Bitcoin’s price has made a new all-time high yesterday, as Trump’s inauguration has flooded the crypto market with optimism.

However, in times of euphoric expectations, caution and risk management are advised.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the asset has once again entered a bullish phase after rebounding from the $92K level. The $100K line has been broken to the upside and even retested before the market made a new all-time high around the $110K mark.

Currently, there is more potential for upward movement, as the $100K level is acting as a strong support, and the RSI is showing clear bullish momentum. As a result, if the $100K level holds, a rally higher toward the $120K area could be expected in the short term.

The 4-Hour Chart

Looking at the 4-hour chart, it is evident that the asset’s breakout above the large falling wedge pattern has paved the way for a new all-time high. The higher boundary of the pattern has also been retested twice and is pushing the price higher.

Meanwhile, the market’s quick rejection from the $108K level is somehow worrying and could lead to a reversal if the price loses the $100K support line in the coming days.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

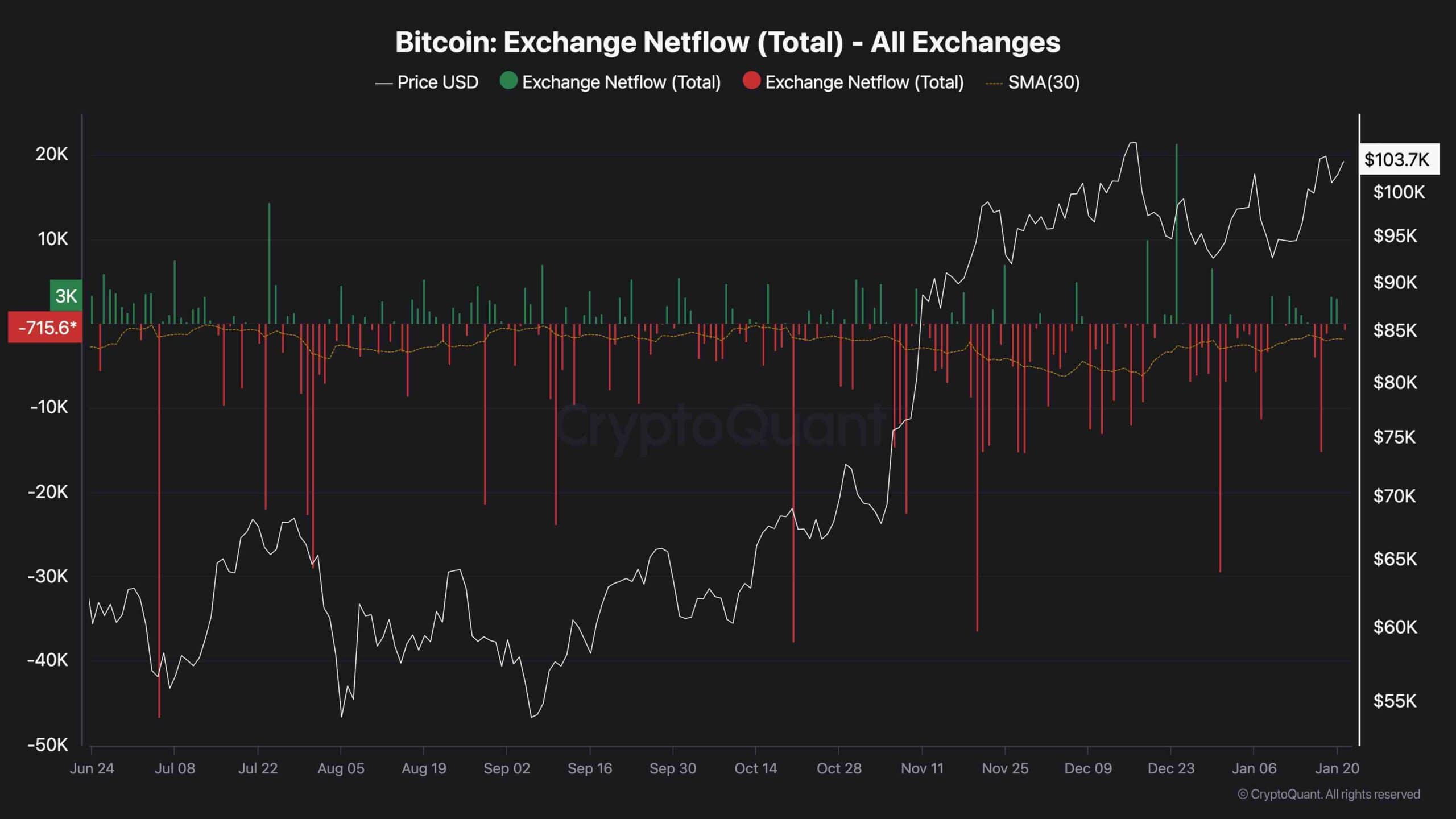

Bitcoin Exchange Netflow

With Bitcoin making a new record peak yesterday, investors are now more optimistic than ever and are expecting a rally higher in the coming weeks. These expectations can be clearly witnessed by looking at the Bitcoin exchange netflow metric.

This metric measures the net amount of BTC deposited to or withdrawn from exchanges. Positive net flows indicate aggregate deposits, while negative inflows show aggregate withdrawals.

As the chart suggests, the 30-day moving average of the Bitcoin netflow metric has been showing negative values for months now. This indicates accumulation by market participants, which shows their bullish expectations and can also lead to these anticipations becoming the truth by creating a supply shock. Therefore, if things remain the same, higher prices are likely for BTC in the coming weeks.

The post Bitcoin Price Analysis: What’s Next for BTC After Latest ATH and Correction? appeared first on CryptoPotato.

9 months ago

78

9 months ago

78

English (US) ·

English (US) ·