Bitcoin price has surged 25% since the spot Bitcoin ETF launch in the United States and significant Bitcoin accumulation by large whales in 2024. Given the low BTC supply coupled with rising mining difficulty situation, an increase in block size could potentially add pressure on miners to sell their holdings.

Crypto Fear & Greed Index hits “Extreme Greed” with a value of 76, indicating a potential crypto market selloff in the next few days.

Bitcoin Miners Under Selloff Pressure

Bitcoin block size has increased by about 40-50% amid a rise in Bitcoin network activity due to BTC’s recent rally, as per a CryptoQuant-verified analyst. Typically, Ordinals increase block size that often leads to an increase in fees. However, there is no significant increase in fees, which means the increase in block size is due to high volume of BTC buying or selling.

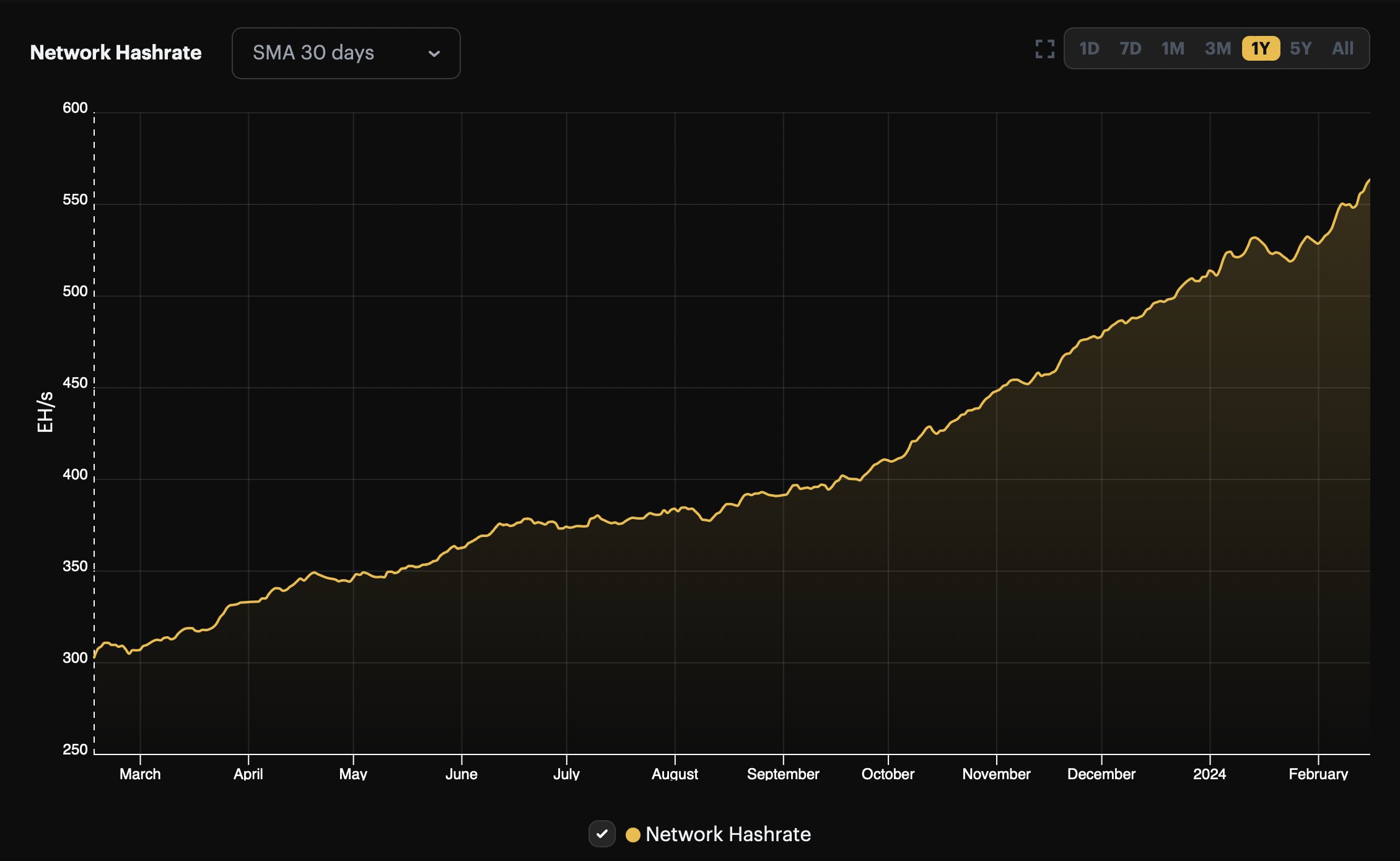

While mining difficulty and block size are different concepts, an increase in block size indirectly affects mining competition as miners spend more time transmitting over the network. Bitcoin mining difficulty hits 81.73T, with network hashrate nearly doubled in the last 12 months going from 303 EH/s to an average of 577 EH/s, as per BTC.com data.

The increase in block size amid rising mining difficulty and BTC price can add pressure on miners to sell their BTC holdings. Notably, the Bitcoin Miners’ Position Index (MPI) is also indicating elevated selling pressure from miners, raising concerns among analysts and investors. Historically, BTC price witnessed correction when MPI was high and miners reserve also fell.

Currently, the miner reserve has declined to 3-year low amid massive demand from spot Bitcoin ETFs and the market. The exchange reserves are also on the brink of dropping below 2 million BTC, a key level maintained until November-end.

Spot Bitcoin ETFs have recorded a net inflow of $323.90 million on Friday, with inflow since launch reaching almost $5 billion.

BTC price fell slightly in the last few hours, with the price currently trading at $51,640. The 24-hour low and high are $51,641 and $52,537, respectively. Furthermore, the trading volume has decreased further by 30% in the last 24 hours, indicating a decline in interest among traders. Analysts such as Ali Martinez predicted a downslide in the next few days.

Also Read:

- Ripple’s XRP Is The Key To Gold-Backed Stablecoin: Black Swan Capitalist Founder

- Binance Plea Deal: US Prosecutors Push For $4.3 Bln Deal Acceptance

- Curve Finance Founder Dumps 2.5 Mln CRV To Binance As Price Drops Below $0.55

The post Bitcoin Miners Under Pressure To Sell, Is BTC Price Retracement Below $50K Imminent? appeared first on CoinGape.

3 months ago

41

3 months ago

41

English (US) ·

English (US) ·