Bitcoin (BTC) price has been struggling below $100,000 for the past eight days. Despite this, BTC keeps its position as the biggest crypto by far, with a market cap of $1.9 trillion.

Whale accumulation has slightly recovered from recent lows but remains weak compared to previous months, suggesting cautious sentiment among large holders. If BTC fails to build buying pressure, it could face further downside, while a breakout above key resistances could reignite bullish momentum.

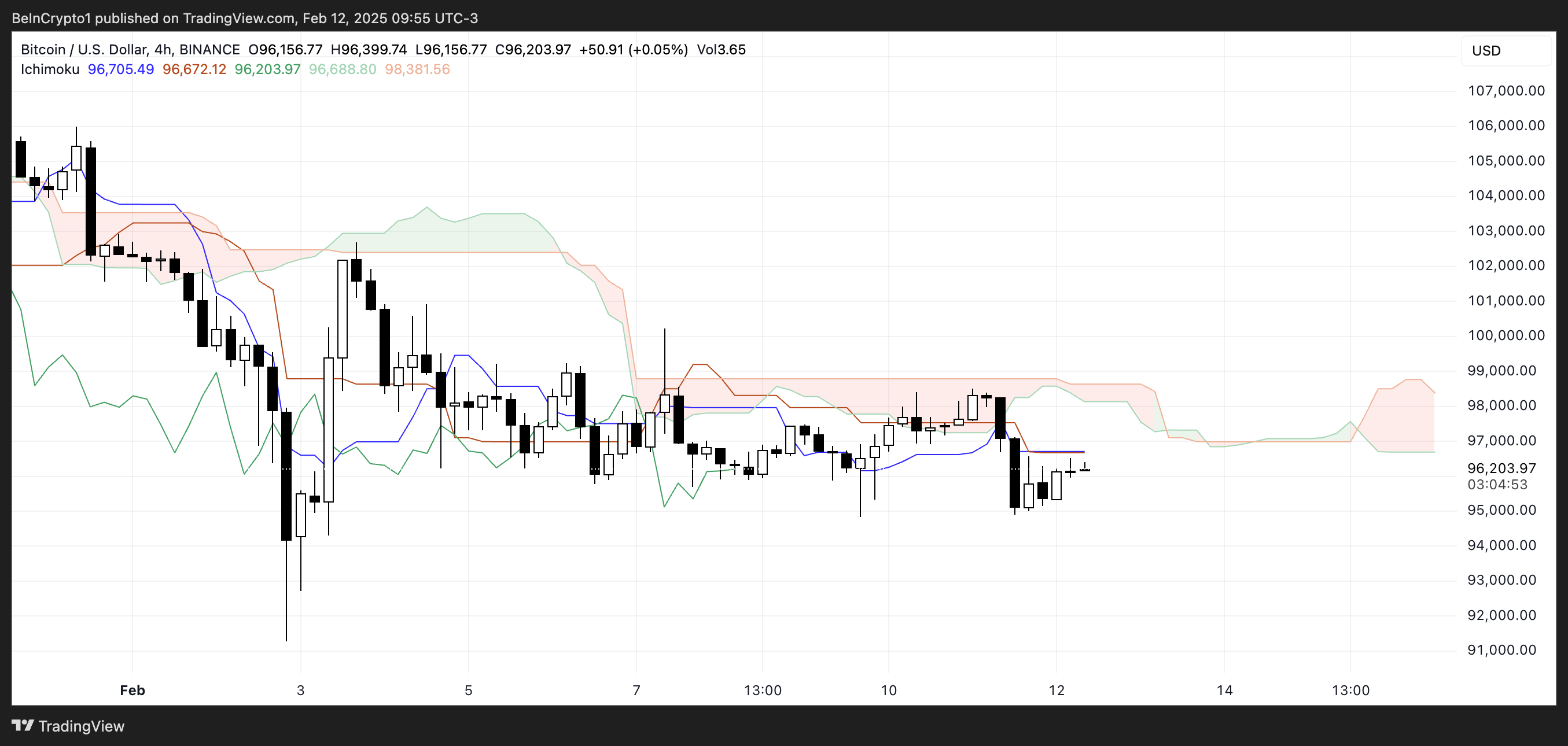

BTC Ichimoku Cloud Shows Mixed Signals

The Ichimoku Cloud for BTC shows a mixed signal. The price is currently trading near the cloud but lacks a strong trend. The Kijun-sen (red line) and Tenkan-sen (blue line) are close together, indicating weak momentum and potential consolidation.

The cloud itself is thin in some areas, suggesting that the indicator provides little resistance or support. Additionally, the price has recently moved below the cloud, which is generally a bearish sign, but the cloud ahead is turning neutral, meaning the trend remains uncertain.

BTC Ichimoku Cloud. Source: TradingView.

BTC Ichimoku Cloud. Source: TradingView.The Senkou Span A (green) and Senkou Span B (red) are nearly flat, reinforcing the lack of a strong directional bias.

The Chikou Span (green line) is hovering around the price, further confirming the market’s indecision. If the cloud ahead starts expanding, it could provide better trend clarity, but for now, the market seems to lack strong momentum.

The combination of a thin cloud and compressed indicator lines suggests Bitcoin is in a phase of low volatility, where neither bulls nor bears have full control.

