced an inflow of $132.7 million on Thursday, March 14, marking a stark contrast to previous days’ $586.5 million influx. Notably, BlackRock’s IBIT, one of the prominent ETF issuers, saw an inflow of $345.4 million, down from $586.5 million the day before.

In addition, Vaneck Bitcoin Trust ETF (HODL) and Fidelity’s FBTC managed to record inflows of $13.8 million and $13.7 million, respectively. Conversely, Grayscale’s GBTC witnessed an outflow of $257.1 million, although marking an improvement from the $276.5 million outflux reported on March 13.

Source: Farside Investors

Source: Farside InvestorsAlso Read: Bitcoin Maxi Pushes for El Salvador Credit Rating Upgrade Amid Cold Storage Move

Price Performance Amid Volatile Market

The diminishing inflow into Bitcoin ETFs has raised concerns among investors, contributing to the sell-off observed in the broader crypto market today. However, despite the recent downturn, the cumulative net inflow into the U.S. Spot Bitcoin ETF remains substantial, nearing the $12 billion mark after 44 days of trading.

Meanwhile, several market pundits suggest that the volatility in the cryptocurrency market, coupled with regulatory uncertainties and macroeconomic factors, has prompted investors to adopt a cautious approach. While Bitcoin’s long-term prospects remain favorable, short-term fluctuations may continue to influence investor sentiment and ETF activity.

As the cryptocurrency landscape evolves, market participants will closely monitor developments in regulatory frameworks and institutional adoption, which could significantly impact Bitcoin’s trajectory. Amid the current market turbulence, strategic decision-making and risk management will be crucial for investors navigating the crypto space.

Meanwhile, the Bitcoin price was down 7.72% to $67,483.45, with its trading volume soaring 54.20% to $74.48 million. Over the last 24 hours, the BTC price saw a high of $73,750.07 and a low of $66,855.76, suggesting the volatile condition in the market.

Bitcoin Price Chart

Bitcoin Price ChartAlso Read: Shiba Inu Community Burns 25 Mln Coins, What’s Next For SHIB?

The post Bitcoin ETF Inflow Drops 80% To $133M As BTC Price Retreats appeared first on CoinGape.

1 month ago

17

1 month ago

17

English (US) ·

English (US) ·