Bitcoin exchange-traded funds (ETFs) have reached a significant milestone. They now hold over 1 million BTC, representing nearly 5% of Bitcoin’s total supply.

Grayscale and BlackRock, with their substantial BTC assets, are leading this sector, highlighting the growing institutional interest in cryptocurrency investments.

Bitcoin ETFs Hold Over 1 Million BTC

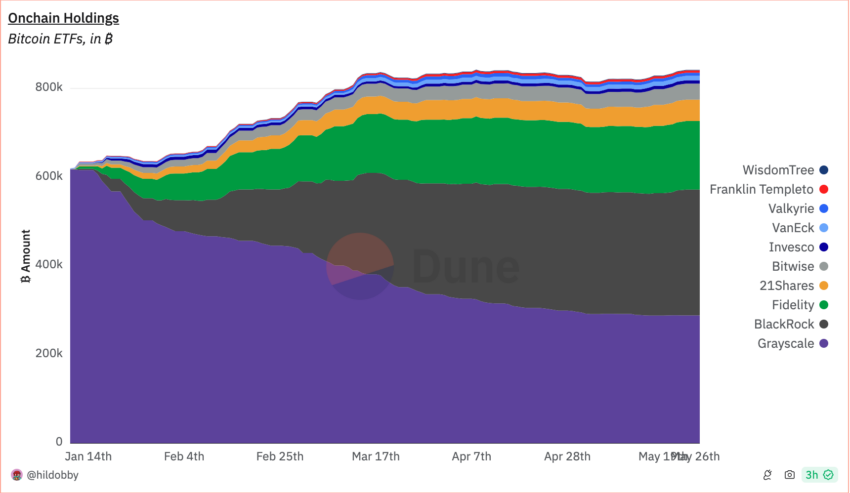

As of May 23, ETF holdings totaled 1,057,039 BTC. Grayscale’s GBTC leads with over 291,000 BTC, followed closely by BlackRock’s IBIT with 279,500 BTC. Recent data from Arkham Intelligence shows increases: GBTC now holds 293,000 BTC, while IBIT owns 284,526 BTC.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

TOTAL BITCOIN HELD BY ETFS. Source: The BOLD Report

TOTAL BITCOIN HELD BY ETFS. Source: The BOLD ReportOutside the US, Germany-based BTC Bitcoin Exchange Traded Crypto (BTCE) is the largest holder with 22,490 BTC. Swedish ETFs, Bitcoin Tracker Euro (COINXBE) and Bitcoin Tracker One (COINXBT) manage 17,830 BTC and 14,580 BTC, respectively. Seven newly launched Bitcoin ETFs in Hong Kong collectively own 5,789 BTC, though investor interest still needs to be paid.

Hashdex, a key player in the ETF market, holds over 7,900 BTC through its HASH11 fund in Brazil. The company’s influence extends to the US with its Bitcoin ETF, DEFI, which has 185 BTC.

US ETFs Dominate the Market

The data clearly shows that US ETF issuers are leaving asset managers from other countries far behind. Michael Saylor, a prominent Bitcoin advocate, highlighted these holdings. On May 24, US ETFs held 855,619 BTC, while global ETFs held 1,002,343 BTC.

“32 Bitcoin Spot ETFs now hold ~1 Nakamoto of $BTC,” he stated.

Assets under management data for US ETFs shows Grayscale remains dominant despite a slight decline in market share. BlackRock and Fidelity maintain steady market shares. Other players like WisdomTree, Franklin Templeton, Valkyrie, VanEck, Invesco, Bitwise, and 21Shares hold minimal market shares, demonstrating slight variation.

Read more: Bitcoin Price Prediction 2024/2025/2030

BItcoin ETFs Onchain Holdings. Source: Dune Analytics

BItcoin ETFs Onchain Holdings. Source: Dune AnalyticsThe ETFs’ stability and growth are indicators of investor confidence and drivers of trading volumes. The launch of spot Bitcoin ETFs led to a surge in trading volumes during US market hours, accounting for 46% of the cumulative volume from January to April, according to Kaiko Research. The trend continued, with the ETFs experiencing the highest net flow in 10 weeks this past week.

The stability and growth of the ETFs are not just indicators of investor confidence, but also drivers of trading volumes. The launch of spot-Bitcoin ETFs led to a surge in trading volumes during US market hours, accounting for 46% of the cumulative volume from January to April, according to Kaiko Research. This trend continued, with the ETFs experiencing the highest net flow in 10 weeks.

Bitcoin’s price hovers around the psychological level of $70,000. From January to April 2024, BTC delivered a 57% return year-to-date, outperforming the S&P 500. This data highlights the growing impact of Bitcoin ETFs on the cryptocurrency market, showcasing their role in driving trading volumes and investor interest.

The post Bitcoin ETFs Now Hold 1 Million BTC, 5% of Total Supply appeared first on BeInCrypto.

5 months ago

59

5 months ago

59

English (US) ·

English (US) ·