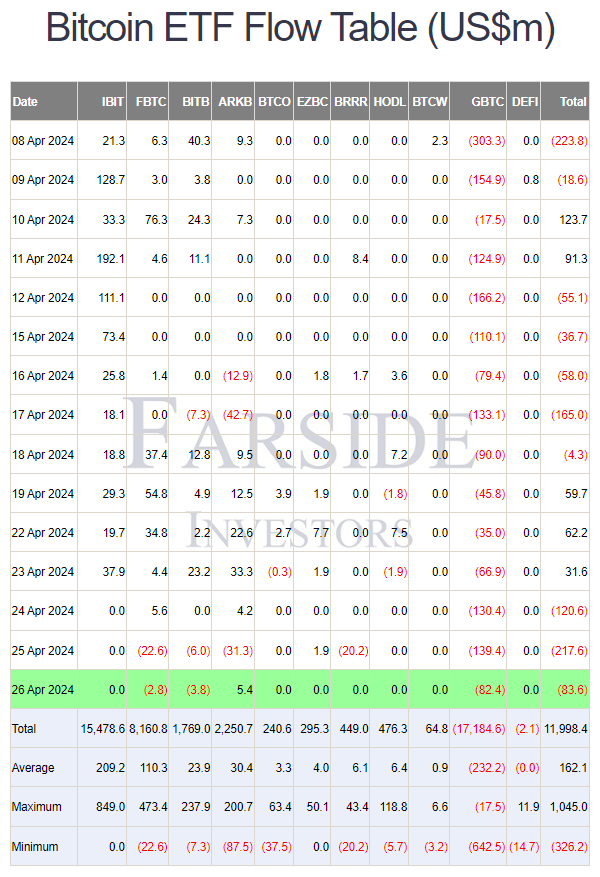

Bitcoin ETF: Spot Bitcoin ETFs in the U.S. continue to perform poorly, with a net outflow of $83.6 million on the week’s last trading day. Grayscale GBTC saw an outflow of $82.4 million and a marginally lower outflow than the past two days, indicating the lack of interest among institutional investors in Bitcoin ETF presently.

This comes mostly due to monthly options expiry and hotter PCE inflation amid Bitcoin’s poor performance in the last few days. Moreover, DTCC’s update on collateral values for certain securities, notably ETFs with Bitcoin or other cryptocurrencies as assets, caused panic in the financial industry.

Bloomberg analyst James Seyffart and Custodia Bank CEO Caitlin Long said DTCC announcement on ETFs with Bitcoin exposure will have zero collateral value for loans is actually “healthy” for the crypto market.

Also Read: Binance v. SEC – US DOJ Filing Counters SEC, Stablecoins Are Not Securities

Spot Bitcoin ETFs Saw $83.6 Million Outflows

After showing signs of recovery earlier this week as Bitcoin ETFs saw net inflows, the outflows have again shadowed the interest in the ETF market. The total net outflow of spot Bitcoin ETFs was $83.6 million, according to data reported by Bloomberg and Farside Investors on April 27. The 11 listed spot Bitcoin ETF witnessed a disappointing day again volumes and buying activity were significantly down.

Ark 21Shares Bitcoin ETF (ARKB) was the only Bitcoin ETF with an inflow. It saw just $5.4 million in inflow amid expectations of buying from the ARK funds as it sold all its holdings in ProShares Bitcoin Strategy ETF (BITO). Shares price fell 1.84% but climbed 0.61% after market hours.

Fidelity Bitcoin ETF (FBTC) and Bitwise Bitcoin ETF (BITB) saw outflows of $2.8 million and $3.8 million on Friday, respectively. This was the second consecutive day of outflows from the two largest Bitcoin ETFs with massive Bitcoin holdings.

BlackRock iShares Bitcoin ETF (IBIT) and other spot Bitcoin ETFs saw zero flows, raising concerns among retail and institutional investors as zero flow data recorded by some Bitcoin ETFs this week could further degrade investor sentiment.

The outflows from Grayscale GBTC have slowed on Friday as compared to past days. Outflow from GBTC decreased to $82.4 million from $139.4 million a day ago. With this, the total outflows from the Grayscale BTC ETF currently stand at $17.14 billion.

Also Read: XRP, ADA, BCH, LTC, STX Declared Zombie Among 20 Crypto By Forbes

Bitcoin Can Still Recover From Here

BTC price fell over 2% in the last 24 hours, with the price currently trading under $63,000. The 24-hour low and high of $62,424 and $64,789, respectively. Moreover, the trading volume has decreased by 24% as traders cautiously look for further signals.

BitMEX co-founder Arthur Hayes predicts a recovery in stocks, crypto market, Bitcoin next week. The reason behind bullish outlook is tax receipts from US citizens added $200 billion to the Treasury General Account (TGA) and the US Treasury Dept’s Q2 2024 refunding announcement next week.

Meanwhile, Republic First Bank became the first regional bank this year to succumb to pressures of higher interest rates maintained by the U.S. Federal Reserve.

Also Read: Former Federal Reserve Adviser Calls Out Trump Allies’ Fed Remodeling Plans

The post Bitcoin ETF Records First All Net Outflow Of $83M Since Launch, Bitcoin Bottomed? appeared first on CoinGape.

1 week ago

17

1 week ago

17

English (US) ·

English (US) ·