For the longest time, my investment approach was simple and straightforward, stick to tried-and-true options like index funds.

Occasionally, I’d sprinkle in a few blue-chip stocks if I was feeling adventurous.

Once I invested, I let it sit and grow, save for an annual or semi-annual rebalancing. This strategy served me well, but the world of cryptocurrency kept calling to me.

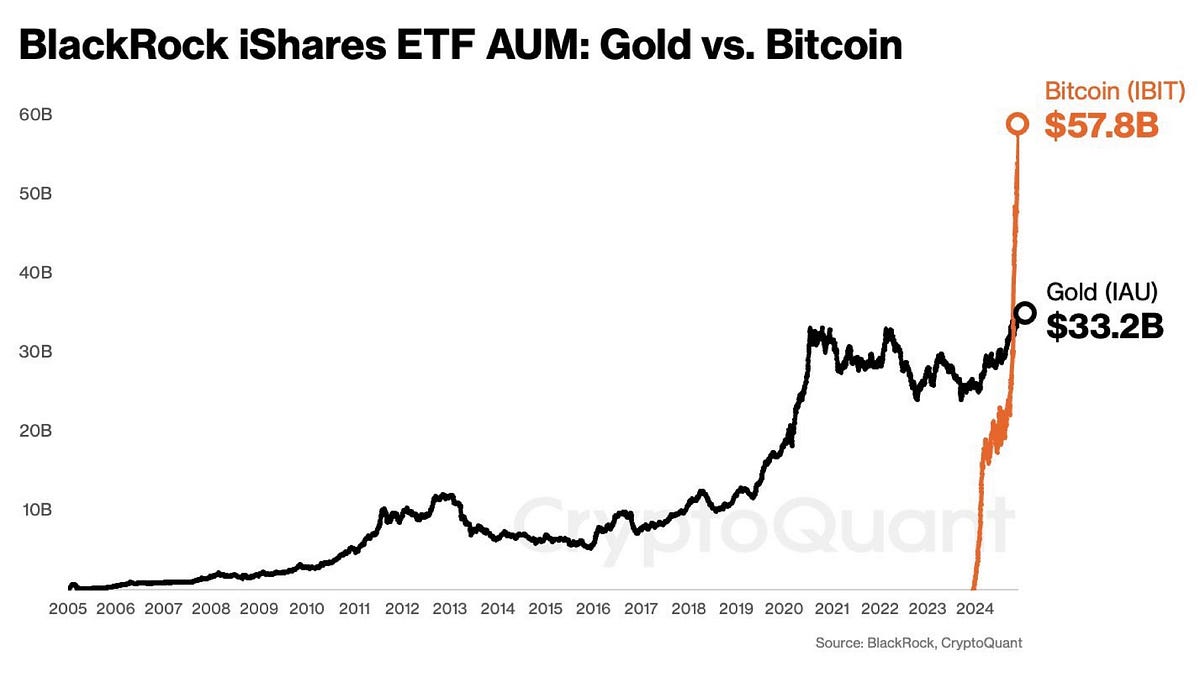

Recently, the buzz around bitcoin became too loud to ignore. Prices were soaring past historic highs, and institutions seemed to be diving in headfirst.

From talks of bitcoin reserves to massive asset managers advocating for its inclusion in diversified portfolios, I couldn’t help but feel like something big was happening. Could bitcoin be my next frontier in investing?

Then there was the time last year when bitcoin hit $100,000, a milestone that captured headlines and created a palpable sense of FOMO (fear of missing out).

Social media buzzed with stories of early adopters who had turned modest investments into life-changing fortunes.

Friends and colleagues who had previously dismissed cryptocurrency were suddenly asking, “Should I be getting into bitcoin?” That fear of being left behind was hard to ignore, and I found myself wondering if I was missing out on a once-in-a-lifetime opportunity.

I decided to find out for myself. But before jumping in, I knew I needed a plan. Bitcoin, after all, has a reputation for its wild price swings. Here’s how I went about crafting a strategy that made sense for me.

Is it too late to start?

The first question that plagued me was whether I had already missed the boat. Bitcoin had risen dramatically, and I couldn’t shake the feeling that I was showing up late to the party.

But someone gave me an analogy that shifted my perspective: If you believe an asset will store value and grow over time, then there’s no such thing as being “too late.”

This made me think. No one asks if they’re too late to invest in real estate or the stock market. Assets with long-term growth potential tend to appreciate regardless of when you start. The key is deciding how to begin.

Taking the first step: The dollar-cost averaging method

Timing the market is hard, even for seasoned investors. Instead of trying to catch the “perfect” price, I opted for a strategy called dollar-cost averaging.

The idea is simple: instead of investing all at once, you spread out your purchases over time.

I allocated a small percentage of my portfolio to bitcoin and decided to split that amount in half. I invested one part right away and planned to invest the rest in small chunks over the next several months.

This approach gave me the flexibility to take advantage of potential dips in the price without stressing about whether I was buying at a peak.

How much is enough?

The next big question was how much of my portfolio to allocate to bitcoin. Given its volatility, I knew it couldn’t be a large chunk. But at the same time, I wanted enough exposure to see meaningful growth if bitcoin truly lived up to its hype.

A balanced approach seemed best. I decided to start with a 1% allocation of my overall portfolio, small enough to minimize risk but significant enough to matter.

If things went well and I grew more comfortable with bitcoin, I could always adjust my allocation later.

The “where” of buying Bitcoin

Once I had a plan, the next hurdle was figuring out how to buy bitcoin. Options ranged from purchasing directly through exchanges to investing in funds that track bitcoin’s price.

Buying directly offers the benefit of true ownership, but it also requires setting up wallets and navigating crypto-specific platforms.

For someone new like me, the idea of managing private keys felt intimidating.

On the other hand, funds and ETFs provided an easier route, allowing me to gain exposure to bitcoin without worrying about the technical details.

I opted for the latter. My brokerage offered a few bitcoin-related funds, making the process as straightforward as buying any other stock or ETF.

There was one twist, though — a pop-up appeared, requiring me to acknowledge the risks and confirm my investment strategy was aggressive enough to handle bitcoin’s ups and downs.

Lessons from the journey

As I made my first bitcoin investment, I felt a mix of excitement and uncertainty.

This wasn’t just another stock or fund; it felt like stepping into a new era of finance.

What stood out most to me was the realization that bitcoin, for all its volatility, represented something bigger than just another investment.

It’s a chance to participate in a movement reshaping the financial landscape, one rooted in innovation, decentralization, and the belief that value can exist beyond traditional systems.

Bitcoin isn’t for everyone, and that’s okay. But for those willing to explore it, the key is to start small, do your research, and craft a strategy that aligns with your goals and risk tolerance.

For me, bitcoin isn’t about chasing quick riches or jumping on a trend. It’s about diversifying my portfolio and being part of something transformative.

I write engaging content about crypto and related topics. If you enjoy my work, don’t forget to clap and follow for more updates!

3 weeks ago

15

3 weeks ago

15

English (US) ·

English (US) ·