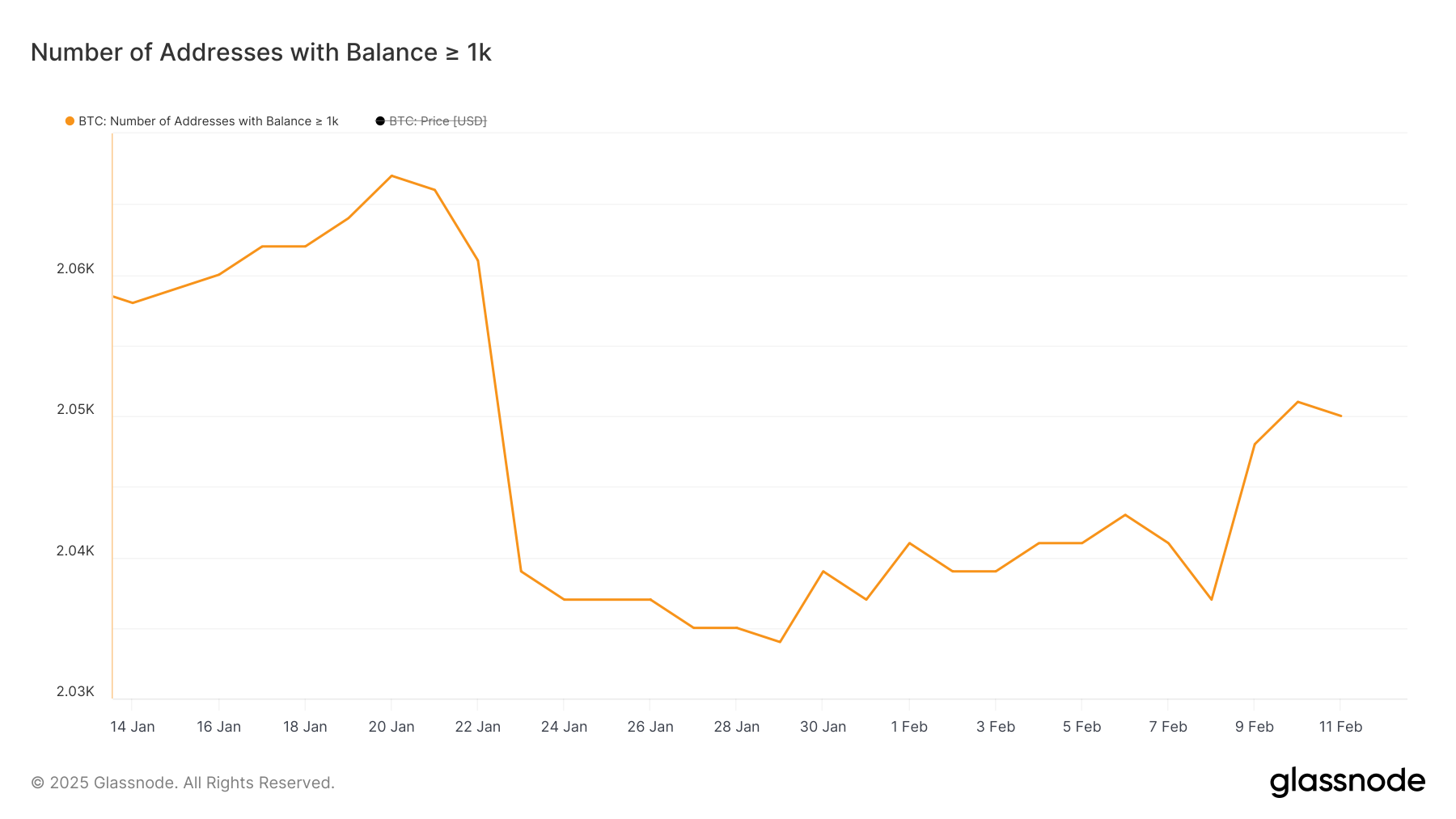

Bitcoin Whales Still Struggle After Reaching Year-Low Levels

The number of BTC whale addresses, those holding at least 1,000 BTC, recently hit a yearly low of 2,034 on January 29, after a sharp decline throughout January. While it attempted a rebound, reaching 2,043 on February 6, the number dropped again before starting a slow recovery to 2,050.

Tracking whale activity is crucial because these large holders often influence market liquidity and volatility.

A decreasing number of whales can indicate reduced accumulation from major investors, potentially leading to weaker price support.

Number of addresses holding at least 1,000 BTC. Source: Glassnode.

Number of addresses holding at least 1,000 BTC. Source: Glassnode.Although the whale count has rebounded slightly from its lowest point, it remains at relatively low levels compared to previous months. This suggests that while some large holders are returning, there hasn’t been a strong resurgence in accumulation.

A sustained increase in whale addresses could signal renewed confidence in BTC, while continued stagnation or decline may indicate cautious sentiment among major investors.

If whales remain hesitant to accumulate, BTC’s price could struggle to build strong upward momentum in the near term.

BTC Price Prediction: Will BTC Reclaim $100,000 Soon?

Bitcoin EMA lines remain bearish, with short-term EMAs still positioned below long-term ones. Currently, Bitcoin price is trading near the key support level of $96,700, which is crucial for maintaining stability.

If this level is tested and broken, selling pressure could intensify, leading to a drop toward $91,274.

BTC Price Analysis. Source: TradingView.

BTC Price Analysis. Source: TradingView.However, if BTC price can establish an uptrend, the first major resistance to watch is $97,766. A breakout above this level could signal a shift in momentum toward $100,222.

If the uptrend strengthens, BTC could test $102,700, and a continuation of strong bullish momentum could push it further to $106,300.

The post Bitcoin Price Struggles Below $100,000 as Whale Accumulation Remains Weak appeared first on BeInCrypto.

6 months ago

36

6 months ago

36

English (US) ·

English (US) ·