Data shows that the sentiment of the Bitcoin market has switched to fear after the retrace. BTC has seen a $58,000 level during the past day.

Bitcoin Fear & Greed Index Is Pointing At ‘Fear’ Now

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the general sentiment among the investors in the Bitcoin and the wider cryptocurrency market.

Market sentiment can be helpful to follow as it can reflect the cryptocurrency’s price. It sometimes plays a role in the asset’s trajectory, which may be unexpected to many investors.

The Fear & Greed Index uses data from the following five factors to estimate the average sentiment among investors: volatility, trading volume momentum, social media sentiment, market cap dominance, and Google Trends.

Based on these factors, the metric represents this mentality as a score between zero and hundred. The index having a value greater than 53 implies the presence of greed among the investors, while under 47 suggests fear in the market. The values in between these two cutoffs suggest a net-neutral mentality.

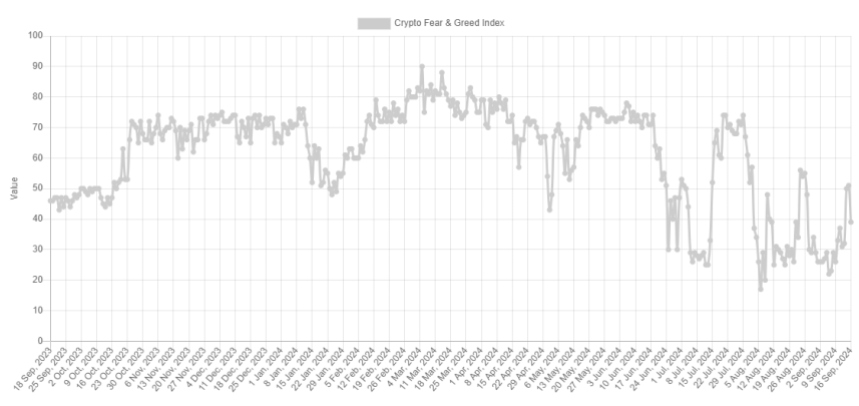

Now, here is what the latest Bitcoin market sentiment has looked like from the perspective of the indicator:

As is visible above, the Bitcoin Fear & Greed Index has a value of 39, which suggests that the majority of the investors in the market are slightly fearful at the moment.

This is a notable change from yesterday, when the index had a value of 51, and the holders had been sharing a neutral mentality. The chart below shows a record of all the changes in the index over the past year.

As displayed in the graph, the Bitcoin Fear & Greed Index saw a sharp improvement over the weekend, caused by the recovery that the asset price had enjoyed beyond the $60,000 mark.

However, the cryptocurrency has kicked off the new week with a plunge back towards $58,000, which may be why the sentiment has also seen a reset to the fear region.

That said, while the index is back in the fear zone, it’s not yet at the 31 value it was at before the earlier recovery. This fact, however, may not be a good sign for the asset.

Historically, Bitcoin has tended to move against the expectations of the majority. The probability of a contrary move occurring has only increased the more the investors have become sure of a direction.

Thus, when the Fear & Greed Index assumes low values (signifying a special sentiment called the extreme fear), bottoms can be probable to occur. Similarly, it being high (extreme greed) can signal tops.

With the Bitcoin market being only slightly fearful right now, it seems the pullback in the cryptocurrency hasn’t been enough to deal a heavy blow to investor morale. Naturally, a pullback can still occur for the coin, but it may be less likely if sentiment worsens further.

BTC Price

Bitcoin has dropped more than 3% over the past day, which has taken its price to $58,100.

1 month ago

19

1 month ago

19

English (US) ·

English (US) ·