Bitcoin has broken below the key 200-day moving average of $83K, exhibiting a notable bearish sign. However, the price encounters buyers’ last defence line at $80K, with a potential breakout leading to a substantial decline toward $75K.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin was rejected at the $92K resistance, triggering a strong sell-off that led to a break below the key 200-day MA at $83K and the 0.5 Fibonacci retracement level. This zone was expected to provide strong demand, but bearish pressure overpowered buyers, resulting in long liquidations and a negative shift in market sentiment.

Currently, Bitcoin is testing the last line of defence from the buyers at the $80K region, which aligns with the ascending channel’s lower boundary and the 0.618 Fibonacci retracement level. If this level fails, another sell-off could drive prices toward $75K, marking a deeper market correction.

Source: TradingView

Source: TradingViewThe 4-Hour Chart

In the lower timeframe, Bitcoin’s price consolidates between $80K and $92K. A recent rejection at the upper end of this range underscores the market’s hesitation. A clear breakout from this zone is needed to establish a definitive trend.

Moreover, a liquidity pool exists just below the recent low of $78K, where numerous sell-stop orders have accumulated.

This pool may serve as an attractive target for smart money, increasing the likelihood of a bearish breakout in the mid-term. Consequently, Bitcoin’s price action in the coming weeks is expected to remain volatile, with further consolidation likely before any decisive move.

Source: TradingView

Source: TradingViewOn-chain Analysis

By Shayan

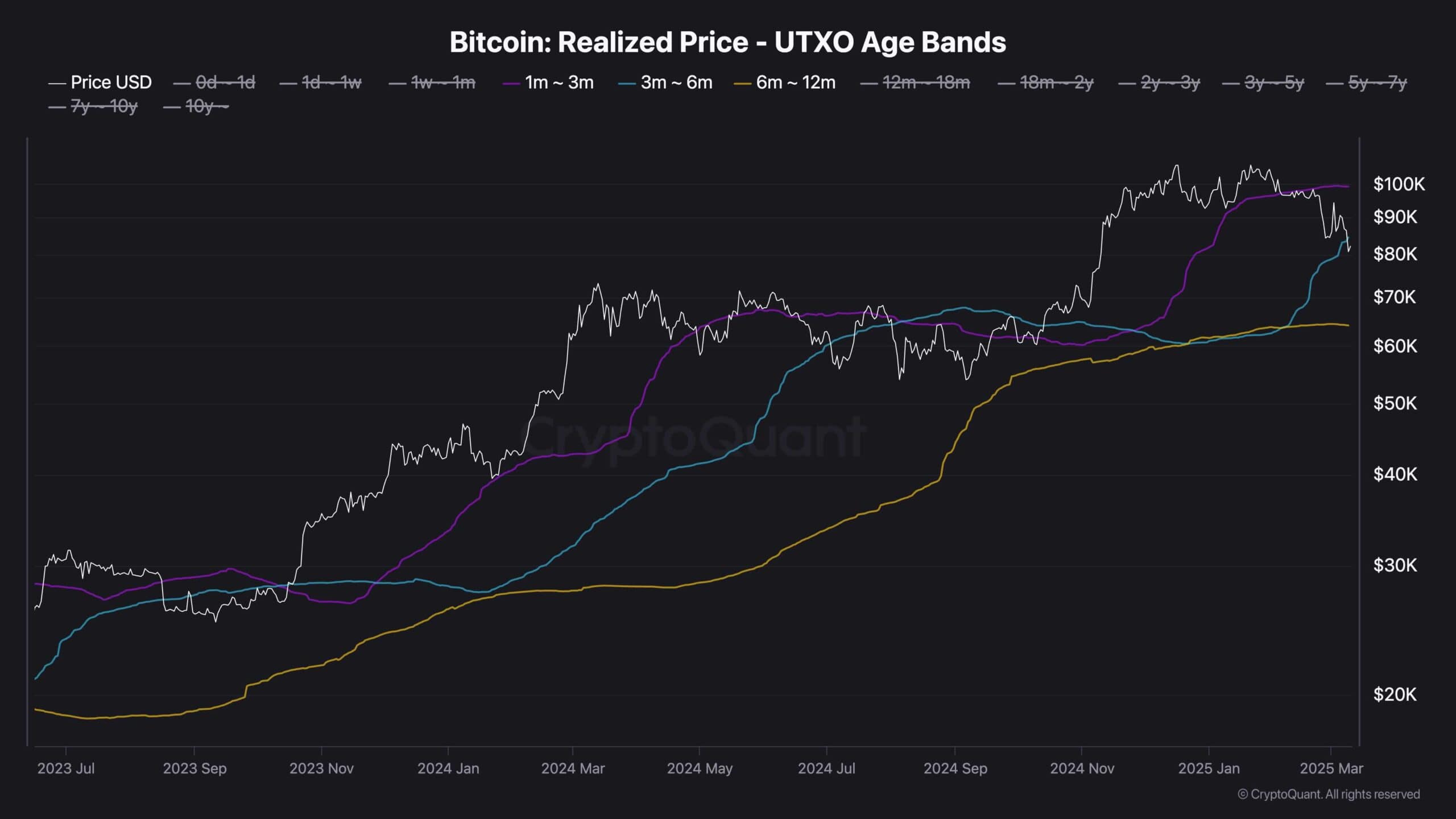

Historically, Bitcoin’s interaction with the Realized Price of 3-6 Month UTXOs has played a pivotal role in defining market direction. This metric often serves as a strong support or resistance zone, reflecting the average acquisition price of mid-term holders.

Currently, Bitcoin is testing the realized price of 3-6 month holders at $83K. Holding above this zone would indicate strong market confidence, reinforcing bullish sentiment and increasing the likelihood of further upside momentum.

However, if Bitcoin fails to maintain support at this threshold and breaks below, it could trigger a shift in sentiment toward fear. This scenario may lead to a distribution phase, where short to mid-term investors offload their holdings, potentially pushing the price into a deeper correction and providing the opportunity for smart money to accumulate at low prices.

Thus, Bitcoin’s price action around the $83K level will be critical in shaping its short- to mid-term trajectory. Whether it rebounds or breaks down will likely determine the next major trend in the market.

Source: CryptoQuant

Source: CryptoQuantThe post Bitcoin Price Analysis: How Low Will BTC Drop This Week Following Loss of $80K appeared first on CryptoPotato.

7 months ago

55

7 months ago

55

English (US) ·

English (US) ·