The post Bitcoin Failed to Hold $64,000, What’s Next? appeared first on Coinpedia Fintech News

Bitcoin could not hold the price level at $63,800 and dropped around 1.92% to $62,573. It was moving average 20 that gave some support to bitcoin price and it again rose and reached the old all time high of bitcoin. With a high liquidity zone this is a resistance zone which further rejected the price back to $62,680.

As we mentioned yesterday, zones around $63,500 and $62,500 have high liquidity, and no matter what side Bitcoin moves, there are chances of it falling back. That is exactly what we witnessed today. The price of BTC first reached around $63,800 and received a rejection that threw it 1.92% down. Waiting a few hours, taking support of Moving average 20, btc price once again tried and got successful to break $64,000. It instantly got rejected and fell 2.18%.

Bitcoin is currently trading at $62,797 and trying to hold this position which looks very difficult as MACD displaying a negative momentum. The volume towards bears is taking over the bulls. The MACD line has crossed below the Signal line displaying loss in bullish sentiment. The RSI indicator has also fallen to 47.66, yesterday we recorded it at 73.2 and predicted this fall.

According to the liquidation data, in the last 24 hours, a total of $159.24 million of trades are liquidation. In just the last 4 hours, a total of $23.01 million of long trades vanished from the market. This leaves no doubts that the market is not ready to rise yet.

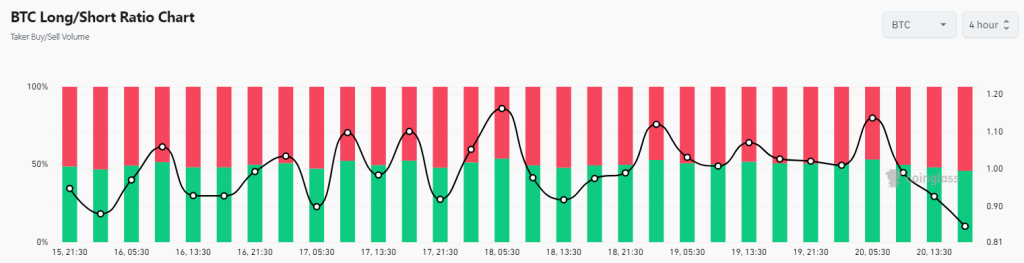

The Bitcoin long-short ratio stands at 0.83, meaning traders have opened more short positions than long ones. Traders liquidated around 63,840 positions in the last 24 hours due to price fluctuations.

Currently, the nearest liquidity lies around $62,000 and hence there are chances bitcoin price retraces back to $62,000. September still have ten days left. Crypto enthusiasts are most afraid this month as it has a history of being a full bearish time. Meanwhile, these movements give opportunities to those who have learned to recognize them.

2 hours ago

8

2 hours ago

8

English (US) ·

English (US) ·