On Tuesday, US spot Bitcoin exchange-traded funds (ETFs) recorded significant inflows, totaling a remarkable $886.6 million.

This influx marks the second-best day for joint net inflows into US spot Bitcoin ETFs. With these elements at play, crypto analysts and community members consider a bullish market outlook for Bitcoin.

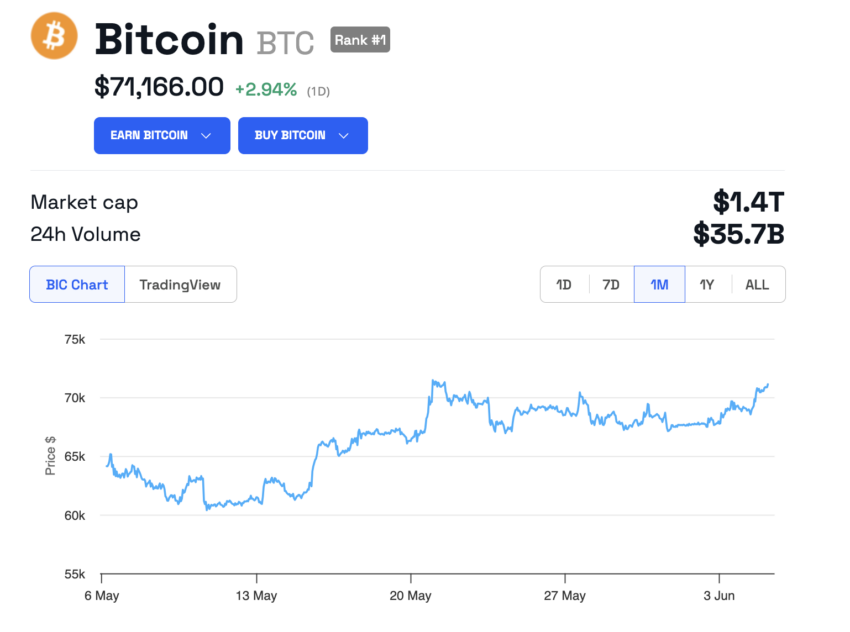

Bitcoin Surges to $71,200

Leading the pack, the Fidelity Wise Origin Bitcoin Fund (FBTC) saw an inflow of $378.7 million. Not far behind, BlackRock’s iShares Bitcoin Trust (IBIT) added $274.4 million. Additionally, the ARK 21Shares Bitcoin ETF (ARKB) reported strong gains, securing $138.7 million in net inflows.

Meanwhile, Bitcoin’s price soared to $71,200 in early Wednesday trading, currently trading at $71,166. On another front, the Grayscale Bitcoin Trust (GBTC) also experienced a significant inflow day, bringing in $28.2 million. This marked one of the few inflow days since its transformation from a closed-end fund to a spot ETF earlier this year.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Bitcoin Price Performance. Source: BeInCrypto

Bitcoin Price Performance. Source: BeInCryptoContrastingly, Bitcoin ETFs managed by Invesco Galaxy, Franklin Templeton, WisdomTree, and Hashdex showed no new inflows on June 4.

Despite this, the cryptocurrency community is abuzz with optimism. Bloomberg ETF analyst Eric Balchunas highlighted the substantial inflows, suggesting a bullish wave.

“The third wave is turning into tidal wave,” Balchunas said.

Moreover, the hash ribbons indicator from Capriole Investments has recently signaled a miner capitulation period. Miner capitulation occurs when Bitcoin’s hash rate’s 30-day moving average (DMA) drops below the 60 DMA, typically signaling potential long-term buying opportunities.

Charles Edwards, the founder of Capriole Investments, emphasized the indicator’s significance.

“Everytime we get a Hash Ribbon buy, it get ridiculed. But the last occurred was when Bitcoin was in the $20,000 range. Time to pay attention,” Edwards said.

The reliability of this indicator is supported by its historical performance, suggesting it remains a robust metric for predicting Bitcoin’s long-term value prospects.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin Price Performance and Hash Ribbons Indicator. Source: Capriole Investments

Bitcoin Price Performance and Hash Ribbons Indicator. Source: Capriole InvestmentsMiners are navigating the challenges post-Bitcoin halving—where block rewards are reduced, diminishing profitability for less efficient mining operations.

Miner capitulations often coincide with broader market weaknesses and volatility. However, they also align with significant market recoveries and are considered strategic investment points.

The post Bitcoin ETFs Garner $886 Million as Hash Ribbons Indicator Hints Bullish Signal appeared first on BeInCrypto.

4 months ago

53

4 months ago

53

English (US) ·

English (US) ·